G10 FX valuation: Why the dollar is not screamingly expensive

The US dollar is not as expensive and the pound is not as cheap as you might think. In trade-weighted terms, the dollar is not screamingly expensive in part due to the decline in fair value of the euro and sterling. EUR/USD screens as fairly valued while the cheapest G10 currency is the Swedish krona. The Swiss franc remains heavily overvalued vs USD and EUR

To gauge the medium-term valuation for the G10 currencies, we employ our Behavioural Equilibrium Exchange Rate (BEER) valuation framework, where we model currency fair values based on variables such as terms of trade, productivity and current account dynamics, among other things. Figure 1 depicts the findings - the G10 currency mis-valuations vs the dollar.

Figure 1: G10 FX BEER valuations vs the dollar

USD: The dollar is not screamingly expensive

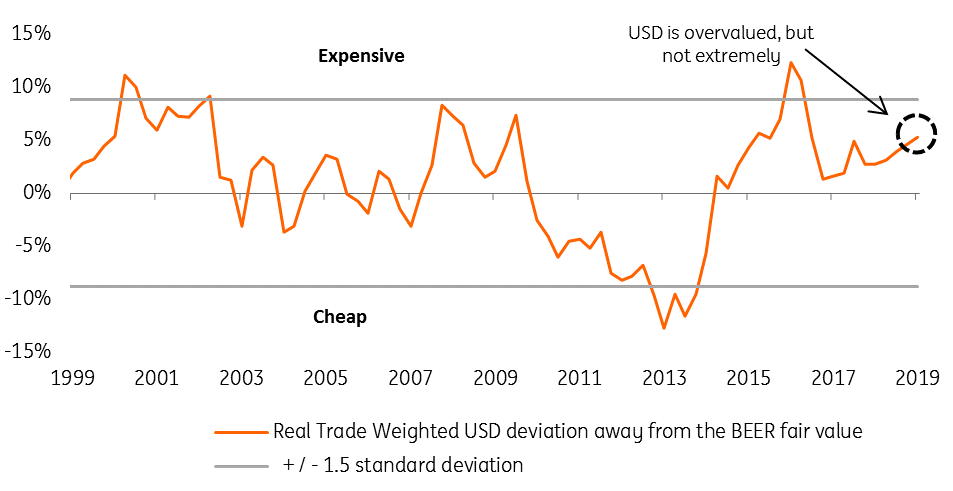

Although the US dollar is overvalued on a trade-weighted basis, the currency is not as rich as was the case in late 2016 / early 2017 (Figure 2). This is because (a) the trade weighted dollar (the narrow index) is currently lower than it was back then; (b) the dollar’s trade-weighted fair value has increased since its valuation peak, reflecting the improved US fundamentals and deteriorating fundamentals of other currencies (EUR and GBP in particular). As per Figure 2, the current 5-6% trade-weighted dollar overvaluation is not stretched in a historical context and suggests there is still scope for further USD gains should the global trade outlook deteriorate and weigh on cyclical currencies.

Figure 2: The dollar is not screamingly expensive

GBP: Large fall in sterling fair value

Within the G10 FX space, GBP has seen the largest deterioration in fair value since the start of 2017 (the period when USD peaked). This should not come as a surprise as Brexit uncertainty has weighed heavily on the UK economy (translating into sub-optimal growth) and translated into the deterioration of GBP fair value vs EUR by 8-9% since 2017. As Figure 3 shows, this was primarily driven by the decline in the worsening relative current account position of the UK. Sterling's fair value decline against the US dollar has been even larger than was the case against the euro as this has been further exaggerated by the drop in EUR/USD fair value (see below).

The meaningful deterioration in GBP's fair value means that the currency is not as undervalued as one might think – as per Figure 1. Rather, the sterling fundamentals have partly caught up with the weak GBP spot levels (whereby the forward-looking market participants front-run the deterioration in sterling fundamentals). This means that GBP is currently “only” 3% undervalued vs EUR (as opposed to the 15% GBP fall vs EUR since 2016 – although sterling's depreciation started from overvalued levels). The lack of meaningful undervaluation suggests there is further scope for GBP declines should the current UK-EU talks fail and the odds of a hard Brexit increase again. At this point, sterling's mis-valuation is not large enough to act as a constraint against more pronounced GBP weakness.

Figure 3: GBP fair value declined, led by the current account dynamics

EUR: Valuation no longer acting as a soft floor under the EUR/USD

Like sterling, the euro has also recorded a meaningful drop in fair value. EUR/USD fair value has declined by 7% since 2017. As Figure 4 shows, the key driver behind its decline was the deterioration in the terms of trade dynamics (government consumption and current account also contributed negatively). The meaningful drop in EUR/USD fair value suggests that even with EUR/USD back below the 1.10 level, the currency is no longer stretched.

This is in stark contrast to the period of 2015-early 2017 when EUR/USD fair value was higher. At that time, EUR/USD at or below the 1.10 level was considered fairly stretched (Figure 5), and the valuation acted a soft floor under the cross. Note that when currencies reach extreme valuation limits - as was the case for EUR/USD in 2015-2017 - it is difficult for them to extend the trend as the currency is already materially out of sync with fundamentals. The absence of any real undervaluation is one the main reasons why we see additional downside to EUR/USD and expect the cross to settle in the 1.05-1.10 area this quarter (see EUR/USD: Lower for longer as dollar is king).

Figure 4: EUR fair value also under pressure...

SEK the cheapest, CHF the most expensive

While the major crosses don’t show material dislocations (like EUR/USD, USD/JPY is also close to its medium-term BEER fair value as per Figure 1), more meaningful mis-valuations are observed in the rest of the G10 FX space.

The cheapest currency in the G10 FX space is the Swedish krona, which is undervalued by 13% vs USD as per Figure 1 (and 12.5% vs EUR). Although the cheapest, we don’t see SEK as a credible value play. If anything, we retain our long-held bearish view on the krona. The nature of the Swedish economy (small open economy levered to global trade) and poor SEK characteristics (high beta, yet negative interest rate) makes the currency vulnerable in the current slow growth / trade war environment. At this point, we see SEK's cheap valuation as the only positive about the currency and without any catalysts in place, the valuation gap is unlikely to correct. If anything, we expect the valuation to get even more stretched and look for EUR/SEK to breach the psychological 11.00 level this quarter.

In contrast, the most overvalued currency in the G10 space is the Swiss franc. The expensive valuation is the by-product of the Swiss National Bank's decision in 2015 to unpeg the franc from the euro, which led to profound CHF strength. Since then, the gap between the fair value and the real EUR/CHF exchange rate has remained constant.

Figure 5: ... meaning that EUR/USD is no longer undervalued

Commodity G10 FX: CAD is the least expensive

In the G10 commodity FX space, the Canadian dollar is the least expensive currency (in fact, USD/CAD screens as fairly valued based on our BEER model). This should not come as a surprise given its link to the US economy (vs the Australian and New Zealand dollars' linkage to China). The Aussie dollar is the cheapest commodity currency, being undervalued by around 12% vs the US dollar and closely followed by the New Zealand dollar and the Norwegian krone, respectively – as per Figure 1.

Status quo to prevail

The narrow and tentative US-China trade deal announced over the weekend has failed to improve the prospects for global growth (see US-China trade deal; don’t get over excited) and as such, we expect the status quo to prevail. USD should remain expensive and become even more expensive against the likes of the euro. While CHF remains the most overvalued G10 currency, the global slowdown and ongoing US-China trade conflict suggest that the safe-haven franc should remain rich. Such a global backdrop also suggests that SEK should get even cheaper. In our view, only a credible US-China trade deal that would improve the global growth outlook and/or a very aggressive Federal Reserve easing cycle would reverse the current USD overvaluation. However, we are not expecting either of these scenarios to play out.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).