FX positioning update: Overstretched GBP longs

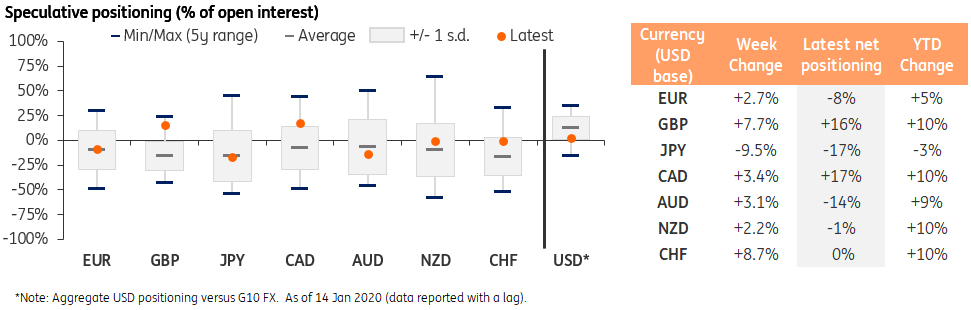

In the week 8-14 January CFTC reports a jump in GBP net long positioning. The yen keeps suffering from a supported risk environment and is now the biggest G10 speculative short. CHF net positions are at their highest since 2017, while the dollar lost ground across the board

GBP positioning now looks overdone

The slump in sterling speculative shorts continued in the week 8-14 January, according to CFTC data. This denotes a singular detachment of positioning data with spot movements: in the same period, GBP/USD lost about 1% while gaining almost 8% (of open interest) on the positioning side. The change is also related to the widespread drop in USD long positions (as evident in Figure 1). With net longs piling up to 16% of open interest, GBP downside potential may be exacerbated in the coming weeks should negative headline news persist, not least on a possible rate cut or on the UK/EU trade negotiations.

Figure 1 - FX Positioning Overview

Waning interest for speculative dollar longs was also mirrored in the EUR/USD net short positioning that contracted below 10% for the first time since October. That may also be a reflection of the sustained underperformance of EGBs, but the lingering grim outlook for the eurozone economy should keep the appetite for the EUR quite muted.

Another slump for JPY, CHF positioning surges

The yen net speculative positions advanced into short territory and amounted to -17% of open interest. JPY is, therefore, the most oversold currency in the G10 space. The further stabilisation in global risk appetite in the aftermath of the “Phase One” trade deal signing suggests the slump in JPY longs may well extend to the next CFTC report. That's especially so when you consider that the Bank of Japan meeting this week is unlikely to provide any respite to the recent JPY underperformance, as highlighted in our FX Week Ahead preview.

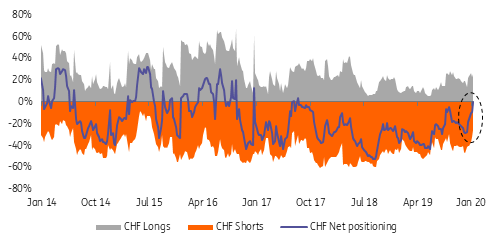

Figure 2 - CHF positioning jumps to the highest since 2017

A very eventful week for the Swiss franc left its mark on positioning data. The US Treasury FX Report sparked speculation that the SNB may refrain from intervening against CHF appreciation, which prompted speculators to slash their outstanding short positions. Net speculative positioning on the franc is now in neutral territory, at its highest since August 2017 (Figure 2). Markets may well continue to test SNB patience about FX interventions, which could prompt another round of short-trimming in CHF.

Elsewhere, positioning on the G10 $-bloc rose mostly on the back of dropping USD longs. AUD remains the only one among its peers in oversold territory: a dynamic we expect to continue on the back of rising chances of an RBA cut and lingering uncertainty with regards to the economic impact of bushfires.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article