FX

G10 FX Week Ahead: Merkel’s put and EUR calls

The tone in FX markets will be a function of the outcome of the ongoing EU summit next week with the calendar otherwise looking very quiet. We're rather optimistic about some progress towards a compromise on the EU recovery fund and expect a positive spill-over on European currencies. EUR/USD may eye the 1.15 mark

Source: Shutterstock

USD: Quiet calendar, quiet dollar

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| DXY | 96.1000 | Mildly Bearish | 94.9000 - 96.5000 | 95.0000 |

- As the US earnings season shifts from major banks to tech giants next week, equities continue to prove a quiet contained sensitivity to both the surge in US Covid-19 cases and geopolitical tensions. Gauging the magnitude of the economic recovery remains pivotal for market sentiment and the safe-haven dollar, but next week’s quiet calendar may not offer much in this sense. Housing data will be the only focus in the US, with expectations around a solid rebound after the jump in mortgage applications. On the politics side, we may be seeing talks around a new fiscal package intensify.

- With the EU Summit’s outcome likely setting the tone towards the start of the week and given our fairly optimistic view on some progress on the Recovery fund, we could see the USD still offered versus currencies sensitive to EU sentiment, although weak sentiment in Chinese equities may limit Asia FX gains.

EUR: Progress towards the EU recovery fund to benefit the euro

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/USD | 1.1410 | Bullish | 1.1330 - 1.1520 | 1.1300 |

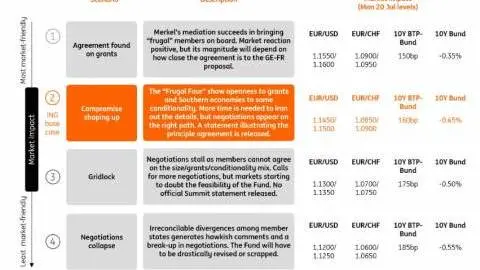

- The outcome of the EU summit (starting today and finishing over the weekend) will be the key for EUR/USD and the wider G10 FX price action. As per EU Summit – Market preview, our base case is for some progress towards a compromise being made, but no final agreement reached just yet as time for more negotiations will still be required. But if negotiations were to appear to be on the right path (and the agreement being a question of when rather than if), this is likely to be positive for EUR, and EUR/USD is to head likely to move to the 1.1450/1.1500 level early next week.

- On the eurozone economic data front, the focus is on the July PMIs (Friday). Both manufacturing and services surveys are expected to rise, with the July PMI Service to move back in the expansionary territory (above 50) for the first time since the Covid-19 pandemic hit Europe. This could give some gentle upside to EUR/USD at the end of the week, thought the crucial driver of the cross next week will be the outcome of / signals from the EU summit over the weekend.

JPY: Stuck in the range

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/JPY | 107.10 | Neutral | 106.60 - 107.60 | 107.00 |

- The BoJ meeting this week left very little marks on the yen as the Bank kept all existing policy measures unchanged. USD/JPY appears stuck in a fairly tight range, failing to sustainably trade below 107.00 despite geopolitical tensions and the downturn in Chinese equities.

- Next week, the yen appears to be lacking clear catalysts for any idiosyncratic move. EUR/JPY may be the most interesting cross to watch, with the EU summit possibly pushing it above 123.00.

GBP: Lagging most of its European peers

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| GBP/USD | 1.2547 | Mildly Bullish | 1.2450 - 1.2710 | 1.2300 |

- If the EU summit provides a boost to risk sentiment over the weekend, we expect GBP to lag most of its European peers (with the exception of CHF) given its relatively lower beta to risk (and uneven one, with GBP more exposed to falling markets than rising markets) and the UK-EU trade negotiations overhang. Still, GBP/USD would likely tick higher mainly driven by the rise in the EUR/USD, with a limited potential for GBP/USD to outperform EUR/USD as GBP still faces the well-known headwinds (the future of the EU-UK relationship) which does not advocate a bullish GBP case for months to come.

- On the UK data front, the focus is on June retail sales and July PMIs (both on Friday). On the former, our economists look for a sharp rebound as the UK exited the lockdown measures, although under the surface there will be changes in the consumer spending behaviour (from sales in physical shops to online). On PMIs, the Services PMI may go back above the 50 level, but its explanatory power is limited as it only tells that more firms (understandably) report better conditions after the free fall earlier in the year. While both positive, this is unlikely to prompt meaningful GBP gains given the idiosyncratic issues sterling is facing (see above).

AUD: Eyes on RBA comments

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| AUD/USD | 0.6987 | Neutral | 0.6930 - 0.7040 | 0.6800 |

- Australia is facing the worst period of its battle against the pandemic, with the state of Victoria in full lockdown but still seeing big daily jumps in cases. The complacency of the Aussie dollar to this situation keeps highlighting some higher downside risks to the currency compared to NZD. Chinese equities dynamics may remain a key driver, given that AUD has the highest correlation with CNY in G10.

- Australia's central bank will release the minutes of the July policy meeting on Tuesday. What might be interesting to note is any currency-related comment, in what was an otherwise uneventful meeting. Some comments on AUD might also come from the speech by Governor Lowe after the release, as we see little probability of any change in rhetoric when it comes to the policy stance.

NZD: Less downside risk than AUD

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| NZD/USD | 0.6548 | Mildly Bullish | 0.6520 - 0.6610 | 0.6500 |

- A less worrying contagion picture in New Zealand, and NZD having already paid the price of its recent strength with some correction in the past few days, suggests NZD may outperform its procyclical peers next week.

- The calendar does not offer much of a catalyst for an idiosyncratic move, except for some trade data at the end of the week, which will leave NZD driven by global factors. But we see the diverging pandemic situations in Australia and New Zealand as likely warranting a move lower (to 1.0600) in AUD/NZD in the short term.

CAD: Still capped by US virus cases

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/CAD | 1.3580 | Neutral | 1.3500 - 1.3650 | 1.3500 |

- Tiff Macklem’s first policy meeting as Governor did not yield any surprises on the policy side – as we've discussed here. This has cemented our view that the central bank stance will hardly prove to be a key driver for CAD in the near future, where instead global risk sentiment, oil and US virus cases will remain centre stage for the loonie.

- On the latter, we suspect that increasingly worrying news on US virus cases can still put a lid on CAD due to Canada’s high exposure to US lockdowns/slower economic recovery. We are, instead, less concerned from an oil perspective, as the cuts tapering by OPEC+ was already part of the plan and the oil market will remain in deficit in the second half of the year as demand recovers. Data-wise, we have retail sales and CPI in Canada next week, although both may have limited market implications.

CHF: More underperformance ahead

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/CHF | 1.0752 | Bullish | 1.0700 - 1.0900 | 1.0700 |

- With prospects of progress towards the EU recovery fund (and thus further compression of the eurozone risk premium) during the EU summit over the weekend, CHF has already started losing its safe-haven allure and EUR/CHF has moved meaningfully higher this week. A constructive outcome from the EU summit should keep the trend in place and lead to further EUR/CHF gains next week. We see EUR/CHF breaking above the 1.0800 resistance level and heading to 1.0850/1.0900 if there is a constructive outcome from the summit.

- It is a very quiet week on the Swiss data front, with July sight deposits out on Monday and June Money supply due on Tuesday are unlikely to affect the swiss franc. The key to CHF price action will be the outcome of the EU summit.

SEK: Benefiting from the summit spill-over

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/SEK | 10.3340 | Bearish | 10.2570 - 10.4420 | 10.4000 |

- We look for EUR/SEK to break below the 10.30 level next week (which would be the strongest krona level since early 2019) in response to signs of progress towards the EU recovery fund. We continue to see SEK as well-positioned within the G10 FX space given the not so dovish Riksbank and the currency’s vastly improved relative real rate position vs the state of affairs last year.

- As is the case for NOK, it is also a very quiet week on the Swedish data front. June unemployment due on Thursday and June PPI inflation due on Friday are likely to have a negligible impact on SEK.

NOK: The outperformer next week

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/NOK | 10.6040 | Bearish | 10.4300 - 10.7730 | 10.6000 |

- Both Scandinavian currencies should be the main beneficiaries from the progress on the EU recovery fund, given their higher beta and positive correlation with EUR/USD (which is expected to rise next week). NOK stands out given its high sensitivity to risk in the G10 FX space, with stable oil prices also supportive of the currency. EUR/NOK is likely to test the 10.50 level next week, with NOK/SEK expected to move back above 0.9800.

- It is a very quiet week on the Norwegian data front. Neither May unemployment rate nor 2Q industrial confidence, both out on Thursday should have any implications for the krone price action next week

Download

Download articleThis article is part of the following bundle

17 July 2020

Covid-19: Europe to the rescue this weekend? This bundle contains 7 Articles

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more