France: Solid rebound and moderate inflation bode well for Macron’s re-election

The economic rebound in France was dynamic in 2021, albeit uneven, and should continue in 2022, with inflation remaining more moderate than elsewhere in Europe

A solid but uneven rebound

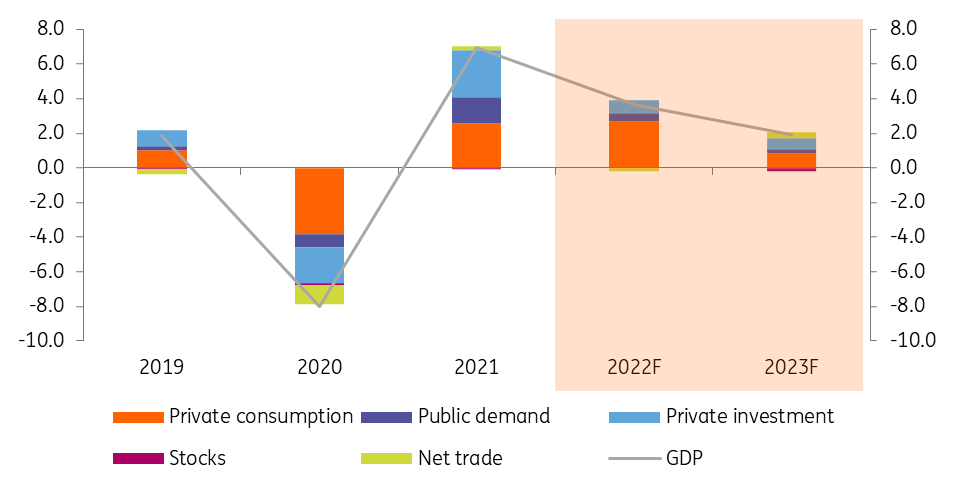

After two strict lockdowns in 2020 that led to an 8% fall in GDP, 2021 was well-positioned for a rebound. Driven mainly by investment and consumption, the economy grew by 7% over the year, enabling France to return to its pre-crisis level of activity in the third quarter and to exceed it by 0.9% by the end of the year. Household consumption, which was still largely restricted by health measures during the first half of the year, rebounded sharply to its pre-crisis level by the end of the year. Overall, the recovery in 2021 was impressive, but also relatively uneven across sectors. While the production of services was, at the end of 2021, well above its pre-crisis level (+3.1%), the production of goods is far from having caught up. At the end of 2021, industrial production was 5.9% below its pre-crisis level and, notably, below the level at the end of 2020. This is due to the generally unfavourable international backdrop, with supply chains severely disrupted, but also due to the specific nature of French industry, which is largely focused on transport equipment - an area that was severely impacted by the health restrictions, with production at the end of 2021 still 19.2% below its pre-crisis level.

Positive outlook, but uncertainty linked to inflation and the presidential elections

For 2022, the outlook is generally positive. Although the first quarter will probably be weaker due to the significant absenteeism caused by Omicron, the rebound should continue and intensify in the second quarter. Thanks to significant regulation of gas and electricity prices, overall consumer price inflation remains moderate in France compared to neighbouring countries (HICP at 3.3% in January). Consumption is therefore less likely to be impacted by a loss of household purchasing power than in other countries and should remain an important driver for growth. This is especially true in the context of a labour market that is doing very well, with the level of employment at the end of 2021 3.3% higher than at the end of 2019, and 61% of manufacturing companies and 54% of service companies indicating that they are having difficulty recruiting (according to the INSEE survey of January). Higher negotiated wages are expected, which should allow consumption to remain dynamic throughout the year. Industry is also expected to become a driver of economic growth as the difficulties on international production lines begin to ease, allowing it to catch up. We expect GDP growth of around 3.7% for 2022 as a whole and 1.9% for 2023, with inflation above 2% for 2022 as a whole, before declining slightly.

Inflation remains an important risk factor, however, as it could jeopardise the economic recovery if it increases much more than expected, and could lead to significant social tension. Memories of the “yellow vest” crisis are still fresh and fuel prices at the pump have risen sharply. With purchasing power the main concern for French people and presidential elections coming up in April, the government will be forced to monitor the situation very closely and has acted on several occasions to lower the impact of rising energy prices on household purchasing power. The presidential elections, and especially the policy direction of the next president of the Republic, are also an important element of uncertainty for the French economic outlook. Still not a declared candidate, Emmanuel Macron seems to be on his way to a second term as he still dominates all polls with nearly 25% of voting intentions for the first round. The right-wing and far-right candidates are just behind, but none of them really stand out (Valérie Pécresse: 17% of voting intentions; Marine Le Pen: 17% and Éric Zemmour: 14%). The left is largely behind, with four candidates each receiving between 3 and 4% of voting intentions, and Jean-Luc Mélenchon at 9%. Whatever the opponent in the second round, the polls all indicate, at the moment, a victory for Macron. In any case, the next president will have the onerous task of establishing a credible budget after a considerable deterioration in public finances, firstly as a result of the aid put in place during the pandemic, and then as a result of the support measures taken in the face of rising energy prices, which have increased public debt to 114% of GDP in 2021, and the deficit to 7.6%. For the moment, no presidential candidate has said anything about how the issue will be addressed, making budget sustainability a largely absent theme from the campaign.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 February 2022

Eurozone Quarterly: Leaving the pandemic behind This bundle contains 11 Articles