FX Markets: The return of mercantilism

It has been a while since we have used terms such as 'currency wars' or 'mercantilism' in FX markets. Such terms normally relate to competitive devaluations to secure export share in a deflationary world. But what's the best currency policy in an environment of scarce commodity resources? The renminbi shows the way here and we think the dollar will follow

Weak currencies fall out of fashion

Faced with disinflationary forces over the last 20 years and particularly during the pandemic last year, most developed nations have preferred weak currencies to support export growth. Competitive devaluations, greater interest in the US Treasury's report on currency manipulation and the term 'currency war' were all synonymous with assumptions that inflation was dead and that all economic levers, including FX, should be employed towards growth.

There are signs that currency preferences are starting to change. Leading the pack amongst the major currencies this year is the renminbi. The broad, trade-weighted renminbi is up nearly 6%. The move seems at odds with China slowdown fears, the People's Bank of China reserve requirement cut and Evergrande related concerns in the Chinese financial sector.

How to explain it? We suspect the move relates to some of the issues we discussed in an article in May. Higher commodity prices have been a concern for Chinese policymakers for some time and this concern has been backed by unprecedented Chinese sales of strategic reserves from energy and industrial metal stockpiles. Most recently, Chinese policy makers have instructed major energy companies to secure energy supplies for this winter at all costs. A stronger renminbi certainly helps in this exercise.

Surging energy prices are also starting to question FX policy preferences elsewhere in the world. Central banks where tightening cycles are underway, especially in emerging markets, would welcome more stable or stronger currencies. And in the developed space, both Norway and New Zealand have already started tightening cycles and would not be averse to currency strength. At completely the other end of the spectrum are the central banks in the eurozone, Sweden, Switzerland and Japan which all retain their fears of disinflation and show no signs of switching to a less accommodative stance.

This brings us to the dollar. Here, expectations of Fed policy are on the move and we are now bringing forward our forecast rally in the dollar.

Broad trade-weighted currencies: The renminbi leads the pack

Bringing forward the forecast dollar rally

James Knightley has had a good call this year being on the right side of the inflation and Federal Reserve policy story. Based on his views that September 2022 would be the lift-off for the Fed tightening cycle, we had expected the bulk of the dollar rally to start coming through from 2Q22 onwards.

But based on a very hawkish set of Fed Dot Plots released in September and the energy price surge - effectively demanding a more urgent policy response - we think this dollar rally can start much sooner - even now. Driving the move is the adjustment in short-term US interest rates. Here, the 1m USD OIS rate priced three years' forward is still some 50bp below Fed projections. We think the pressure from better US activity data and progress towards the Fed's employment goals over coming months can maintain the hawkish re-pricing in US rates markets and keep the dollar bid.

An unresponsive European Central Bank should mean EUR/USD presses 1.15 and possibly trades to 1.13 over coming months. But seasonal dollar weakness in December is the reason for our 1.17 end-year '21 target. And we are bringing forward our 1.10 end-2023 target by a year to end-2022.

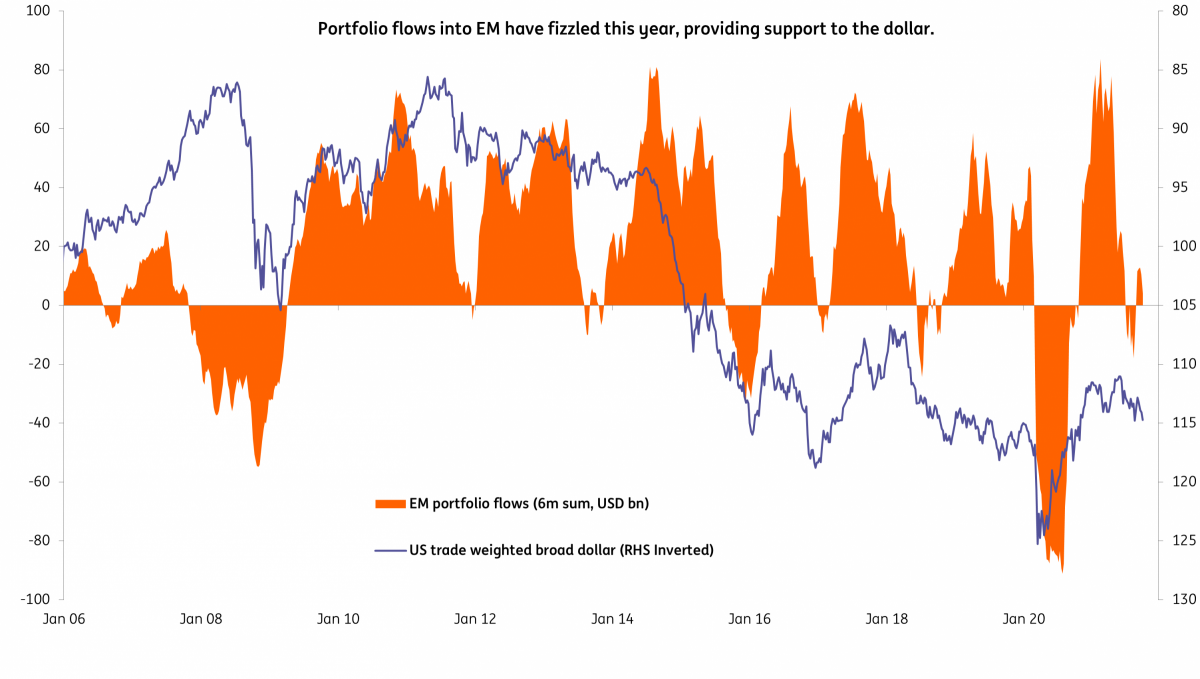

Higher US rates and ongoing trade and supply chain problems suggest 2022 will be a difficult time for emerging markets. The year also sees some big and contentious elections in Brazil. 2021 has been a poor year for flows into EM and one of the reasons the anti-cyclical dollar has stayed supported. A tough year for EM portfolio flows in 2022 is another reason why we see the dollar staying supported for the next 15 months.

Portfolio flows into EM have been disappointing this year

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 October 2021

ING Monthly: Starting the great rotation This bundle contains 11 Articles