France: Enjoying cyclical strength

President Emmanuel Macron is everywhere, controlling every national reform while remaining very active on the international scene, where he still lacks a major diplomatic victory. The French economy could help him out. Despite risks, we think growth remains very supportive of reforms

The first year of the Macron presidency is over. For him, this is not the time to analyse results but to persevere in producing them. It has been a busy year with several reforms, including initial labour and institutional reforms as well as the much-contested railway reform. Macron benefits from a 44% approval rating, which is higher than both Francois Hollande (25% after year one) or Nicolas Sarkozy (36%) and very close to Jacques Chirac. His popularity is highly concentrated in those who voted for him in the first round; he already lost some of the support he gained on the left in the second round. Despite being governed from the centre of the political spectrum, France is therefore as divided as last year, between those who call for reforms and others who prefer the status quo. Highly symbolic of this division is the dispute over railway reform (and subsequent strikes), which failed to gather enough street power to trigger any significant change (aimed at preparing the company for international competition and partly absorbing its debt of nearly 50 Bn€, roughly 2% of GDP).

| 2.1% |

Our expectation for French GDP growth in 2018, the highest since 2011 |

The current economic reform agenda remains heavy:

- The housing market. Low-interest rates and recovering prices, which have risen by 2% year on year on average since 2016 after eight years of stagnation (average price growth of 0% between 2008 and 2015) are boosting housing investments. The market should be helped by the reform of the housing tax (or €22bn of fiscal revenues for local collectivities) which should be scrapped by 2020, starting with a 30% reduction for 80% of households in 2018. There is also a €14bn plan to help households renovate their homes (to reduce carbon emissions), of which €1.8bn should go to public buildings while local collectivities will be able to levy €2.5bn more for their own buildings. The plan should allow for the renovation of 500,000 housing units per year.

- The labour market. A reform encouraging more flexibility is now being applied and the second part of this measure should be voted on in September, comprising €15bn of investment in training and apprenticeship. This should allow for the creation of a “training account” for each worker to help everyone keep pace with changes and replace the subsidised contract schemes of the Hollande era (which reached 500,000 people and an annual budget above €2bn at its peak). This should be in place before the end of the year, after tough negotiations over regional competencies. For now, the main areas still debated are the reform of unemployment allowances for independent workers and single-person companies and measures to curb the use of fixed-term contracts, which are seen by the government as a counterpart to the increased flexibility offered by the 2017 reform.

- Pension reform. Discussions will likely start this summer, with the view to a vote in the summer of 2019. The aim is to harmonise the 42 different pension regimes and set up a pension account with a Scandinavian touch.

All in all, year two should be busy, too. On that front, the main risks are reform fatigue (which can always happen if results are not showing quickly in unemployment figures), and a more cohesive opposition. During year one, both the right and the left were in disarray while unions never succeeded in talking with one voice. The second year of the presidency could see more opposition from Les Republicains (LR party) outside their main year one debate theme (immigration), especially on pension reform.

It is hard not to recognise the positive effects of the reform atmosphere the Philippe government has succeeded to install

If the extreme Left seems to limit its parliamentary fights, former Presidential candidate Jean-Luc Mélenchon may organise resistance in the streets. He could be instrumental in reconciling the main unions, a task that will be made easier by the end of the mandate of Jean-Claude Mailly (from Force Ouvrière) who has been a wiser and less confrontational negotiating voice in the last round of reforms than others, especially as Pascal Pavageau looks to be on a similar hard line as Philippe Martinez (CGT). It is therefore unlikely that opposition pressure will decrease in year two, although we do not think at this stage that they will be able to paralyse reforms. A condition to that would be that Macron is still supported by a dynamic economy.

Confidence remains high across sectors

In the services sector, confidence has been stable in recent months, just below its January peak (109), at 107 in April. Hiring and investment intentions, in particular, remain upbeat at the start of the second quarter, boding well for the current trend of declining unemployment. Still, the last consumer confidence figures show only a slight rebound in April. It seems that the job market is not really the main worry, in fact, French consumers are still upbeat on the economic recovery. Instead, they fear for their own financial situation and their capacity to save. Nevertheless, purchasing intentions remain elevated and lower unemployment could transform these intentions into acts.

The main confidence slowdown comes from the manufacturing sector, as has been the case throughout Europe since the start of 2018. Confidence there was below its 12-month average in April while order books were still seeing inflows. We expect confidence to stabilise at these lower levels, showing a consolidation of growth prospects at a high level for 2Q, but without further acceleration. This was reflected in the industrial production figures of the first quarter which showed a 1.3% quarter on quarter drop, while the trend on a yearly basis remained stable at 2.3% year on year overall. Manufacturing has been slowing down from 2.8% growth on average in 2017 to 2% in 1Q18.

Investments should feed domestic demand dynamism in 2018...

This year, the first quarter GDP figures posted some unpleasant surprises in terms of domestic demand dynamism. First, private consumption came in below expectations, at a mere 0.2%, showing no sign of improvement for the last two years. Private consumption grew by only 1.3% in 2017. With such a weak start to the year, it is difficult to see 2018 consumption growth above 1.5%.

We believe that some acceleration should materialise this year with lower unemployment. The first quarter has sent positive signals on that front as the number of unemployed (all categories) declined by 51.7k (in 2017 the total increase was 55.6k) and although past subsidised contracts continued to decline (-47k in categories D and E which count unemployed people not looking for a job as they are on training, apprenticeship or some form of subsidised jobs), they were absorbed by new job creations, leading to a net decline of 41.6k in the main unemployed category (A). This has allowed the unemployed population to decline to 3422k (-2.2% YoY). 120k subsidised jobs should disappear in 2018, which means that weak readings in the unemployed population data do not necessarily reflect labour market weaknesses. We therefore continue to believe that improvements will be felt by French consumers this year, leading to somewhat higher private consumption growth in 2018 and decisively higher in 2019.

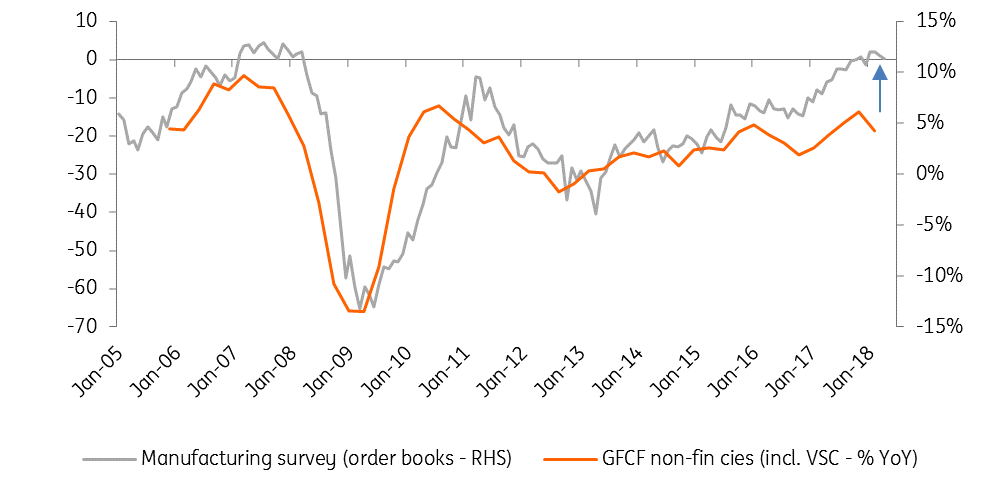

Non-financial companies’ investments slowed down to 0.5% QoQ, their lowest speed since the end of 2016. However, given order book levels and high capacity utilisation (at 85.2%) we believe it should rebound and post an acceleration on 2017’s 4.4% YoY growth. Finally, public investments grew by 0.9% QoQ, their strongest growth pace since 2011. This is only the second positive contribution to growth of public investments in the last 20 quarters. With regional elections looming in 2019, we expect this trend to continue.

…and for once net exports should contribute positively to 2018 growth

France’s competitiveness did not improve much in recent years, especially in relative terms (compared to Germany, the Netherlands or Spain). However, France is benefiting from the robust Eurozone demand recovery and a catch-up of its tourism exports (weakened by terrorist attacks in recent years) while weak private consumption is limiting imports. The phenomenon already favoured 2017 which showed a limited negative contribution to growth (-0.4pp after -0.8pp in 2016) and should bring a positive 0.3pp contribution to growth in 2018.

Currently, the government expects this positive contribution to be maintained through time. We think this is optimistic. Once private consumption is robust again and Eurozone demand softens, probably at the turn of 2019, the situation should reverse itself. Only if exporting companies make investments to boost competitiveness and lower production costs could France count on less negative net export contributions to growth. And this is without counting a number of risks.

Main risks to the growth outlook

- Strikes. There has been much debate so far in 2018 around the impact of rail and airline strikes on economic growth. In 1995, 22 days of general strikes had a 0.2pp impact on GDP growth. This year, only transport was hit, and workers have a greater ability to cope with it compared to 20 years ago. The most impacted sectors will be transportation services of course (as Air France and SNCF should endure a total of €500 to €650 million losses because of the strikes), and tourism, as the strike in both rail and air travel strongly affected the end of the Easter holidays and the long weekends of May. With the end of the movement in Air France and no more strikes announced at SNCF (beyond 28 June), the effect on 2Q18 GDP growth should be limited to 0.1pp at most.

- Oil prices. In 2Q17, oil prices (Brent in EUR per barrel) were at €46.4. If oil prices stay above €60 in 2Q18 (which is not unlikely), energy costs on the year will be 30% higher, which is a strong acceleration. This could affect household purchasing power and delay the recovery in private consumption. It could also delay some business investments.

- A strong euro. In recent weeks, stronger inflationary pressures in the US together with higher oil prices and disappointing first-quarter growth in the eurozone have brought the euro under 1.20 against the US dollar. This interrupted a strong EUR appreciation (from 1.05 to 1.25 over a few months) which could hurt French exporters, especially if it resumes before year-end. Our current forecasts incorporate the fact that the EUR/USD will go beyond the 1.25 level in 2019. If the appreciation were to start sooner in 2018, one cannot exclude a less positive contribution of net exports to growth than the 0.3pp currently pencilled in.

All in all, the picture has changed dramatically in France in one year. The conditions for an economic acceleration are there and it should not be long before consumers join the party. It is hard not to recognise the positive effects of the reform atmosphere the Philippe government has succeeded to install. Even if most measures will not take effect for some months, expectations can be built on stronger grounds. We expect reforms to continue in 2018, which should help GDP to reach 2.1% this year. There are risks, however, with the possibility of an appreciating currency, prolonged strike periods and persistently higher energy prices.

Back on the European scene

A mix of low interest rates and higher GDP growth helped France to get its public deficit back at 2.6% of GDP in 2017, a figure that should improve further in 2018. In 2019, due to some fiscal changes, a temporary rebound is expected. This should allow France to see its debt decrease after 2019, without reaching 100% of GDP. For that reason, France has been allowed out of the excessive deficit procedure (EDP - where it was still together with Spain) despite the fact that the country did not comply with the structural deficit reduction asked year after year by the European Commission.

This probably makes official the return of France on the European political scene, Macron appears as the most powerful leader for now. However, in the middle of Brexit talks, with an Italian caretaker government and a weakened Spanish prime minister, there is little overall appetite for eurozone reforms. A roadmap towards completing the banking union should be decided upon in June, but France is unlikely to gain support on other initiatives. The June European Summit will be tough for President Macron, but will also illustrate how far he wants to go to push the eurozone forward.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles