G10 FX Week Ahead: The dollar’s not hot

With the White House set to nominate a new Fed Chair anytime within the next month, we take a look at whether any of the leading candidates pose a threat to our strategically bearish USD view.

Theme of the week: Fed Chair uncertainty weighing on US rates

While President Trump did say that he would nominate a new Fed Chair around mid-October, it looks like the search is nowhere near being concluded - with White House Chief of Staff John Kelly last week noting that interviews are still in the 'first round' stage, while Treasury Secretary Mnuchin hopes that a nomination will be made within the next month.

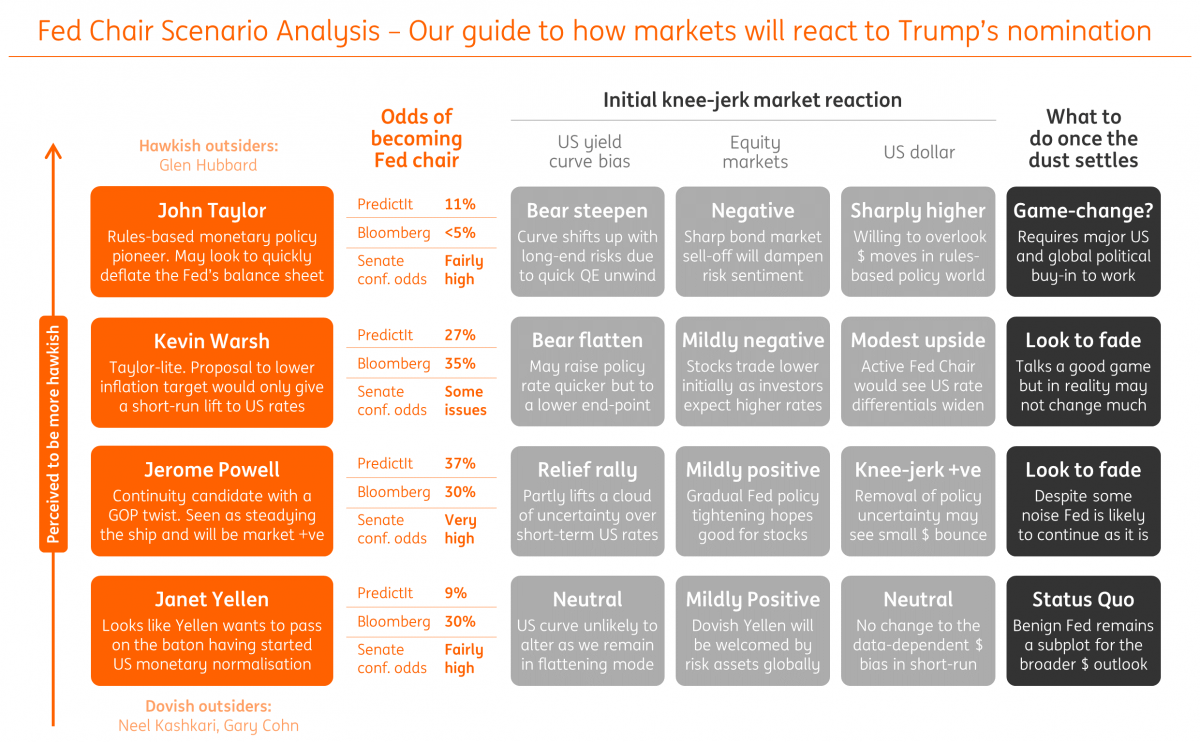

We strongly believe that it is way too early to make any sweeping assumptions about what particular nominees would mean for the future of Fed policy. Yet, we are wary that markets are likely to react to President Trump's nomination based on their current preconceived ideas. And while perceptions and reality may be two different things, our scenario analysis table below aims to provide a snapshot of what we expect to happen in markets if one of the leading Fed Chair candidates were to be nominated in the coming weeks.

Fed Chair Scenario Analysis - Who will be game-changing for markets?

Given that uncertainty over the next Fed Chair is likely to be weighing on short-term rates - not least because it currently makes any US monetary policy call largely invalid beyond Feb-2018 - the nomination of a new Chair would be USD positive. But most of the candidates would not be game-changing for our strategically bearish USD view and we would be inclined to fade any post-announcement moves.

In fact, we think only John Taylor - renowned economist and pioneer of a rules-based monetary policy framework - would pose serious risks to the current 'goldilocks' market environment. But again, the reality may not be what it seems on paper; even Mr. Taylor knows that for his more radical rules-based policy proposal to work, it requires international coordination to the likes not seen since Bretton Woods. The likelihood of this happening is trivially low.

Elsewhere, we do see the next few weeks as a window of opportunity for the EUR. It's somewhat disappointing not to see the EUR higher on the latest ECB 'sources' floating the idea of a cut in monthly asset purchases to EUR 30bn from January 2018. However, expect more of these 'sources' and 'leaks' to sporadically appear in the build-up to the 26 October ECB meeting - and it's hard not to see Eurozone yields and the EUR moving higher on any relatively aggressive QE taper speculation.

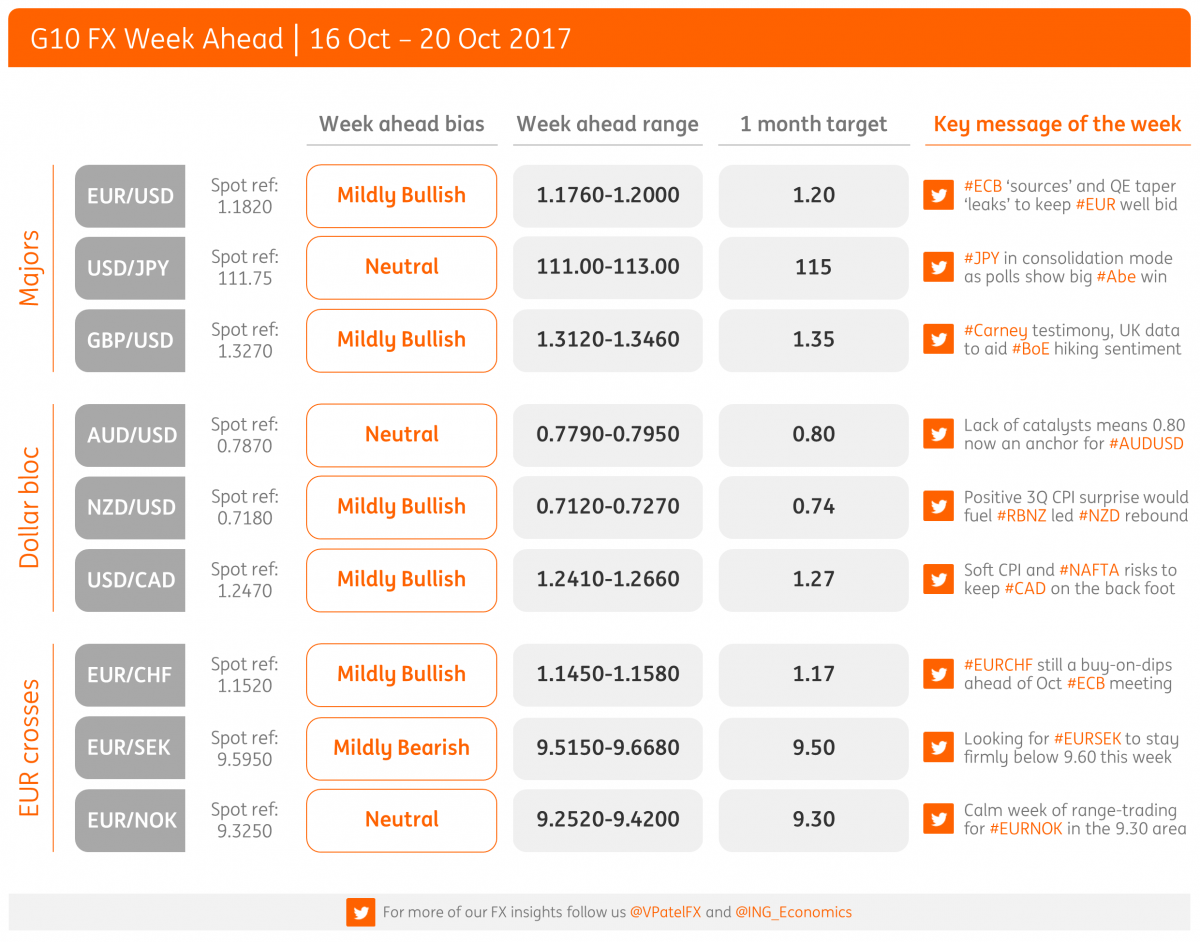

G10 FX Week Ahead | Summary Table

Majors: Politics versus policy

We expect the dollar's cyclical decline to continue as markets have little optimism over US economic fundamentals. Politics in Europe and the UK are unlikely to thwart either the euro or pound, with the focus starting to narrow on key upcoming central bank policy meetings.

EUR: ECB 'sources' and QE taper 'leaks' to provide support

- Discounting the hurricane-related distortions to headline CPI and retail sales, the softer 0.1% MoM change in core CPI has dented any trivial US inflation optimism. The fallout may be limited given the lack of inflation premia priced into markets, though the lack of any upside risks to the long-run US economic outlook reaffirms the idea of structurally low bond yields for longer. Such an environment supports our strategically bearish USD view. Fed speakers this are unlikely to rock the boat - especially as the Sep minutes suggest that confusion seems to reign within the committee.

- The Austrian elections over the weekend should have a limited impact on the EUR. Reality is that the currency will shift its focus to 26 Oct ECB meeting over the coming weeks and any talk from ECB speakers that errs on the more hawkish side should keep the currency bid. We feel the announcement of a 'lower for longer' QE taper schedule would drive Bund yields circa 10bps higher, with a one-time move up in EUR crosses. Eurozone data wise, we have the final release of Sep CPI and the German ZEW survey (both Tue), as well as balance of payments data (Fri).

JPY: In consolidation mode as polls show big Abe win

- With the dollar's short-term luck running out, USD/JPY looks to remain in consolidation mode. Focus on the 22 Oct Japanese elections may narrow and a be a JPY factor to consider, though the latest polls suggest that Abe is heading for a big election win - which would be a major thumbs up to Abenomics. Indeed, if the Japanese PM could secure more than 310 seats, he would have the two-thirds majority needed to sign-off on constitutional amendments.

- Domestic calendar sees final Aug industrial production data (Mon) and Sep trade data (Thu). Our economists note that Japanese economic activity has been quite robust of late, which may in part be limiting JPY downside as it places less pressure on the current ultra-accommodative BoJ policy stance.

GBP: Carney testimony, key UK data to support BoE hiking sentiment

- After a few weeks of highly charged political focus, we expect the narrative for GBP to slowly shift towards the November 'Super Thursday' BoE meeting. This week's UK data releases - including the CPI report (Tue), job market report (Wed) and retail sales (Thu) - are unlikely to derail sentiment for a 25bp Bank rate increase next month. While that's all but in the price of the pound, we prefer to focus on how robust underlying UK inflationary pressures are - and whether any upside surprises prompt the Bank to signal the start of a 'more than a withdrawal of stimulus' hiking cycle next month. On that note, Governor Carney testifies to UK lawmakers this week (Tue) - along with new MPC members Ramsden and Tenreyro. Any hawkish signals could steepen the UK rate curve and we think GBP/USD at 1.35 is a strong possibility around the Nov BoE meeting.

- GBP’s whipsaw price action last week is indicative of the currency’s somewhat inexplicable sensitivity to Brexit-related headlines. Deadlock talks, contingency planning around a 'no deal' scenario and talk of a transition deal shouldn't be new news and we think short-term - as well as broader - political risks are fairly priced into GBP for now. Therefore we expect to see little fallout in GBP when EU leaders this week conclude that there has been little progress in talks thus far. As we have noted previously, it is a Brexit transition deal matters more for GBP sentiment (see GBP: Deal or No Deal) and PM May's 'emergency' meeting with the EU on Monday might push the agenda towards tranisition talks.

Dollar bloc: Goldilocks is here to stay... good news for carry

Lacklustre US inflation dynamics should see the benign bond market environment persist and the high-yielding AUD and NZD recover some recently lost ground. In Canada, there's key inflation and retail sales data to keep an eye on before an important Bank of Canda meeting later this month.

AUD: 0.80 level an anchor point amid lack of catalysts

- It's a fairly eventful week in the domestic calendar with the September labour market report (Thu) in the spotlight; market consensus is looking for a slowdown in the pace of monthly job gains (+15k), although this will still be seen as signs of a tighter labour market. Some good data needed for the AUD after the disappointing retail sales figures earlier this month.

- We'll also get the October RBA meeting minutes (Tue) - as well as a couple of central bank speakers in Ellis (Tue) and Bullock (Wed). AUD moved lower after the RBA's Harper recently failed to rule out a rate cut, though we think markets may have overreacted to this. Expect AUD/USD to remain anchored around the 0.80 level in 4Q17 amid the lack of any major directional catalysts.

NZD: Positive 3Q CPI surprise may fuel hawkish RBNZ repricing

- Despite the political vacuum in New Zealand, the kiwi continues on a recovering trend amid a benign bond market environment. While it is expected that a government will be formed this week - although it does it appear that NZ First's leader Winston Peters is taking his time to choose his coalition partner - NZD price action will likely take its cue in the week ahead from the 3Q CPI release (Mon). The consensus is looking for a small pickup to 1.8% YoY, still a tad shy of the 2% midpoint of the RBNZ's target band.

- Under a National-NZ First coalition, we suspect RBNZ rate hike expectations could nudge forward into the middle next year (relative to the current pricing of a Sep-2018 hike). A positive CPI surprise would support this story. We look for NZD/USD to continue moving higher towards 0.7240 (50% retrace of the recent election-related move lower) - with our target for 0.74 by year-end.

CAD: Soft CPI data and NAFTA risks to weigh

- Canadian CPI and retail sales data (both Fri) will dominate the focus for CAD markets this week - especially ahead of the 25 Oct BoC meeting. Policymakers have been gradually shifting to a more cautious stance over further rate hikes amid concerns that markets may have moved too far too fast for their liking. In the absence of any big positive inflation surprise (consensus is looking for core common CPI at 1.5% YoY), we would expect a pause in the tightening cycle for the remainder of the year.

- Watch out for the 3Q BoC Business Outlook Survey this week (Mon) and in particular whether local firms see recent CAD strength as weighing on competitiveness. Manufacturing sales data (Wed) may show some preliminary evidence of this. Equally, ramped up NAFTA uncertainties could keep the BoC in wait-and-see mode for the time being. We expect CAD to remain on the back foot given the more contentious US trade stance, with a move to 1.27 not off the cards if further tariffs on Canadian firms are issued.

EUR crosses: Under pressure from a more hawkish ECB

As markets narrow their focus on ECB...

CHF: Swiss franc to underperform ahead of Oct ECB

- EUR/CHF has held onto its gains despite the Catalan crisis and will also be digesting the outcome of the Austrian elections over the weekend. We remain constructive on EUR/CHF but are a little surprised that CHF sight deposits (Mon) haven't fallen more quickly - suggesting investors are retaining CHF longs.

- Local events see September trade data on Thursday. Net trade had detracted from GDP in 2Q17; any softer data would reinforce the view that Swiss growth underperforms the Eurozone - and that the SNB will normalise policy later than ECB.

SEK: Looking for EUR/SEK to move back below 9.60

- Despite the below-consensus Sep CPI and the subsequent SEK weakness, we don’t expect the SEK weakening trend to continue. Look for EUR/SEK to drift below the 9.60 level this week. The negative SEK effect from the weak inflation data should be one-off in the same way the re-appointment of the dovish Gov Ingves had only a one-off negative impact the currency three weeks ago.

- It is also a very calm week on the data front, with the Sep unemployment rate on Thursday being the key data point. This suggests limited catalysts for further idiosyncratic SEK weakness.

NOK: Calm week of range-trading in the 9.30 area

- Similarly to Sweden, the busy inflation-orientated week in Norway will be replaced by a relative calmness, with a lack of market-moving data points in the calendar. We have 3Q house price index on Thursday and 3Q Industrial production on Friday; both will likely have a limited impact on NOK.

- The bid oil price provides additional support to NOK and in contrast to SEK, it has provided NOK with a buffer to the below-consensus Sep Norway inflation reading.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more