Five charts explain how the Fed plans to shrink its balance sheet

Why the Fed's USD 4.5 trillion balance sheet reduction plan matters for markets - and why this could push yields higher

We've got the plan, now all we need is a date

The Federal Reserve's balance sheet has ballooned since the start of the financial crisis, expanding from $700bn to $4.5 trillion today. With the growing economy, asset prices having recovered and the financial system in much better health, the Fed has made it clear it wishes to 'normalise' or shrink it. This will be done very gradually by ceasing its current policy of reinvesting maturing assets.

However, we are yet to receive a start date. The minutes of the July FOMC meeting suggested several participants were 'prepared to announce a start date', but 'most preferred to defer that decision' until there were some stronger economic figures.

We believe the upcoming September FOMC meeting will be that point, with an October start looking likely.

Fed will let a capped amount of Treasuries roll-off each month

The Fed outlined their plan in June. They will start the process with USD 10bn per month in balance sheet shrinkage: USD 6bn from Treasuries and USD 4bn from agency & MBS – rising by similar amounts at three-month intervals over 12 months until the monthly ‘caps’ for Treasuries and MBS reach USD 30bn and USD 20bn, respectively. The FOMC anticipates the caps will remain in place once they reach their respective maximums.

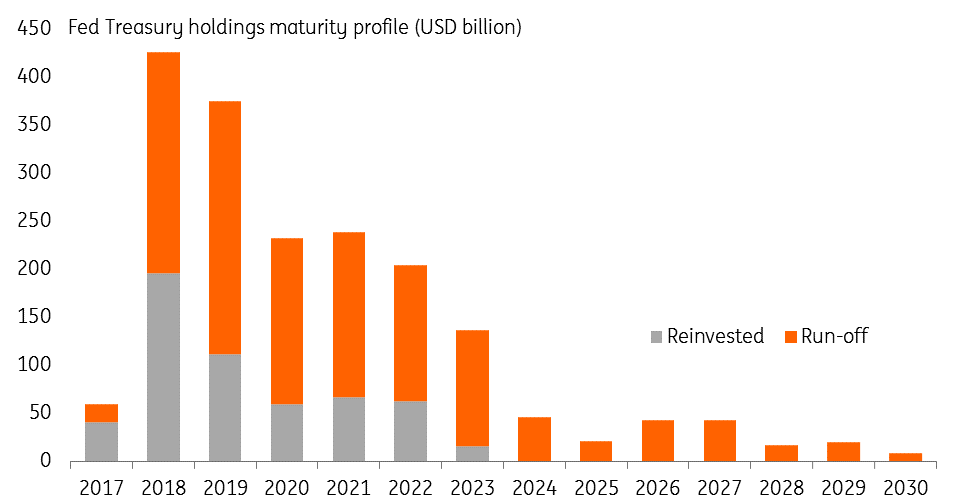

Significant chunk of Treasuries to roll-off each year

This chart shows the proportion of the Fed's Treasury holdings that will mature annually. If the Fed were to start unwinding the balance sheet in October this year, only USD 197bn of the USD 425bn in maturing Treasuries in 2018 would still be reinvested.

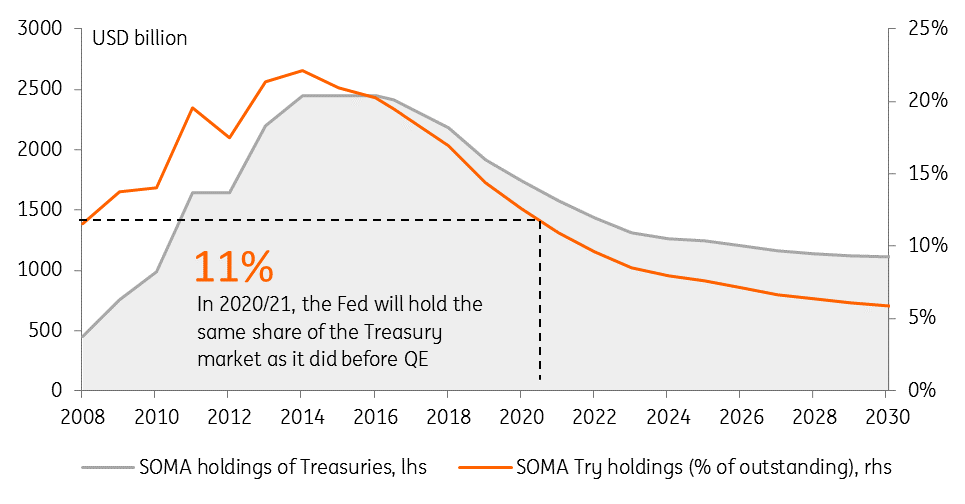

Fed plans to 'grow into' its balance sheet

Under the current plans, the Fed’s holdings of Treasuries would remain well above pre-crisis levels. The Fed has previously talked about 'growing into' the balance sheet as the economy grows.

But the Fed’s market share would drop back below it by 2020/21 assuming ongoing positive net bond issuance by the Treasury and unchanged roll-off caps.

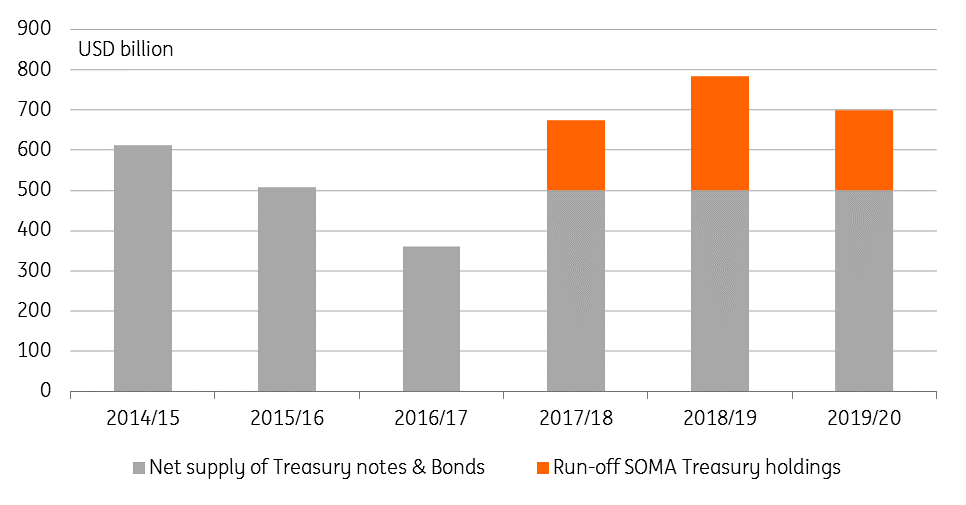

The yield curve could steepen as the Fed unwinds

Given the size of the market, the Fed’s reinvestment changes should result in a gradual, but relatively limited, increase in the share of Treasuries held by private investors. The flow effect could be more significant. Indeed, whatever is assumed about the net supply of debt from the US Treasury, it is clear that the Fed’s balance sheet normalisation will leave a sizable chunk of extra bonds for the market to absorb.

On balance, we see a risk of higher Treasury yields and a steeper curve, especially given the recent curve flattening.

We estimate the isolated effect on 10yr yields (and the spread with two-year yields) to be around 5-10bp. This could be amplified if Treasury secretary Mnuchin’s ultra-long issuance ideas become a reality.

(Our calculations here assume constant $500bn net supply in fiscal years 2017-20)

Hikes to continue - if inflation stages a turnaround

The Fed remains upbeat on economic prospects. Officials believe 'economic activity will expand at a moderate pace' with the risks to this assessment appearing 'roughly balanced'.Second quarter GDP grew 2.6%, and in our view, 3% is looking possible for 3Q17. The Fed does acknowledge the recent softness in inflation stating that it will 'remain somewhat below 2% in the near term, but will stabilise around 2% over the medium term'.

The last set of Fed official forecasts suggested members were expecting to hike interest rates on four occasions over the next 18 months; however, markets have serious doubts. Inflation has consistently come in below target, wages are failing to respond to the tightening labour market, and there is a clear disappointment on the lack of progress regarding President Trump's tax plans.

However, we see some positive signals in the activity data and with wages showing tentative signs of picking up, oil prices rising once again and the dollar's 10% fall since the start of the year nudging up import prices, we think inflation will be back above target before the end of the year. With the Fed already mentioning easier financial conditions and 'somewhat rich' asset price valuations this should provide enough ammunition for them to raise rates again in December with two more hikes anticipated for 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article