Finland: Political changes ahead?

Finland goes to the polls in April after years of strict policies of wage moderation to improve competitiveness. A more left leaning parliament could succeed at a time when Finland has managed to return to sound public finances and a closed output gap. The question is how long modest growth can continue in a weak global economic environment

Growth has peaked as trade outlook clouds economy

The Finnish economy has slowed significantly since the first quarter of 2018. Just like the rest of the Eurozone, Finland has experienced moderation in its growth rate as the output gap has been closed and the global economy sees mounting risks. After the disappointing 0.3% growth in 2Q18, 3Q18 saw just a small recovery to 0.4% GDP growth. Even though this may be somewhat disappointing after an exceptional pace of growth at the beginning of 2018, it does look like Finland is ended 2018 on a better note than some of the larger Eurozone economies. The question is whether Finland can weather a Eurozone storm given the openness of its economy.

The fourth quarter is likely to have remained quite strong, despite faltering production in the larger Eurozone economies. The Finnish trend output index fell slightly in October, but was up by 2.9% on the year. As September had already seen strong growth, the base effect for 4Q18 is quite favourable. This suggests that concerns about declining output in Germany, France and Italy in 4Q18 have not taken effect in Finland as yet.

The question is how long this can last. With foreign trade an important engine for growth in Finland, the weakened outlook for the Eurozone is likely to have an impact on the Finnish economy. We expect growth to be weaker than previously expected for the year at 1.6%, with further downside risk due to Brexit and a possible revival of the trade concerns between the EU and the US.

Will Finland lean left at the coming elections?

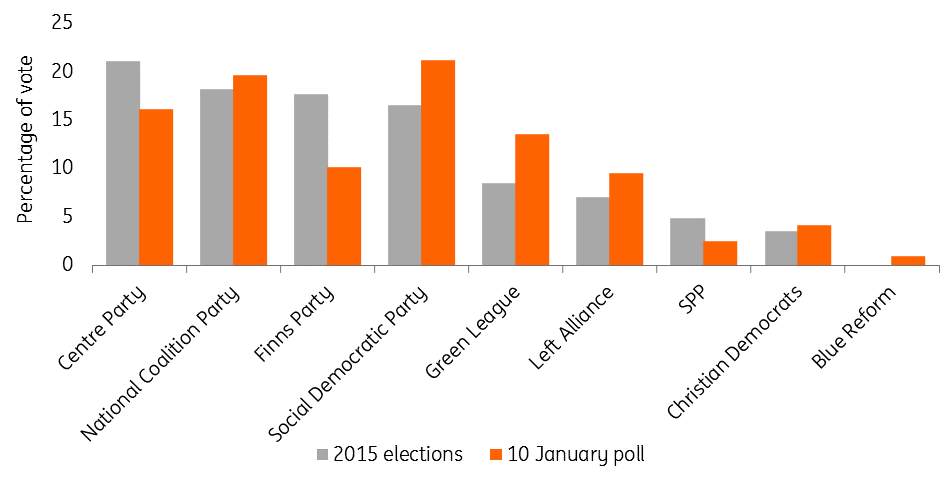

With elections in April, Finland seems to be heading towards a change in government. Polls over recent months have consistently put the Social Democrats (SPD) in the lead, while coalition partners NCP and Centre Party are in second and third positions. The populist former coalition partner Finns Party is in fifth place with about 10% of the vote, which is well below the 18% it received in the 2015 elections although they have been rising in the polls somewhat recently.

Although serious campaigning has not yet begun, the polls would suggest that Finland looks set to return to the more traditional parties and that the left is set to gain. Besides the gains that the SPD has made since the last elections, the Greens are also advancing in the polls and are now the fourth-largest party. Economic issues seem to be at least in part responsible for the surge in the polls of the left leaning parties, as recent easing employment legislation proposals have been met with opposition. This is in line with opposition to the competitiveness pact.

Early polls show gains for left wing parties

This increases the chances of a more left leaning government than the current centre-right Sipilä cabinet. With Blue Reform currently at just 1% of the vote, a continuation of the current government is highly unlikely. The three governing parties combined represent just 35.7% in the polls for now. A centre-left government could be a possibility, although it would not be straightforward to construct.

Public finances in Finland are sound ahead of the elections. In the second quarter of 2018, government debt dropped below 60% of GDP, marking a return to the target of the Stability and Growth Pact for the first time since 2014. Nonetheless, the budget balance remains negative for the moment as infrastructure spending projects are pushing up government spending. As these projects are one-offs, this will not impact government finances much in the longer run. A small buffer has been created, the question is whether a new government at a time of slowing growth and unemployment rates higher than neighbouring countries will be keen to keep things that way.

The Finnish economy in a nutshell (% YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains 13 Articles