FX: Re-connecting with rates

Last month saw the dollar strengthen, dramatically re-connecting with interest rate spreads. But we still think the dollar will weaken come the end of the year and into 2019

Whether it was the two-year EUR:USD swap spread moving through the psychological 300bp level or a brief respite in Trump’s twitter account, the last month has seen the dollar dramatically re-connect with interest rate spreads. This has caused substantial problems for investors positioned for a benign dollar trend and emerging market growth stories. While we have been forced to upgrade our dollar profile for this summer, we still think the dollar will be weaker by year-end and throughout 2019.

Interest rate spreads had little bearing on the dollar trend between last September and this March. But that all changed from mid-April onwards, which has now seen the trade-weighted dollar reclaim all of this year’s losses. We believe the severity of the move primarily owed to positioning – our long-held dollar bearish had very much become mainstream this year – and probably higher oil prices driving US rates higher.

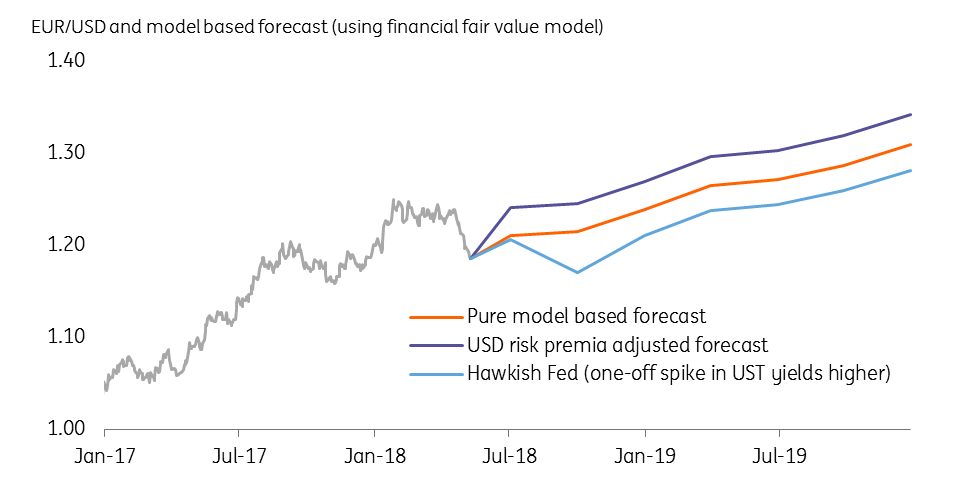

What if interest rate spreads alone drive EUR/USD over coming quarters?

If, for a minute, we assume that rate spreads – and only rate spreads – drive EUR/USD over coming quarters, what will the EUR/USD profile look like? Using ING’s baseline views for rates, which see the US two year yields pushing into the 2.75/80% area this summer, our financial fair value model would see EUR/USD trade near 1.17 this summer before pushing to 1.30 into 2019. A more hawkish interpretation of US rates, with two year-yields at 3.00% this summer, could see EUR/USD at 1.15.

But the above assumes that i) the economic divergence between the US and the Eurozone continues, ii) that there is no protectionist or fiscal risk premia in the dollar and iii) investors abandon the ECB normalisation story that so helped the EUR in 2H18.

EUR/USD profile under alternative scenarios

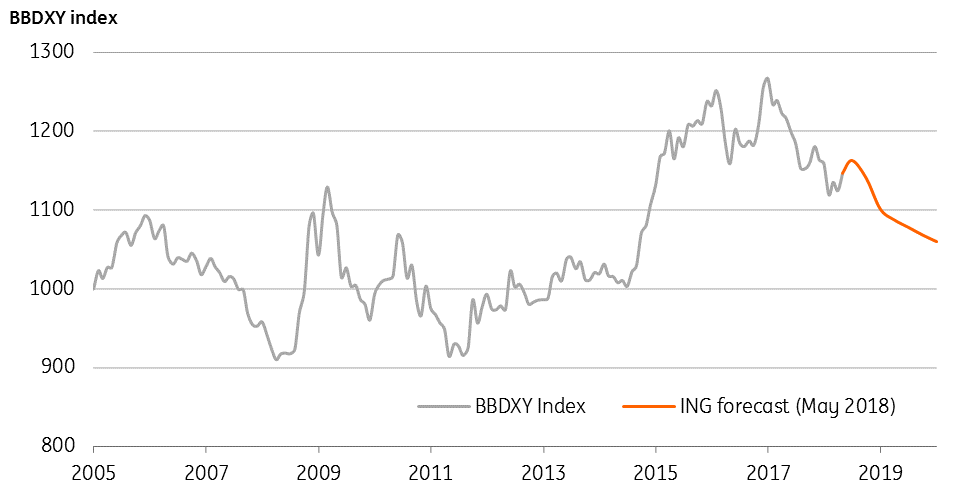

ING’s forecast for the trade-weighted dollar

Expect EUR/USD downside to be limited

Instead, we see: i) US and Eurozone divergence at its peak right now and expect the Eurozone to recover from the strike/weather/flu-related slow-down in 1Q18, ii) protectionist fears may re-appear in late May when Washington decides which tariffs on China won’t be watered down and iii) expect the ECB story to come back into focus into July and particularly by year-end.

We, therefore, see EUR/USD downside limited to the 1.15/17 area this summer and retain targets above 1.30 in 2019.

On-going dollar strength would cause more problems in the emerging market space. Argentina and Turkey normally top the list of those most exposed to a sudden stop in portfolio flows. And elections this year in Turkey, Mexico and Brazil will keep investors on their toes.

But as long as emerging market growth rates – and Rest of World growth rates in general – hold up, economic convergence stories should drive the trade-weighted dollar weaker into 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

ING’s May Economic Update This bundle contains 8 Articles