France: Response to fuel protests is too little, too late

As a new type of grassroots activism sweeps across France, the government is swinging into action. But measures to reduce fuel costs are likely to be too little too late

| 0.8% |

French core inflation in October |

New funds to help drivers

Higher fuel prices have given rise to a new form of grassroots activism in France. This Saturday, a movement known as the 'yellow vests' plans to block more than 1500 roads across the country amid anger over a new tax on diesel vehicles, which along with higher oil prices over the summer has pushed prices at the pump to the highest level in years.

- Most of the demonstrations have not been registered, potentially leading to clashes with police forces.

- Interior Minister Christophe Castaner has called for local organisers to register to avoid fines or imprisonment.

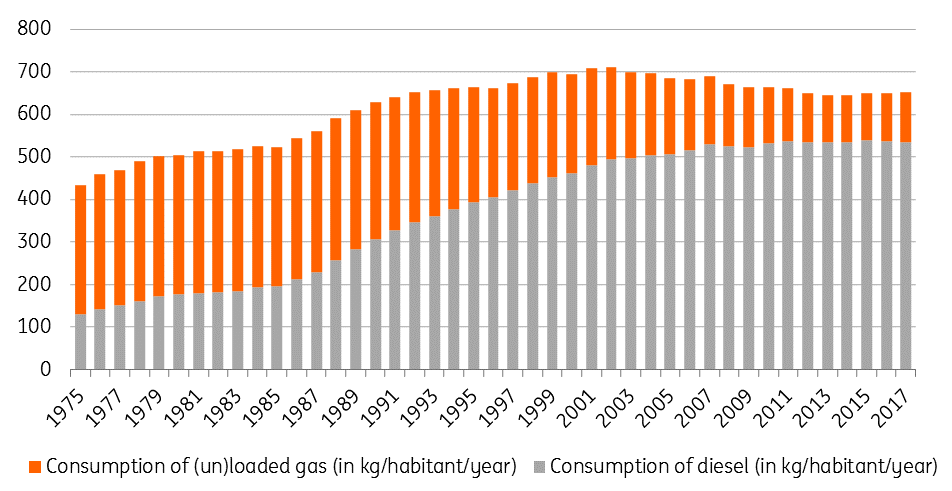

The tax hike was one of the measures taken by Environment Minister Nicolas Hulot, who resigned two months ago. It followed years of pro-diesel policies, which brought diesel consumption from 30% of total gas consumption in 1975 to 82% last year. More than three private cars out of four are now using diesel.

The move has hit purchasing power and has been especially hard on lower-income households who have not yet benefited from President Macron's fiscal largesse. As a result, the government today announced that it would increase the budget aimed at energy transition, spending €0.5 billion on several new measures.

- The first is a conversion premium: those who want to switch to a low-emission vehicle already get €2000, lower-income households could get €4000 thanks to the new measure.

- The second is to temporarily increase support for the 5 million people driving a long way to work who already benefit from tax reductions. In parallel, there will be help for those using gasoline to heat themselves.

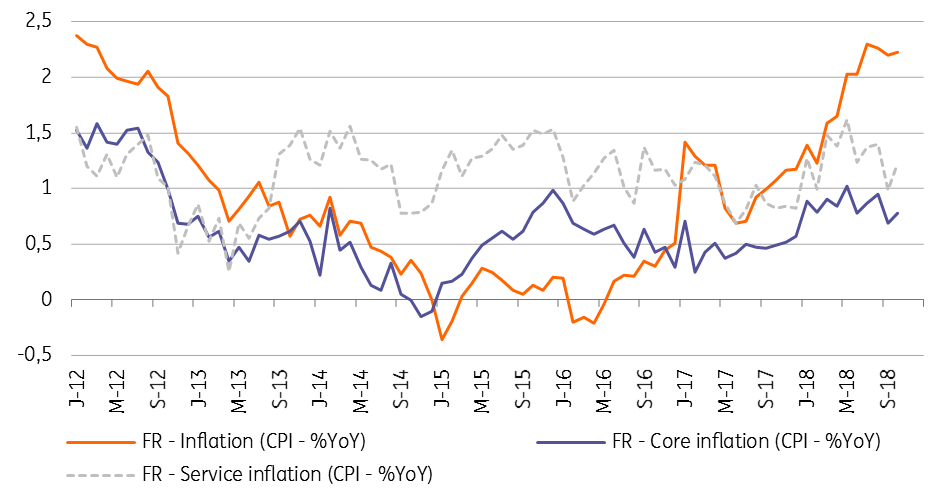

New inflation figures suggest the stress could fade

Still, most of these measures will only be valid from 2019 and won't be enough to stop the weekend protests, dealing another political blow to an already wounded Emmanuel Macron. The good news is that the fury should abate in coming months as oil prices settle below the €60 a barrel threshold. Inflation figures published this week confirm that French inflation was on a downward trajectory in October (at 2.1%) and peaked last summer at 2.3% in August. Currently, core inflation (0.8% in October) remains limited and mainly supported by service prices. If oil prices remain below €60 in the course of 2019, the impact of oil prices on inflation should become negative before the driving season next summer. This, together with scheduled fiscal measures for 2019, should restore sentiment. In the meantime, these grassroots protests are giving extreme parties a comfortable platform to kick off their European election campaign and could take consumer confidence to new lows in coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article