FXFX Talking

G10 FX Talking: Easier monetary policy on its way

It looks like the European Central Bank and the Bank of England will very shortly be following the Swiss National Bank and the Riksbank in cutting interest rates. Federal Reserve Chair Jerome Powell sounds like he would love to cut rates too – if only US data would allow. We have a slight bias for a lower dollar ahead of a first Fed rate cut in September

Main ING G10 FX forecasts

| EUR/USD | USD/JPY | GBP/USD | ||||

| 1M | 1.08 | → | 152.00 | ↓ | 1.24 | ↓ |

| 3M | 1.09 | ↑ | 150.00 | ↓ | 1.25 | → |

| 6M | 1.10 | ↑ | 145.00 | ↓ | 1.25 | → |

| 12M | 1.10 | → | 140.00 | ↓ | 1.25 | ↓ |

| EUR/GBP | EUR/CHF | USD/CAD | ||||

| 1M | 0.87 | ↑ | 0.97 | ↓ | 1.38 | ↑ |

| 3M | 0.87 | ↑ | 0.98 | ↑ | 1.36 | → |

| 6M | 0.88 | ↑ | 0.99 | ↑ | 1.34 | ↓ |

| 12M | 0.88 | ↑ | 1.00 | ↑ | 1.32 | ↓ |

EUR/USD: Does the divergence trade have legs?

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/USD

1.0768

|

Neutral | 1.08 | 1.09 | 1.10 | 1.10 |

- A month ago, the standout narrative was a strong US economy and dwindling chances of Fed rate cuts offset against an ECB confidently predicting a rate cut. A month later, the US story has softened, the eurozone picture has improved, and volatility has fallen as EUR/USD continues to trade near 1.07/1.08.

- We suspect this environment can continue for another month or so with probably symmetrical risks for EUR/USD from here. US activity data, including jobs, could start to slow, yet the US price data could stay sticky and limit Fed easing expectations.

- We suspect US election risk will only start to hit FX markets from August/September onwards, with Trump seen more positive for the dollar.

Source: Refinitiv, ING

USD/JPY: Tokyo presses the intervention button

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/JPY

155.84

|

Mildly Bearish | 152.00 | 150.00 | 145.00 | 140.00 |

- It looks like Japanese authorities have intervened twice to sell USD/JPY – selling a total of $50bn in the 158/159 area. The amounts will only be confirmed at the end of May. Tokyo’s objective here will be to inject some two-way risk into USD/JPY and buy some time until – they hope – the broad dollar trend turns lower in the second half.

- At the same time the Bank of Japan is starting to talk up the effects of the weak yen on inflation. We look for rate hikes in July and October, but speculation of a hike may emerge as early as 14 June.

- We estimate the yen is the most undervalued G10 currency, but a weaker dollar or higher volatility is needed to turn the trend.

Source: Refinitiv, ING

GBP/USD: BoE inches towards the first rate cut

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

GBP/USD

1.2518

|

Neutral | 1.24 | 1.25 | 1.25 | 1.25 |

- The BoE policy cycle is getting interesting! We think Governor Andrew Bailey would like to join two fellow MPC members in voting for a cut, but is struggling to convince the majority. A June rate cut is now priced with a 60% probability (entirely possible) but our slight preference is for August. The key piece of data determining the timing of the cut will be April services CPI on 22 May.

- We look for sterling underperformance from here as the BoE cycle is priced closer to the ECB than to the Fed.

- The core story here is that the UK is running a negative output gap – making the BoE far more likely to cut rates earlier and deeper than the Fed. This should keep GBP/USD subdued.

Source: Refinitiv, ING

EUR/JPY: 170 was too much for Tokyo

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/JPY

167.82

|

Mildly Bearish | 164.00 | 164.00 | 160.00 | 154.00 |

- If one wanted to draw lines in the sand, one could argue that 160 in USD/JPY and 170 in EUR/JPY were the triggers for FX intervention. In reality, however, it was more about the speed of the moves than the levels. Investors may now be asking how much firepower the BoJ has for intervention. For reference, BoJ FX reserves are in excess of $1tr and we could see them using $200-250bn in this exercise.

- Both the eurozone and Japanese economies are showing signs of improving. Yet the ECB should be cutting in June, while the BoJ has already hiked. A scaled-back ECB easing cycle could help EUR.

- EUR/JPY is overvalued and 155 seems a reasonable 12m target.

Source: Refinitiv, ING

EUR/GBP: Starting to move

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/GBP

0.8602

|

Mildly Bullish | 0.87 | 0.87 | 0.88 | 0.88 |

- The 0.8500 base in EUR/GBP now looks more secure and we think this pair is ready to break higher. The only question is whether the move happens in May or June. We have a slight preference for June – when we have a better chance of seeing UK services CPI coming in lower. EUR/GBP downside should be limited now.

- Regarding the UK election, polls continue to show a substantial 20% lead for Labour. We doubt sterling requires a risk premium for the election, although global FX volatility is skewed higher into and after the main event of the year – US elections in November.

- The ECB is reluctant to be drawn on the scale of its easing cycle – though most expect the low point in the 2.25/2.50% area, with the neutral real rate seen something like 0.25%.

Source: Refinitiv, ING

EUR/CHF: Slight core inflation surprise helps CHF

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/CHF

0.9775

|

Neutral | 0.97 | 0.98 | 0.99 | 1.00 |

- A key driver of Swiss franc weakness this year has been low Swiss inflation. This has seen the Swiss National Bank change tact on FX policy – no longer using the franc as a tool to fight inflation. The slight upside surprise in Swiss core inflation in April – albeit at only 1.2% YoY – has thus provided a little support to the CHF.

- Equally two-year EUR:CHF swap differentials have been a big driver of EUR/CHF. With the Swiss leg of this differential very anchored, EUR/CHF has therefore been a function of ECB easing expectations. Markets price 75bp of ECB easing, ING call is for 75bp, but the bigger risk is now 50bp – i.e., a +ve risk for EUR/CHF.

- Look for an SNB 25bp cut in June – taking the policy rate to 1.25%

Source: Refinitiv, ING

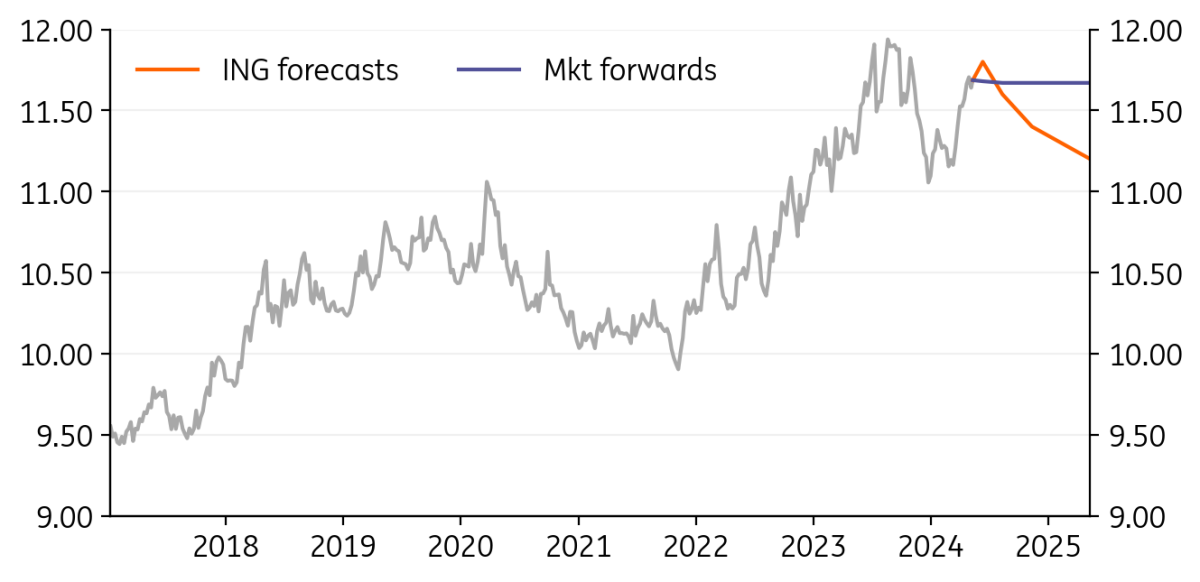

EUR/NOK: Norges Bank remains a NOK-positive

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/NOK

11.67

|

Neutral | 11.70 | 11.50 | 11.30 | 11.00 |

- Norges Bank kept moving to the hawkish side of the spectrum, signalling at the May meeting that rates may be kept high for longer than previously anticipated, and keeping a hike on the table if necessary. It also stressed concerns about the weak krone and its inflationary potential.

- FX purchases have been increased from NOK 350m to 550m daily in May. That isn’t positive for NOK, but also far from the 1bn+ of 2023, which still did not hinder NOK’s rally in December.

- Admittedly, the outlook for the relatively illiquid krone remains almost entirely a function of USD rates. We still like the chances of Fed cuts this year, so we remain positive on a NOK recovery after some more short-term downside risks.

Source: Refinitiv, ING

EUR/SEK: Don’t rule out back-to-back Riksbank cuts

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/SEK

11.68

|

Mildly Bullish | 11.80 | 11.60 | 11.40 | 11.20 |

- The Riksbank rate cut in May conveyed the message that policymakers are probably less concerned about a weak krona than what they signal in their communication (more in this note).

- The forward guidance (two cuts in 2H) should not be taken by the letter. If inflation keeps slowing, the growth outlook doesn’t materially improve and SEK at least stabilises, then risks are skewed towards three cuts this year.

- All this means SEK is less attractive than NOK, AUD and NZD in a bullish (lower USD rates) scenario. EUR/SEK upside risks remain tangible in the near term, with new FX reserve hedging potentially being re-deployed if EUR/SEK closes in on 12.00.

Source: Refinitiv, ING

EUR/DKK: Denmark awaiting the ECB cut

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/DKK

7.4604

|

Neutral | 7.46 | 7.46 | 7.46 | 7.46 |

- Danmarks Nationalbank’s last FX intervention was in January 2023, and a quite stable EUR/DKK around the 7.4600 central peg level means chances of more intervention remains very low.

- A 25bp rate cut by the ECB in June appears carved in stone, and there are no reasons for the Danish central bank not to follow with the same amount. The exchange rate is the target of monetary policy, but inflation below 1.0% in Denmark makes it quite inconsistent with the current 3.60% policy rate. The krone remains also quite weak in trade-weighted real terms.

- We maintain our view that EUR/DKK will keep stabilising around 7.46 over coming quarters.

Source: Refinitiv, ING

USD/CAD: BoC June cut still on the table

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CAD

1.3654

|

Mildly Bullish | 1.38 | 1.36 | 1.34 | 1.32 |

- Canadian inflation slowed to 2.9% in March, with core measures at 2.8% (median) and 3.1% (trim). With the Bank of Canada setting the inflation target at 1-3% - and having signalled openness to cuts recently - we think a 25bp rate cut at the 5 June meeting looks more than possible.

- Canada’s jobs market has been showing some signs of loosening, but employment gains proved very strong (+90k) in April. We still think the BoC will be more focused on inflation, though.

- We see downside risks for CAD moving ahead. While the direction of travel for USD/CAD will depend on developments in US jobs and inflation, the loonie can show some weakness in the crosses as the BoC starts cutting rates.

Source: Refinitiv, ING

AUD/USD: Could the RBA hike again?

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

AUD/USD

0.6608

|

Neutral | 0.66 | 0.68 | 0.67 | 0.66 |

- In line with our expectations, the disinflation process in Australia is facing some hiccups. With measures of core CPI still above 4.0% (1Q data), the RBA has no incentive in turning to an even slightly more dovish narrative at this stage.

- It is not our base case, but we still see some risks that the RBA will have to hike rates again if inflation proves stickier than expected.

- The AUD curve is not pricing any easing by the RBA before year-end but might start to flirt with the idea of another hike, keeping AUD’s advantage over many other G10 currencies well justified. AUD/USD may stay under some pressure as US data still proves slow to turn lower, but we still like the chances of a summer rally.

Source: Refinitiv, ING

NZD/USD: Sticky inflation to discourage RBNZ doves

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

NZD/USD

0.6016

|

Neutral | 0.60 | 0.62 | 0.62 | 0.61 |

- We don’t expect major changes in communication by the Reserve Bank of New Zealand at the 22 May policy meeting. 1Q data showed some loosening in the Kiwi jobs market, with unemployment ticking higher to 4.3%.

- However, non-tradeable inflation came in above expectations at 1.6% QoQ in 1Q, endorsing our view that the spike in net migration will make the disinflation process lengthier.

- In light of all this and the repricing higher in USD rates, the RBNZ should refrain from signalling more openness to rate cuts this year. That can help the New Zealand dollar recover some ground against AUD, while an NZD/USD rally does not look too likely already this month.

Source: Refinitiv, ING

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

13 May 2024

FX Talking: Under Starter’s Orders This bundle contains 6 Articles