French households have never been richer but they’re still cautious

ING has just published a study (in French) about French financial wealth. It shows that households have never been so rich, but have little taste for risk when it comes to savings. It also appears that inequalities are much bigger in France when we consider wealth and not income

| €178,200 |

Average household wealth in France |

Household financial wealth remains concentrated in non-risk assets

Household financial assets reached €5,233bn in 3Q17, 8.5% higher than a year before. This represents an average household wealth of €178,200. With €1,576bn of debt, net financial wealth was €3,658bn, or €107,700 per household, which is 15% more than in Germany.

French savers have developed a strong preference for long-term safe assets through the years, with life insurance now representing 37% of the total and the various forms of savings accounts representing 18% of financial wealth. Since 2009, French households have saved €722bn representing around €260 per month. They disinvested stocks and mutual funds in favour of savings accounts and life insurance.

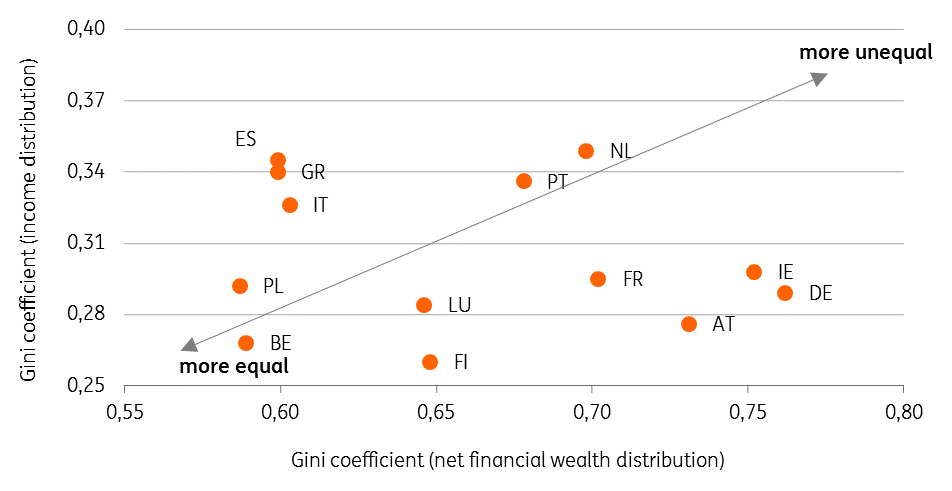

Riskier financial assets like mutual funds, bonds or stocks represented a mere 12%. This is in line with recent surveys showing that 8 out of 10 people do not trust stocks for their savings. This has not stopped the French from being among the largest holders of stocks in the Eurozone, but that's largely because wealth distribution in France is not as equal as one may think.

Looking at the distribution of wealth, it is interesting to note that while France is among the European countries with a relatively low income inequality, the inequalities in wealth distribution are more pronounced.

A recovering housing market is pushing household debt upwards despite a low interest rate environment

Non-financial assets reached a value of €7,500bn in 3Q17, of which €6,880 are real estate assets. This represents 55% of the total household wealth, down from a peak of 60% in 2008. Household debt mainly comprises mortgages (€940bn in 3Q17, or 70% of GDP, which is higher than what is observed in the three others big Eurozone economies). If the financial crisis brought the quick rise in debt to an end in 2008, it is gaining traction again, thanks to low interest rates and more favourable fiscal conditions for private investors. Household mortgage debt has increased by €54bn in 2017 as a whole and we expect this trend to continue in both 2018 and 2019, bringing the household debt to GDP ratio well above 70%.

You can see the full study in French here:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article