Four Bank of England scenarios, with a rate cut widely expected

Expect an 8-1 vote in favour of another rate cut next Thursday, though we doubt the Bank will drop too many hints on what comes next. We're looking for three further cuts later this year, but a shaky jobs market and the prospect of lower services inflation risks pushing the BoE into more aggressive moves

Four 2025 rate cuts is the path of least resistance

Slowly but surely, financial markets are coming around to the idea of four rate cuts from the Bank of England this year. Policymakers are poised to take rates lower by 25 basis points at its meeting on 6 February. And though they’ve not quite said so, it’s heavily implied that the Bank expects once-per-quarter cuts for the rest of this year. That's our base case, and markets are now pricing 78bp of easing by year-end, up from just 29bp in mid-January.

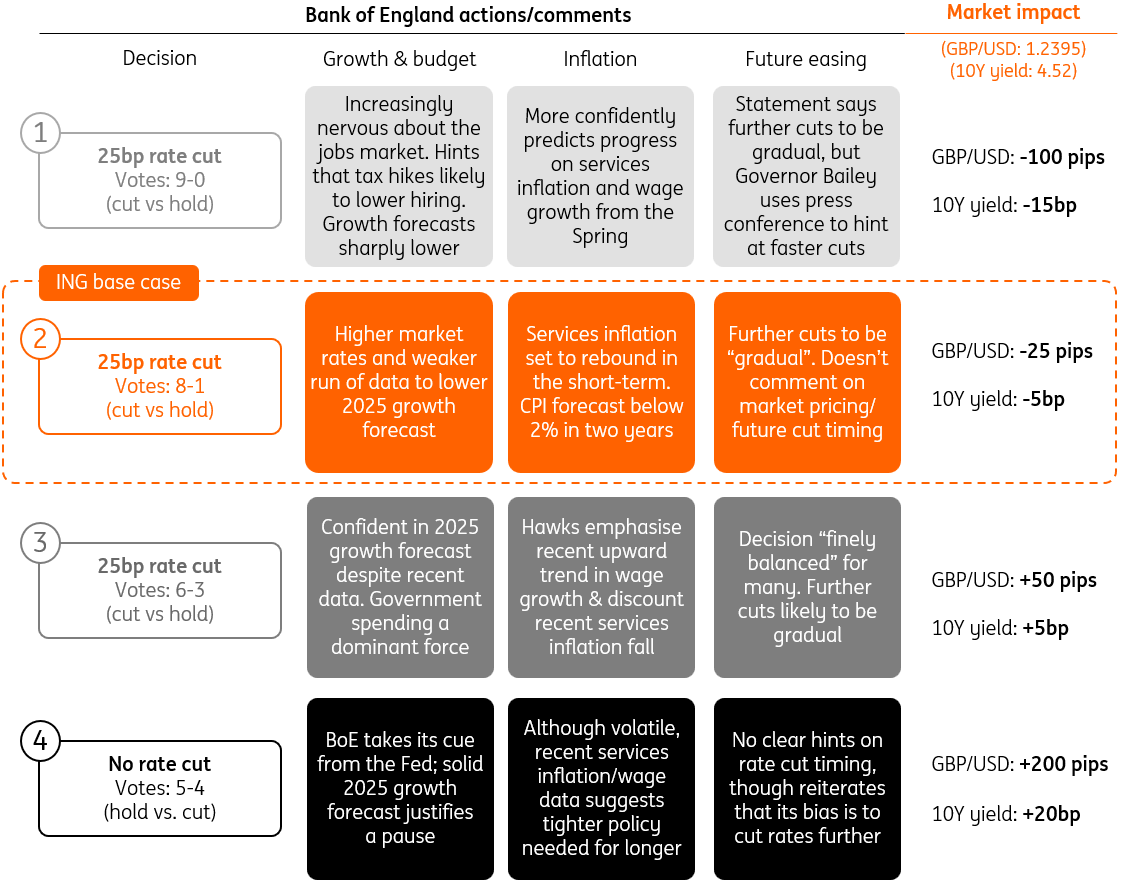

February’s meeting is unlikely to rock the boat too much, though if anything we think the risk is for a more dovish reaction in financial markets. Here’s what we expect:

Four Bank of England scenarios for February's meeting

Vote split – watch out for Catherine Mann

We expect a 8-1 vote in favour of that 25bp cut, with arch-hawk Catherine Mann once again dissenting. She is yet to vote for a rate cut and had consistently voted for further hikes, long after the Bank’s tightening cycle had ended.

None of that would be remotely surprising, but if we’re going to get a dovish surprise, then this is where it’s going to come from. Remember at December’s meeting, three committee members voted for a cut, which – while still a minority – was more than many had expected. And the real surprise next week would be if Mann finally throws in the towel and votes for a cut. That feels unlikely, but it would be the single most dovish thing that realistically could happen at February’s meeting.

Could we see at least one official voting for a more aggressive 50bp cut? Again, possible, but unlikely. The most likely candidate would be Swati Dhingra, who lies at the opposite extreme to Mann. Were she to be a lone voice calling for faster easing, we suspect investors would conclude there’s little read-across to what other committee members might do at future meetings.

The BoE's data dashboard

Forecasts set for downward revisions

We’ll get new growth and inflation forecasts this time and the overall theme is likely to be dovish. Growth is set to be revised down, in part because the recent data has been lacklustre. Fourth-quarter GDP will probably be flat where the BoE had previously pencilled in 0.3%. That lowers the starting point for 2025 annual growth. On top of that, market interest rates, which these forecasts are based upon, are up by roughly 50bp across the curve since November. Higher expected borrowing costs means weaker activity. Where the Bank previously had 2025 growth at 1.5%, it could be revised down to around 1%.

While that’s not hugely important for markets, it would shine a light on the Office for Budget Responsibility, the body that polices the government’s fiscal policy. At the time of the October budget, it expected growth of 2% this year, which looked optimistic at the time and has only grown more so since. That will inevitably get revised down in the Spring Statement on 26 March. If this is also the case for future years, that’s more bad news for the chancellor. Her fiscal “headroom” – the margin of error around the fiscal rules – has already been eradicated by the recent bond sell-off.

Markets are expecting higher BoE rates, relative to November

Back to the BoE, and on inflation the news is more mixed. Headline inflation is likely to be a little higher than it expected in November and could touch 3% (2.5% now) later this year. That’s mainly down to energy, though. And just as with growth, higher market rates will mechanically lower inflation further out.

The key number, as always, is where inflation is seen in two years’ time, the horizon over which monetary policy has its biggest impact. It’s likely to be at or below 2%, having been seen a tad above back in November. In theory, that tells us the Bank thinks rate expectations are a little too high to deliver inflation at target. In practice, the BoE has downplayed these forecasts as a signal about its future intentions.

Further gradual cuts to come

Much like the Federal Reserve and European Central bank, the BoE is unlikely to be drawn much on what it’ll do next. Expect its policy statement to simply reiterate that further gradual easing is likely, without any comments about timing. Four rate cuts this year feels like the Bank’s base case, and that's our thinking too.

But don’t ignore the risk of more aggressive easing later this year. Markets have a tendency of lumping the BoE in the same category as the Fed, despite the macro story looking increasingly different in the UK.

Services inflation, the most critical indicator for the BoE, fell sharply in December. That may be a temporary blip – and it’ll likely bounce to 5% in January – but the trend is undoubtedly down. We expect it to slip below 4% in the second quarter, and the progress is likely to look even better when volatile/less relevant categories are excluded.

The jobs market is looking shaky, too. Employment in the private-sector, judging from payroll data, fell gradually in 2024. Vacancies are well down. Wage growth has been proving sticky, but surveys suggest that will gradually change as the year goes on.

Faster cuts aren’t our base case, but they remain more likely than a Fed-style pause later this year.

Shorter-dated gilts could benefit from dovish BoE

Gilt yields eased lower from their peak in early January, where the 10-year yield fell from 4.8% to 4.5% currently. Markets remain more sceptical about the BoE’s ability to ease, especially against a backdrop of increased government spending. Having said that, most of the recent gilt yield dynamics were actually dictated by US rate developments. And similarly to what we see for euro rates, we expect shorter-dated bond yields – e.g., gilts with a 2-year maturity – to start moving more independently from US influences. As such, the 2-year gilt yield might find itself significantly lower on a more dovish BoE, while the 10-year gilt is kept more anchored at elevated by levels by high 10-year UST yields.

Sterling may start to hand back recent gains

The pound has made a mini-recovery from its gilt-led sell-off in mid-January. The global bond market rally has helped – as has the introduction of the BoE’s new gilt-crisis liquidity facility, the CNRF. But we doubt sterling has to rally too much further.

We say this because the prospect of UK fiscal consolidation in March should be pushing on the open door of an under-priced BoE easing cycle. This is a bearish combination for sterling.

In terms of the impact of Thursday’s BoE rate decision sterling, the FX market is very relaxed. The FX options market only prices in an expected 40 USD pip trading range for the one-day straddle options structure.

Additionally, the relationship between rate differentials and GBP/USD is far less pronounced ever since the Trump trade dominated market thinking from last October. Before then, an independent 10bp move in 10-year gilt yields was worth around 120 pips in GBP/USD. The risk premium around tariffs is clearly impacting GBP/USD now as it is for FX markets in general.

Nonetheless, potential downside risks to sterling are evident in the vote split or the growth forecast downgrade and what it means for the fiscal position. And through the second quarter, we think GBP/USD will be trading closer to 1.20 and EUR/GBP to 0.85.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article