France: household confidence hits bottom in November but December should be better

French consumer confidence has plunged to the lowest level since the “yellow vest” crisis in 2018, due to the latest lockdown measures. But announcements of a gradual lifting of restrictions should lead to an improvement

Sharp deterioration of consumer confidence

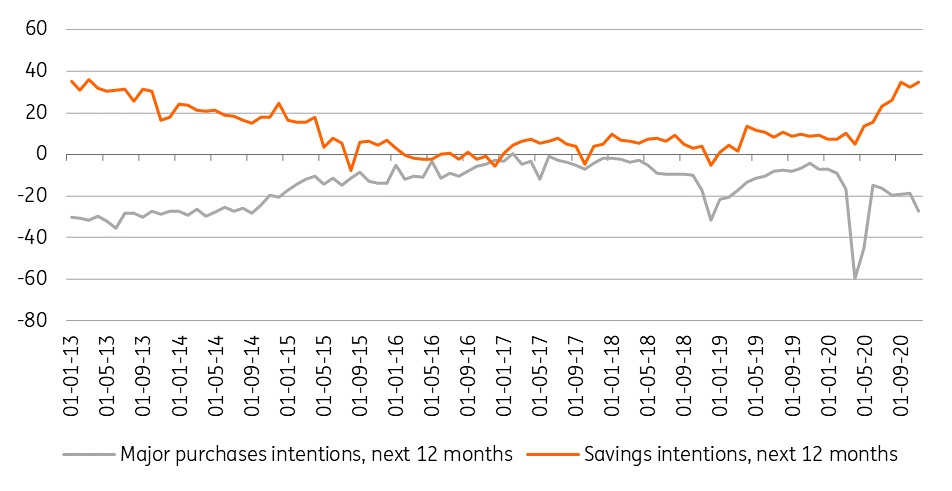

In November, French consumer confidence deteriorated sharply due to the second lockdown. At 90, the indicator is now below its April level during the first lockdown, and has reached the lowest level since the December 2018 "yellow vest" crisis. Households believe that the outlook for their personal financial situation, for the standard of living in France and for unemployment is deteriorating sharply. Despite the labour market support policies implemented by the French government (including partial unemployment), household fears about the future development of unemployment are increasing. In November, the indicator reached its highest level since June 2013. At the same time, households feel that this is not the time to make major purchases and want to save even more in the next 12 months. Saving intentions are also at their highest level since 2013.

Some easing of restrictions in sight

While the data for November is not encouraging, the good news is that the situation should improve in December. Indeed, President Emmanuel Macron has announced some easing of the lockdown, which should allow a gentle recovery in some sectors in December and lead to an improvement in household confidence. In particular, under pressure, the French officials have decided to reopen non-essential shops from 29 November. The lockdown is nevertheless maintained, which means that a certificate is required to move around and that travel between regions is not allowed. The end of the lockdown is scheduled for 15 December, health conditions permitting. On this date, all movement will be allowed during the day, but a curfew between 9pm and 7am will be introduced. Bars, restaurants and sports facilities must remain closed until at least 20 January 2021. Although crucial for winter tourism in France, the ski lifts in the ski resorts have not been allowed to reopen for the end-of-year holiday period and will also have to wait until January to hope for a relaunch. By planning a very cautious easing of measures in different phases, French officials are trying to avoid the mistakes made during the first deconfinement that led to the second wave of the pandemic, and at the same time satisfy French companies and households who are asking for clarity.

Uncertainty remains

Thanks to this relaxation of measures, the month of December should be better from an economic point of view than the month of November. Nevertheless, the restrictions on movement, the curfew and the closure of bars, restaurants and ski resorts throughout the month will not allow a return to the level of economic activity that prevailed in September and October. We therefore still expect a contraction of around 5% of GDP quarter-on-quarter in the fourth quarter of 2020.

With President Macron's announcements, we already know that January will continue to be negatively impacted by health restrictions. But the question remains open as to what will happen after in 2021. Everything will depend on the evolution of the disease, and in particular, whether the restrictive measures, coupled with the vaccination campaign, will make it possible to avoid a third wave. In addition, the question of household consumption and savings remains crucial for 2021. It remains to be seen whether the expected rebound in confidence will be sufficient to push households to use the savings accumulated in 2020. At this stage, and given the surveys, it is not clear how quickly this will be the case. Consequently, we will probably have to wait until the second half of 2021 to start seeing a de-accumulation of savings and thus a real catch-up in consumption.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article