British pound and the Bank of England: Carney’s chameleon act

While the prospect of a May Bank of England rate hike will most likely come and go at this week’s meeting, what matters for the pound is whether Governor Mark Carney is a man with or without conviction over future rate hikes. Risk-reward favours GBP/USD upside in particular – where we think the recent decline looks overcooked relative to the adjustment in short-term UK rates

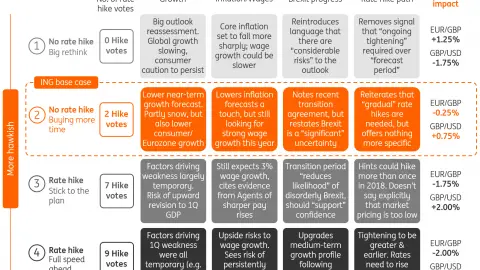

GBP outcomes to possible May BoE meeting scenarios

Key takeaways

- The pound’s sharp rise and fall over the past month should be a warning shot to the Bank of England that markets are still struggling to get to grips with their policy reaction function in a post-Brexit world. Hence, what policymakers choose to signal at the May ‘Super Thursday’ meeting could set the tone for GBP markets over summer.

- Recent wild swings in GBP are somewhat indicative of an “all or nothing” sentiment when it comes to further BoE rate hikes (“all” being two or more rate hikes in 2018 versus “nothing” being that the Bank will not hike again). There is a middle ground, which we expect to be reiterated at the May meeting; the combination of a 7-2 split MPC vote (two rate hike dissenters), the Bank downplaying the soft 1Q GDP data and a reiteration by Governor Carney that another rate hike this year remains "likely”. This should be enough to provide a modest uplift to short-term UK rates following the recent scaleback – or at the very least keep the curve supported where it currently sits.

- The decline in GBP/USD to 1.35 looks overcooked relative to the more tempered BoE policy rate expectations. This – coupled with cleaner positioning and relatively limited sentiment for additional downside – means that we think the risk-reward favours GBP/USD upside going into the May BoE meeting. Signs that the BoE tightening cycle remains intact could lift GBP/USD up towards 1.3600 – while keeping EUR/GBP supported around 0.8750.

- As our economists outline, we do see tail risk outcomes on either side. A subtle hawkish surprise for GBP markets would be a 6-3 MPC split vote, which would give greater support to an August BoE rate hike (currently 50% priced in). An additional hawk joining the rate hike dissenters (with Chief Economist Any Haldane or external MPC member Gertjan Vlieghe the most likely candidates) may also give greater conviction to the MPC's medium-term hawkish bias – especially with resident hawk Ian McCafferty's term coming to an end after the August meeting. A 6-3 MPC split vote scenario (with three rate hike dissenters) could see GBP/USD moving up towards 1.3700

- Bottom line: We think GBP's fall in recent weeks - especially against the USD - looks overdone relative to the adjustment that we've seen in short-term UK rates. We remain medium-term GBP bulls, though acknowledge that the short-term outlook will be a function of what the BoE chooses to signal at the May policy meeting and 2Q UK economic data outturns. Should policymakers keep the prospect of a 2018 rate hike on the table this week, then we would expect signs of a 2Q rebound in UK economic activity to lift GBP/USD up towards 1.40 by end 2Q18 – with EUR/GBP resilient around 0.87-0.88 amid a recovering EUR.

Market expectations: Curve adjusted to May rate hike rise and fall... all eyes on August now

Dissecting the Rise and Fall: GBP's decline looks overcooked relative to the adjustment in UK rates

GBP positioning: Shaken but not stirred

Fast-money investors (leveraged funds) have, as expected, slashed their net long GBP/USD positions in half over the past few weeks – as odds of a May Bank of England rate hike have receded and USD sentiment has recovered. But the most surprising element of the latest CFTC positioning data is that asset managers have turned neutral on GBP/USD for the first time since summer 2014. This suggests one of two things to us:

- Some institutional investors sniff a bullish opportunity with GBP/USD at these depressed levels and/or

- These group of investors overall no longer see scope for much further downside in GBP/USD. While the underlying breakdown shows tentative evidence for both factors at play, the former has greater substance given asset manager long GBP/USD positions increased from 13.6% to 21.6% (the highest since Dec 2008). A reassessment of UK political risks may be more of a driving force here for these medium-term investors, though we'll need to see whether this is more than just a quirk in the positioning data.

For this week at least – and given the greater link between leveraged funds positioning and BoE policy sentiment – we think Governor Carney's reiteration that another rate hike remains likely this year should put a backstop to any further GBP positioning adjustment. Instead, the much cleaner positioning means that GBP/USD is more vulnerable to a sharper rebound in the event of a hawkish surprise (ie, a 6-3 vote MPC split).

GBP sentiment: Consolidation in risk reversals suggests limited scope for further downside

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 May 2018

Our Bank of England Decision Day Guide This bundle contains 2 Articles