How French politics could affect European asset markets in June

French bond markets are selling off for a second day as investors adjust positions ahead of the unexpected French parliamentary elections later this month. We take a look at how European bond, FX and credit markets could perform

Politics: Markets focus on French fiscal challenges

European financial markets remain under pressure for a second day as investors assess the possible outcome of French parliamentary elections later this month and where they could impact policy. Our ING colleagues discuss what the weekend developments mean for France here, and also for European policy making and its impact on the economy more broadly here. Needless to say it is not good news.

When it comes to financial markets, the focal point of stress is the French government bond market. Investors knew that France had a problem with its 5%+ budget deficit and that it would likely be placed on an Excessive Deficit Procedure by the European Commission on 19 June. However, the shape of the forthcoming French parliament and its attitude towards fiscal consolidation is now taking its toll on French government bonds. We take a look at the fallout on debt, FX and credit markets below.

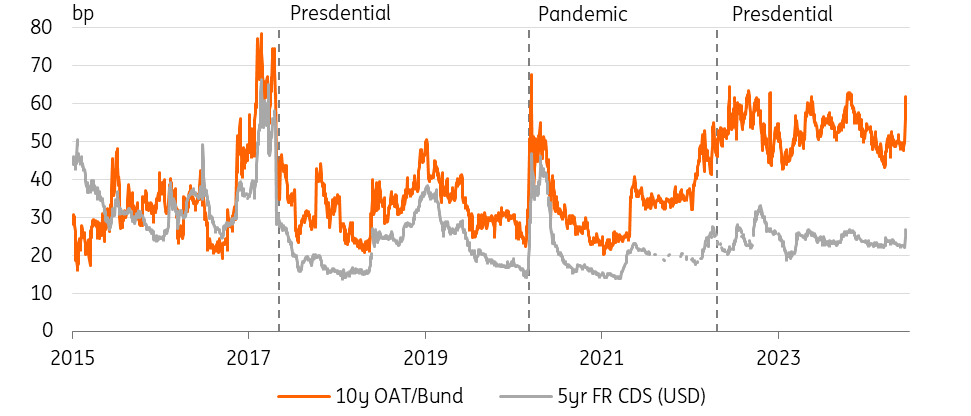

France-Germany sovereign yield spread, France 5 year CDS

Bonds: Little reason for French-German spreads to tighten

Heightened uncertainty and (perceived) spread volatility mean investors demand a higher compensation for holding spread risk. Accordingly, 10Y French sovereign bonds saw their yield spreads over Bunds widen by close to 8bp yesterday as a reaction to the political fallout. They have continued to widen another 8bp today, approaching 64bp – their widest level since October 2023.

Is that a worrying level? The spread has spiked only briefly over the 60bp threshold in more recent history. In 2023 when the Silicon Valley Bank failed and when the Middle East turmoil erupted; in 2022 on multiple occasions when the European Central Bank started to tighten policies. The French presidential elections of 2017 saw the spread spike to around 80bp. However, the bond spread is not the only measure of risk sentiment, and it reflects factors that may have more to do with the stage of the ECB policy cycle. This includes extraordinary measures such as bond buying, which the ECB started to reduce and phase out over 2022, or general risk perception – for instance, implied volatility levels are still somewhat elevated compared to 2014 through 2021 despite having already declined considerably from a recent peak.

More idiosyncratic measures of French country risk have shown a more muted reaction. The 5Y CDS has widened a bit more than 4bp and now sits close to 28bp, about 2bp above its two-year average. That is not to say that paired with fiscal concerns the political dynamics cannot push spreads wider from here. The ECB backstop that has helped to contain spread turmoil over the past decade is no longer a given. The ECB’s trigger levels to intervene appear higher than before, with the central bank having set quantitative tightening on a preset course and with all reinvestments set to end by the end of this year. The ECB now relies on its Transmission Protection Instrument (TPI) to contain sovereign bond market turmoil, although conditionality here is officially tied to compliance with budget rules.

Taking these points together, we see scope for a further widening of the 10Y OAT-Bund spread in the near term. We see plenty of sources of looming uncertainty, including the EU's excessive debt procedures later this month. As a macro backdrop, we have the ECB’s quantitative tightening which in and of itself exerts widening pressure on bond spreads. So until the elections, we see little reason for spreads to tighten.

FX: French fiscal risk to keep a lid on the euro

EUR/USD has sold off around 1.5% since Friday, largely on the back of strong US jobs data but particularly yesterday on the fallout from weekend elections. Notably the trade-weighted euro fell 0.7% yesterday, with EUR/GBP and EUR/CHF some high profile pairs to break decisively lower. Can the euro fall much further in June as markets focus on French fiscal risk and the outcome of the elections?

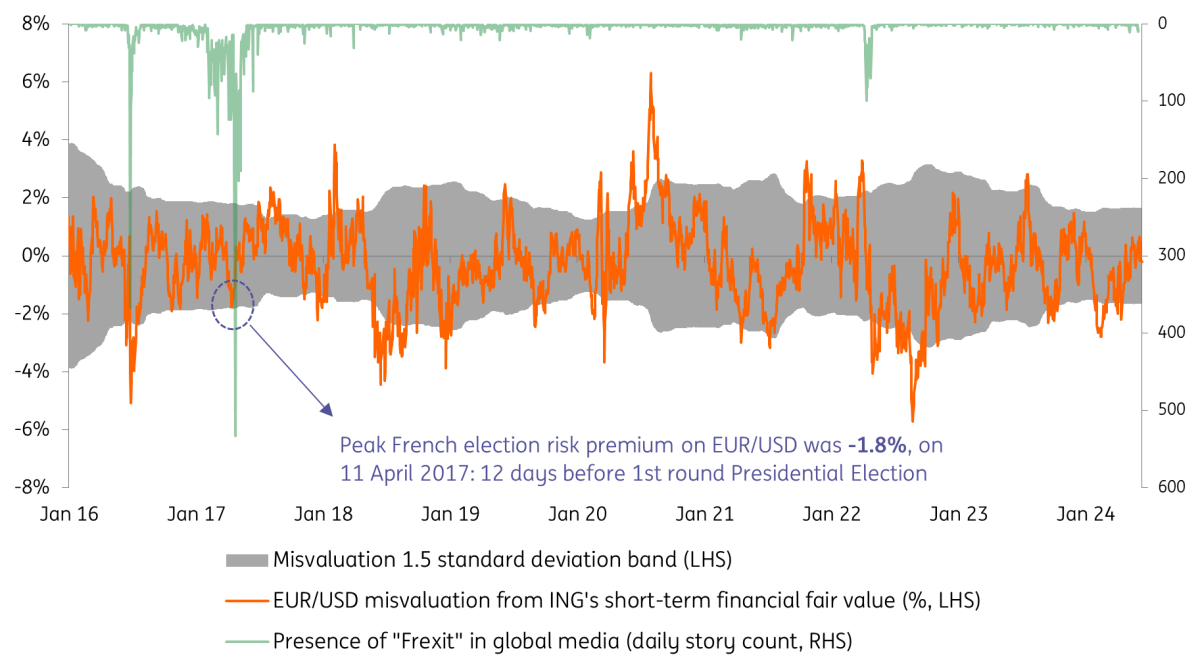

To gauge how far the euro can fall, we try to estimate what kind of risk premium is in EUR/USD, for example. We do this by comparing EUR/USD spot to our Financial Fair Value (FFV) reading. Our financial fair value model uses a number of interest rate and equity variables to estimate the short-term fair value of a currency pair. In periods of political turmoil in the EU, EUR/USD showed a tendency to build a risk premium (i.e., EUR/USD being undervalued for some time). As shown in the chart below, the peak of EUR/USD risk premium related to French politics was in April 2017, in the run-up to the first round of the French presidential election (23 April 2017) and amounted to around 1.8% in our estimates. That was related to the perceived risk of France holding a referendum to leave the EU (“Frexit”), but was quite small compared to the risk premium related to the Brexit vote in 2016 and Italian political turmoil in 2018.

Currently, “Frexit” is no longer seen as a risk, but markets are looking somewhat jittery ahead of the snap parliamentary election scheduled for 30 June/7 July. Back in 2017, that 1.8% undervaluation in EUR/USD matched the lower bound of the one-year 1.5 standard deviation band for misvaluation. Should we observe something similar this time, we could see EUR/USD trade some 1.5-1.7% below its short-term fair value. The misvaluation as of Monday 10 June’s market close was -0.2%, in our estimates.

In short, we could see another 1.5% weakness in EUR/USD this month were the risk premium to build further.

EUR/USD deviation from fair value and French elections

Credit: French banks bonds wider, but effect in corporates more muted

The most significant reaction in credit was from French banks, where non-preferred senior bonds saw widening of 6-8bp. Meanwhile in subordinated, the T2 bonds widened by 10bp and AT1 bonds fell 1.5pts. The reaction was a bit more muted for French corporates, with some small widening in some names but no major widening.

Euro credit is fairly priced to a touch rich and trading within this range as technical strength and yield attraction keep credit at these tight levels. This results in most negative events being shrugged off rather quickly. As such, any small hiccup and widening of spreads offers buying opportunities for additional pick-up, as we expect a slow grind tighter through the summer months.

The French Utility EDF is bringing three bonds to the market today (Green 7yr IPT: MS+145a, 12yr IPT: 175a, 20yr MS+220a). While it will be interesting to see where they get priced, it does show the ability to still get deals done and the more muted effect of these elections on corporate credit markets.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article