Finland: can it bounce back from recession as structural challenges mount?

The Finnish economy is set to undergo a milder economic winter than previously expected, but structural challenges will work against a swift recovery in 2023

No vigorous bounce back in the making

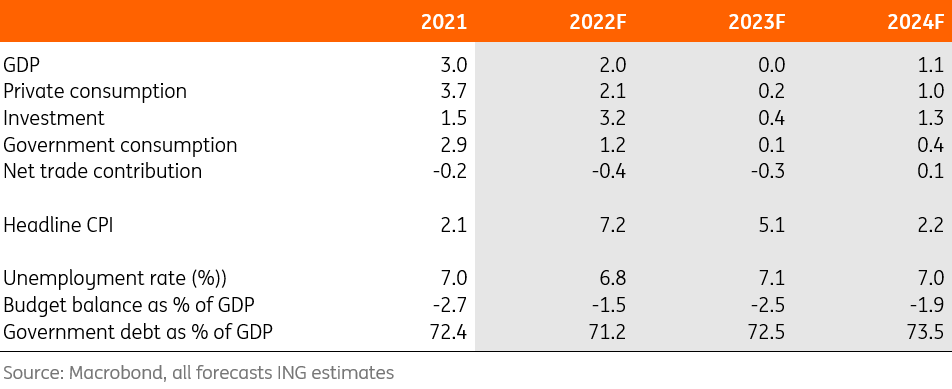

The Finnish economy shrank in the third quarter of 2022 and is expected to currently be in recession. This is mainly because of the energy crisis and subsequent purchasing power squeeze. Thanks to the warmer winter weather Europe is experiencing, the impact of the energy crisis is smaller than initially expected, which means that a recession in Finland is likely to be rather mild. That means the big question for 2023 is how fast Finland can recover.

The Finnish economy is set to remain under strain over the course of 2023. A fast recovery seems unlikely as the current drivers of economic weakness are set to persist over the coming quarters. While inflation is expected to moderate during 2023, real wage growth is set to remain negative for quite some time to come as energy prices are expected to remain elevated. That will put pressure on consumption growth as purchasing power will remain squeezed.

Exporters continue to face a challenging environment

Exports are also set to remain under pressure in Finland as the main export markets are likely to experience mixed economic activity this year. Concerns about Germany and China remain significant, where weak recovery in Germany is likely to dampen external demand for Finnish products, while China remains a big uncertainty in terms of how it will recover from the current wave of Covid-19. Russia – traditionally one of the largest trade partners of Finland – is unlikely to return to that position given the sanctions in place.

In the meantime, it is not just the energy crisis and Russia that provide persistent headwinds for 2023. The housing market is also cooling off on the back of the aggressive ECB rate hikes as mortgage rates rise quickly. Home sales have been on the decline since the beginning of 2022 as rates started to increase. Prices have also started to correct with December showing a 3.4% year-on-year drop. On the back of this, building activity has started to moderate. As rates are not expected to show a correction again, we expect the housing market to continue to have a dampening effect on economic activity over the course of 2023.

A robust labour market and government support dampen inflation impact

So no miracles are to be expected for 2023; a mild recession followed by a sluggish recovery. Still, there are positives to mention despite this environment. Like much of Europe, Finland has a very strong and resilient labour market at the moment, which is not expected to show a large surge in unemployment despite economic challenges. That means that labour shortages are likely to remain elevated in 2023 and beyond, which will keep wage pressures more significant than before the pandemic. While this is a concern from a competitiveness perspective, it also dampens the negative income impact of this winter’s downturn.

From a government finance perspective, Finland has challenges ahead. Debt-to-GDP has fallen to 71.6% after peaking at 75.6% in early 2021 after government support during the pandemic caused spending to soar. The high inflation rate has been beneficial for government finances, but forecasts for 2023 and 2024 see government debt increasing again. Compensation measures for the energy crisis and increased defence spending are set to contribute to higher debt levels for Finland this year.

Finland in a nutshell

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 January 2023

Eurozone Quarterly: Better is not good enough This bundle contains 10 Articles