FX: Sell in May….

May is typically a bad month for EUR/USD. 1.10 looks the target this summer as US data holds up well and the ECB contemplates the signals it wants to send with the TLTRO III in June. A surprise decline in the renminbi would also shake up the low volatility mood

'Activity' currencies to stay on the back foot

The investor adage of ‘Sell In May’ has not always been that helpful – the S&P 500 has actually rallied for the last six consecutive months of May – but rising geopolitical risk certainly gives rise to caution. A less benign environment suggests activity currencies (including the Euro) will stay on the back foot, while the dollar should hold onto gains.

FX markets have largely been characterised by declining volatility this year (helping some high yield currencies) and high short term US rates that seemingly support the dollar in good times and in bad. In addition to monetary policy (especially the ECB’s), the low volatility story has also been driven by the tightly managed USD/CNY near 6.70. However, that anchor looks to be slipping.

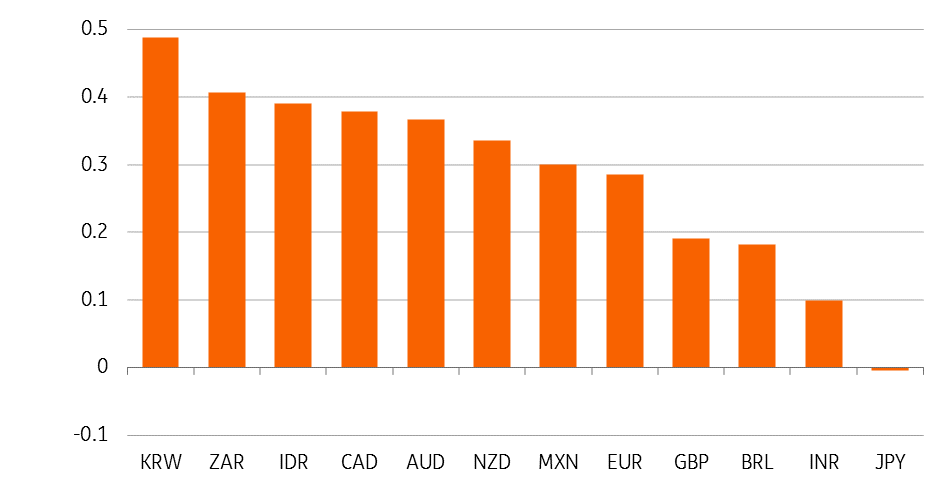

No one knows how US-China trade relations will play out over coming weeks and months, but a breakdown in negotiations and the CNY sliding back to towards 7/USD (not our preferred view) would certainly un-nerve emerging market currencies and re-direct investments towards the safe haven USD and the JPY.

Year-to-date correlations with CNY (versus USD)

European growth concerns remain

That story would also pressure the EUR at a time that the Eurozone is struggling to shake-off the effects of last year’s trade war. Despite the slightly better than expected 1Q19 GDP figure, Euro area growth concerns remain and the market will be wary of the ECB’s meeting in June where details of TLTRO III will be announced, cementing low rates.

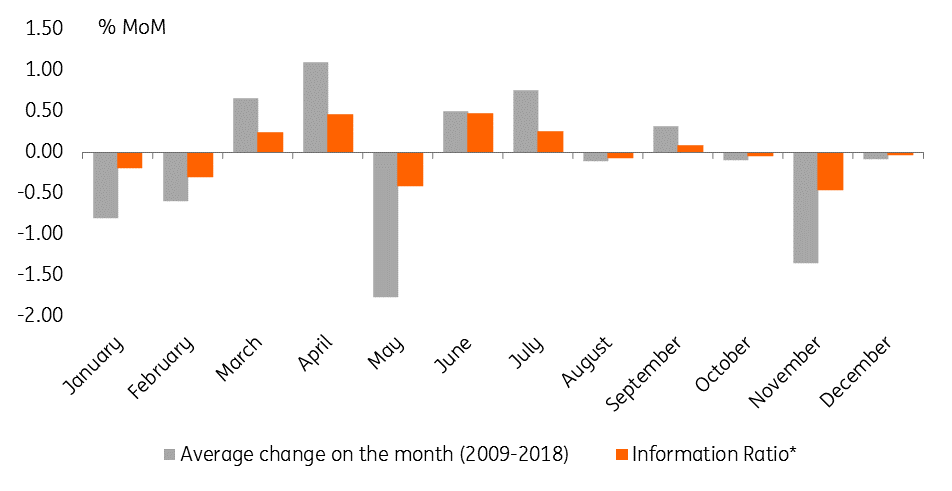

Seasonal trends suggest May is a bad month for EUR/USD

Additionally, the wild card of European elections and Washington’s threat to impose tariffs on auto imports hang over the Euro this summer. If that weren’t enough, seasonal trends also suggest May is a bad month for EUR/USD. It has fallen in eight of the last ten months of May for an average decline of about 1.5% on the month.

EUR/USD average returns… sell in May

We see no reason to change our 1.10 EUR/USD forecast for end June 19. We have, though, recently scaled back the expected EUR/USD recovery into 2020/21, but importantly keep the view that widening US deficits and the mature business cycle means that the dollar peaks this year. The timing of that peak will have to be driven from the US side – since re-rating stories overseas are conspicuous by their absence.

Elsewhere, we are not now big subscribers to the idea of a GBP re-rating this summer. The path ahead for a Brexit deal remains clouded and the market has stopped listening to BoE threats of a path to more frequent rate increases. The scope for a UK leadership election in 3Q19, ushering in a more Eurosceptic PM, still poses a health warning to GBP.

This article forms part of our Monthly Economic Update which you can find here

Tags

May Monthly UpdateDownload

Download article10 May 2019

May economic update: Just when things were looking up This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more