France activity data - not as poor as expected

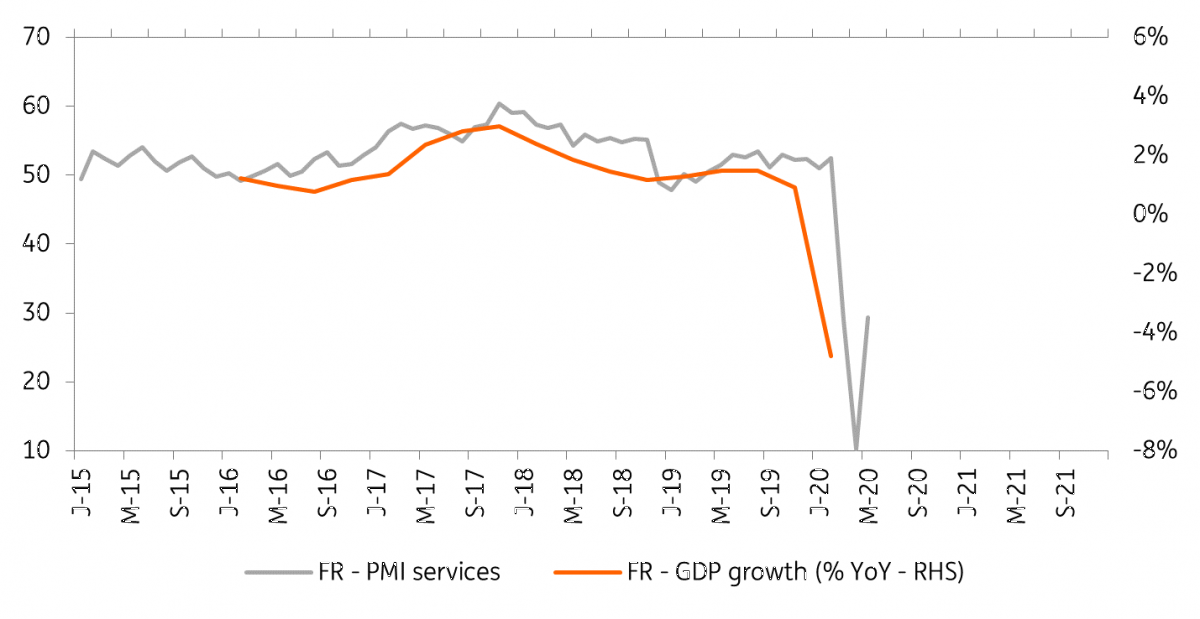

French activity data has been ugly but that's not really a surprise - it's always better when data doesn't disappoint. 1Q20 GDP data and first growth estimates for 2Q20 should not drive more, but less pessimism about the French economy

1Q20 growth figures slightly less awful than announced

In France, GDP figures for the first quarter confirmed the first estimates of the economic contraction during the Coronavirus crisis.

A drop in activity of around 35% (including a 32% drop in industrial activity) during the last two weeks of March led to a contraction of 5.3% QoQ non-annualized in the first quarter.

Details show that it is domestic demand that will have weighed the most on growth, with the -6.1% QoQ drop in exports being offset by the sharp drop in imports. Private consumption contracted by 5.6% and investment by 10.5% QoQ non-annualized.

These historically poor figures will nevertheless be dwarfed by second-quarter figures, which are expected to be at least twice as bad.

French economy is 4.8% smaller than it was a year ago

All eyes are now on second-quarter

According to INSEE, the latest surveys show a gradual return of activity as lockdown measures ease.

While the first half of May saw activity 30% below normal (after 35% in April), the second half on May saw activity return to 20% below normal. INSEE estimates that June will be 15% below normal, which would lead to activity in the second quarter still on average 25% below its level of what we saw towards the end of 2019. This would imply a further contraction in GDP of around 12% in the second quarter (i.e. 50% annualised quarterly growth), in line with our current forecast.

However, INSEE points to the many uncertainties surrounding these estimates and warned yesterday in a business outlook note that the contraction could reach 20%. Despite the expected recovery, such a figure would bring French economic growth in 2020 to -13%, well below our current estimate of -9%.

We currently continue to expect a 6.5% recovery in 2021, which would still leave GDP 4.5% below its pre-crisis trend at the end of next year.

Consumer spending rebounds strongly

Estimates of business recovery after the lockdown are based among others on rail freight traffic and electricity consumption as well as payment transactions in shops.

The latter shows that consumption recovered strongly in the first two weeks after the lockdown: spending is estimated to have been just 6% below its February level. This figure contrasts sharply with the drop in spending recorded in April and published this morning, i.e. -33% compared to the pre-confinement situation.

However, it is not certain that this recovery will be sustained since as these are the initial purchases as the lockdown eases.

Despite fears of unemployment

However, these figures are encouraging in light of the consumer confidence, which remained low in May, and fears of unemployment, which limit consumers’ purchasing intentions, especially for the most vulnerable.

The figures published yesterday showed a historic increase in the number of unemployed, up by 827,000 people, or just over a million in total since February. In 2008, it took more than four years to reach this figure.

Temporary workers, very short-term contracts and interim workers paid a heavy price and accounted for almost three-quarters of the increase. From this point of view, the business surveys published this week showed a very strong recovery in hiring intentions for temporary workers, which should de facto limit the spectacular rebound in unemployment over time.

We are still expecting an increase of around 600,000 unemployed people at the end of the year, with the unemployment rate 1.5pp higher than in December, at 10%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article