Four things that matter for the Bank of England as Carney goes cautious

A May rate hike still looks more likely than an August move, but Mark Carney's cautious comments sent a clear warning to those anticipating two or more rate hikes from the Bank of England this year

The 'unreliable boyfriend' is back, or so it seems

Having more-or-less fully priced in a May rate hike, markets have received quite a shock following comments from Bank of England (BoE) Governor Mark Carney that appear to cast doubt over a move at the next meeting. This is all the more surprising given BoE rhetoric so far this year, most of which had suggested policymakers were looking to guide markets towards a May rate rise, following better wage numbers and recent Brexit progress.

So what do we make of all of this? Well for now, we still narrowly think the Bank will hike rates next month, although this has become much more of a 50:50 call. Amidst bad weather, consumer caution and a sharper-than-expected fall in core inflation, it’s entirely possible that policymakers may be looking to buy some time to see how things play out, before considering a rate rise at August’s meeting.

But either way, Carney's comments will send a clear message to markets. The debate on where policy should go next is still far from clear-cut, and this means that any thoughts of two-or-more rate hikes this year still look premature.

Here are four things that will be feeding into the Bank’s thought process.

Wage growth and global growth remain (largely) on track

An expectation that wage growth would soar in 2018 was one of the key reasons for hiking rates back in November. Bank agents had indicated that firms expected the best year since the crisis for pay settlements. Since then, we suspect even the more hawkish committee members will have been surprised by just how quickly wage momentum has picked up over recent months. Of course, it’s still early days, and the pace of increases has slowed a little in the latest couple of readings, although we suspect not nearly enough to cause concern amongst policymakers.

Global growth – another key plank in the November rate hike decision – has also held up reasonably well. Admittedly, the Eurozone has shown some signs of fatigue since the start of the year, but with order books still fairly full and a variety of temporary factors holding back growth, our team is still upbeat on prospects for the next few months.

This all means a UK rate hike in the near-term still looks like a reasonable bet.

Seize the day! The rate hike window may not stay open for ever

If the build-up to the December and March EU leader's meetings is any guide, the months leading up to the October summit could see negotiations get increasingly noisy as we head through the year. For this reason, we’ve long warned that the rate hike window may well close as we head into the autumn. Unless the Bank has, in fact, become suddenly more concerned about the economic outlook, we would be surprised if policymakers didn’t look to capitalise while they can – particularly with markets relatively on-board with the idea of a hike over the next few months.

A dreadful quarter for retail means the Bank has to tread carefully

The latest dip in retail sales rounded off what has been a dreadful quarter for spending, ranking as one of the worst since the financial crisis. Some of this was certainly down to snowy weather, and this has also seen other manufacturing and service sector activity drop off in March. But much of it also has to do with ongoing consumer caution.

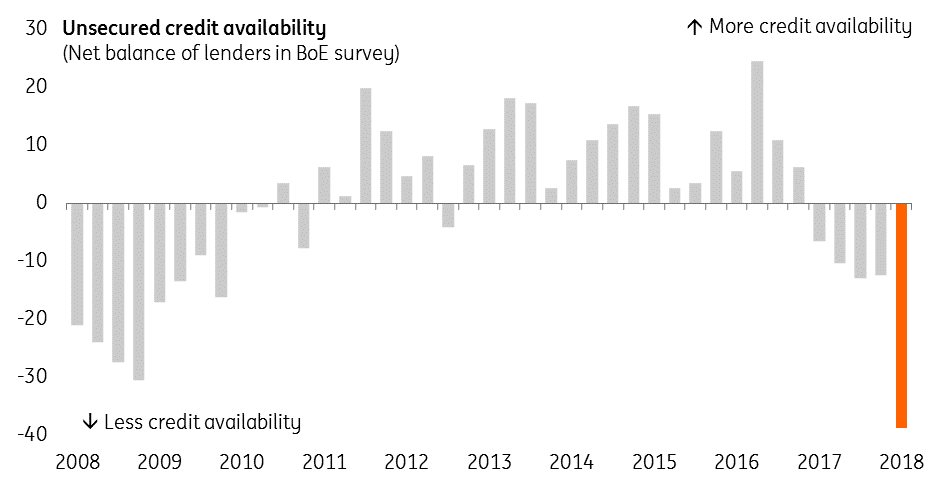

It is certainly true that the household squeeze is no longer at its worst – inflation is easing, whilst wage growth is finally showing signs of life. But real incomes don't look set to rise materially any time soon either - and it's not clear that savings or credit will come to the rescue. Consumers had already been diving into savings as the wage squeeze started to bite, and credit availability has plunged since the start of the year according to a Bank of England survey. With confidence near multi-year lows (particularly stark when compared to Europe or the US, where shoppers are the happiest they've been in well over a decade), the retail sector is not out of the woods just yet.

With retailers' margins also being squeezed by higher minimum wage costs, as well as increased business rates, the Bank will have to tread carefully when raising rates - particularly as many firms have built up debt in the post-crisis years.

Unsecured credit availability has reduced significantly according to the BoE

Core inflation is now near-enough back to target

Inflation has fallen noticeably faster than the Bank of England was forecasting back in February. Part of this can admittedly be chalked down to the fact that the early easter didn't boost prices as much as thought. But it's also clear that the effect of the pound's post-Brexit plunge is fading rapidly. Prices have now more or less adjusted to the new value of the pound, and that's seeing the cost of currency-sensitive goods starting to fall. This is only set to continue, and we expect to see core inflation back at target at some point over the next three-four months.

This is another reason why we think the Bank may only hike rates once this year - although as we said above, policymakers have been increasingly taking their cue from wage growth as a guide of underlying inflationary pressures.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 April 2018

In Case You Missed It: The unreliable boyfriend returns This bundle contains 6 Articles