FX Daily: ECB unlikely to revive EUR bulls today

We think that the balance of risks is skewed to the downside for EUR/USD ahead of the ECB policy meeting today, as we suspect that clarifications on the strategy review and any new guidance will have a dovish tone and lead markets to expect less tapering in 2022. In South Africa, we expect the SARB to keep rates on hold, while any hawkish tilt should not rock ZAR.

USD: All about the ECB today

The ECB meeting today is largely seen as the main event in a week where major FX currencies have not shown large moves.

Still, defensive trades have generally dominated the FX market, leaving the dollar supported against all pro-cyclical G10 currencies except for the loonie, which appears to be benefitting from a delayed positive impact from last week’s BoC tapering announcement (which in our view suggests asset purchases in Canada will end by the end of 2021). The data flow in the US remains very light and looks unlikely to drive market expectations ahead of next weeks Federal Reserve meeting in one direction or another.

EUR: Dovish ECB unlikely to help the euro

Last week’s comments by Christine Lagarde and the recently published strategy review raised the stakes for today’s ECB policy meeting.

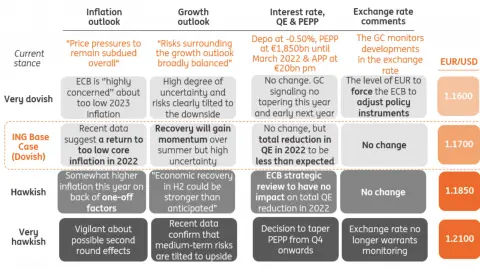

As discussed in our “EUR & ECB Cribsheet”, we think the distribution of probabilities for EUR/USD are skewed to the downside today. The main reason is that we see a non-negligible risk that the clarifications following the strategy review will lead markets to think that the Bank will increase purchases under the APP while unwinding the PEPP, which ultimately suggests that the pace of tapering for 2022 may well be smaller than previously expected. In addition, we think that any clarification about the new symmetrical inflation targeting will underscore how this will imply a more dovish stance.

Despite President Lagarde announcing last week how there will be a change in the ECB guidance today, our economists do not think this will be in the sphere of rates forward guidance, which should remain anchored to the lower-bound, but instead on the mix between PEPP and APP, which, as mentioned, could imply a lower net reduction of purchases in 2022. This should underpin the notion that the ECB is not following the Fed in its hawkish trend, and encourage markets to stay broadly bearish the EUR/USD for today when we could see a decisive move into the lower half of the 1.1700-1.1800 area.

Still, we expect the ECB-Fed policy divergence to fully emerge in 2022 when we expect EUR/USD to give up the gains we still forecast to see in 2H21.

GBP: Re-aligning with short-term fair value

EUR/GBP corrected lower and is trading below 0.8600 this morning. According to our fair value model, the recent spike in the pair has led it to reach a short-term overvaluation.

In line with our view that the ECB meeting may have a negative impact on the EUR, EUR/GBP may continue retracting today. However, any sustained downtrend in the pair may have to face the Brexit-related news flow, which is once again signalling the political divergence between the UK and the EU as the latter reiterated that re-negotiating the Northern Ireland Protocol is not an option.

ZAR: SARB unlikely to be rushed into hikes

South Africa’s central bank – or SARB – meets today to set interest rates and is widely expected to keep the policy rate at 3.50%. Unlike peers in Russia, Brazil and Mexico, the SARB is not being rushed into rate hikes since inflation remains remarkably contained in South Africa. Headline and core are just 4.9% and 3.2% YoY respectively – well within the SARB’s target of 4.5% +/- 1.5%.

The SARB does note upside risks to inflation – largely through wages or energy prices – but it looks too early for the SARB to conclude anything from the recent widespread riots – e.g. South Africa’s largest oil refinery recently had to shut due to public safety concerns.

The riots will impact growth, however, though again it may be too early for the SARB to revise lower its 4.2% GDP projection for 2021 – a forecast only recently revised higher.

What does all this mean for the ZAR? The SARB in May felt that the ZAR was near its long run equilibrium level – USD/ZAR was trading 14.00 at the time. While strong terms of trade, high trade surpluses and 5% implied yields all make the ZAR look attractive, we doubt USD/ZAR can make it below 14.00 on a sustainable basis anymore. And were the SARB to sound a little hawkish today (cementing the two hikes expected by the market by year-end), we suspect the 14.25/35 area may be the best levels for the ZAR, before USD/ZAR heads through 15 later this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

FX DailyDownload

Download article

22 July 2021

It’s ECB day: What you need to know This bundle contains 5 Articles