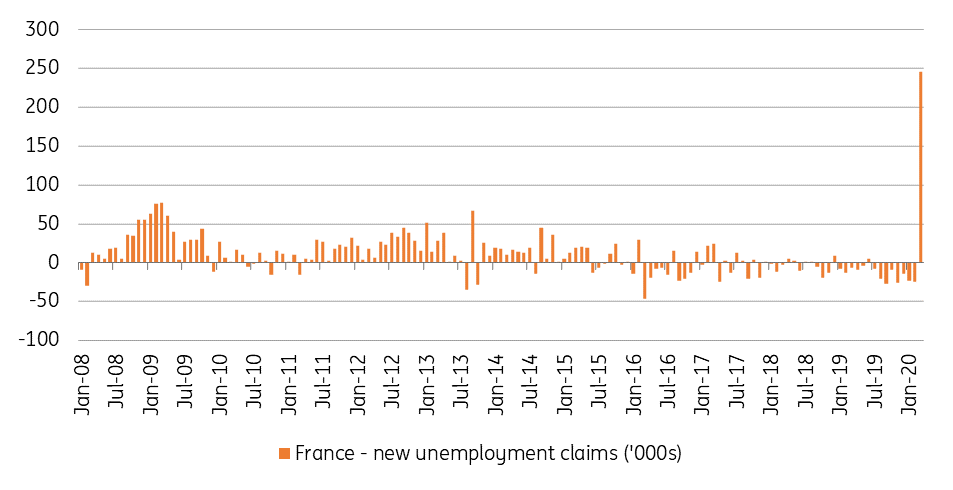

France: historic jump in unemployment claims

March unemployment figures show a historic jump in new claims, despite temporary unemployment measures. We think the April figure will make this look small in comparison. Once more, the figures show that the most vulnerable workers are paying a high price in the current Covid-19 crisis

| 246k |

French unemployment claims in April |

In France, 1Q20 unemployment statistics shed some light on what has happened to the job market at the beginning of the Covid-19 crisis. With more than one third of all employees (nearly 10 million people) now facing temporary unemployment, the impact on the unemployment rate is still to be measured. Indeed, all employees will not benefit from the scheme and some of those benefiting may yet lose their jobs as many employers file for bankruptcy.

Unemployment increased by 246k in March. Back at the beginning of the financial crisis, it took 10 months to reach a cumulative 250k increase in 2008. The details show that the most vulnerable workers were hit first as interim contracts were terminated (+150% MoM) as were short term contracts (+30%). Together, these currently account for 12% of employees.

This is only the beginning. The April figure is likely to be more than twice as bad (in the high 600k). We believe that the unemployment rate should end 2020 at 10%, up from 8.5% at the end of 2019. This would mean that the unemployed population at year-end would still be higher by 700k than in February. This figure is likely to be surpassed in the short term, while the recovery expected for 2H20 should bring it down significantly.

Thanks to the economic safeguard measures put in place, notably in terms of temporary unemployment, France will avoid seeing millions of unemployment claims registered, which would have led to an unemployment rate close to 15%. Nevertheless, with more than 300,000 people under short term contracts and an estimated 3 to 4% of employees at risk of being victims of employer bankruptcy, the Covid-19 impact on unemployment this year should exceed 800,000 people. While this is more than in 2009, we expect half of the impact to be wiped out by the end of 2021 thanks to the economic recovery. This also means that the impact will be long lasting in the job market (with an unemployment rate above 9% for longer) and will call for longer-term action plans.

Historical jump in French unemployment claims on the back of the Covid crisis

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article