Fibre rollout: the hardest part is yet to come

With almost half of European homes now having access to fibre broadband, alternative internet service providers (altnets) have accelerated the fibre rollout in most countries. Incumbents, especially in the UK, Germany and Italy have to pick up the pace to swiftly connect the rest of Europe, and future-proof their networks

Towards a Gigabit society

The European Commission set a target for all European households to be covered by a Gigabit network by 2030. This is more ambitious than the goals set in the Broadband Europe plan, of access to at least a 100 Megabit per second (Mbps) connection for all households and a 1 Gbps for so-called socio-economic drivers such as schools, universities, hospitals, digital-intensive businesses and transport hubs, by 2025. Although goals are formulated on speeds, not technology type, the EC focuses on fibre to the home (FTTH) and 5G. In general, governments and local authorities rely on commercial initiatives. To achieve 100% broadband connectivity, public financial support is usually necessary, especially in rural zones.

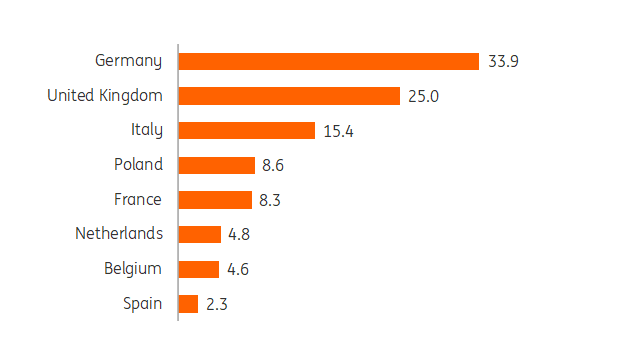

Germany has most homes yet to be passed by FTTH

Homes not passed by FTTH, September 2020, in mln.

Incumbents in lagging countries have big ambitions

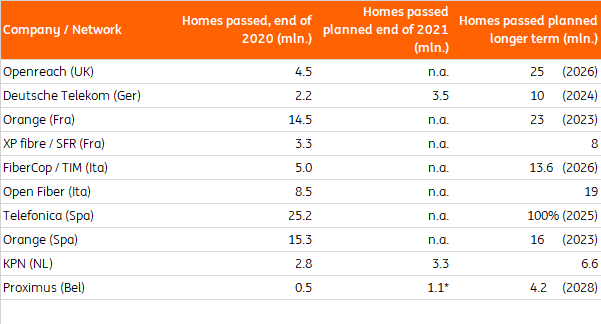

In countries where the rollout of full-fibre was slow in the past, a significant increase in pace can be seen to make networks future-proof. In Belgium, Germany and the UK, homes passed by fibre networks, grew by more than 60% in the year to September 2020. Proximus plans to pass 2.4 million homes by 2026 and 4.2 million by 2028. This requires a significant increase in the speed of deployment resulting in the yearly addition of almost 0.5 million homes, which coincidentally is the current number of homes passed in total. In Germany, Deutsche Telekom plans to have a fibre network of 10 million homes passed in 2024, eventually passing 2.5 million premises a year. Openreach (BT) wants to connect 4 million homes per year, rolling out FTTH to 25 million premises in 2026, up from 4.5 million today.

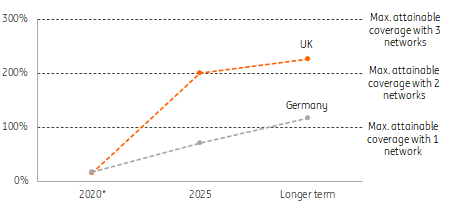

Build-out plans in UK and Germany indicate ambitious targets and overbuild

In the two markets with the least FTTH homes passed (Germany and the UK), there is a substantial risk of overbuild. If the announced plans of both incumbents and altnets are executed and cable networks are upgraded to full-fibre (as indicated), the cumulative effect would be a coverage ratio of over 100%. The UK will show the quickest rise to over 100% coverage if plans come to fruition. By the end of 2025, Openreach, Virgin/ O2 and the altnets would cover over 60 million premises or 200% of households with full-fibre. While it is likely that overbuild will materialise in the most attractive areas, the ambitions of altnets still seem very optimistic. They expect to grow from 2.5 million premises passed today to 30 million in 2025. Overbuild in broadband between a telco and cable offering is common practice, but plans are likely to be adjusted if multiple networks are already in place.

In Germany, planned growth seems more benign, but this may draw in even more competitors (which we already see with Liberty announcing a return). By 2025, Deutsche Telekom, Deutsche Glasfaser, Telefonica , Tele Colombus and the regional altnets plan to have some 30 million homes passed (70%). Towards 2030, coverage will move to over 100%.

Full fibre rollout plans indicate overbuild

Number of planned fibre connections as % of households

Italy aims to have full Gigabyte coverage by 2026

In Italy, the rollout pace has also been picking up, with 2.8 million homes added by September 2020. Prime Minister Mario Draghi has put digitisation at the heart of his agenda, aiming for superfast connections of 1 gigabyte available to all Italians by 2026. OpenFiber, which is partly state owned, aims to reach 19 million homes eventually. FiberCop (TIM) sets out to deploy to 13.6 million homes by 2026. The creation of a state-sponsored entity, merging the two networks, seems on hold, which will possibly slow down the pace of the rollout.

In the Netherlands, KPN will be the main driver of FTTH, planning to add approximately 0.5 million homes annually, with Open Dutch Fiber together with T-Mobile aiming at 200,000 premises passed per year.

Long term plans and current state of European FTTH networks

France and Spain already moving towards full coverage

In countries where deployment is in a much more advanced stage, such as France and Spain, it will be increasingly difficult to add a large numbers of homes to the network, as the commercially, most interesting and densely populated areas, have been tackled first. What remains is rural, sparsely populated regions.

In France, in these zones, fibre projects are financed and deployed using public funds to achieve full countrywide FTTH coverage. Most countries are unlikely to aim for full FTTH coverage, as there will be areas where the costs of deploying fibre will be deemed too high and alternatives such as fixed-wireless access (FWA) that partially use mobile networks, are more feasible.

Highest rollout speed needed in Germany and UK

Required speed of rollout in households per week if 70% of homes are to be connected by FTTH in 2025 and in % of households

Both incumbents and altnets should drive future growth

According to the FTTH Council / IDATE, the number of homes that can be connected to full-fibre in Europe (EU + UK) is expected to double to approximately 200 million by 2026. To reach that figure, a lot of fibre building needs to be done. The altnets were driving growth, but incumbents have set ambitious targets as well, requiring them to significantly increase building speed.

Costs per home passed vary between countries and areas. The costs are known to range from €200-€250 (urban areas Spain) to €1000 - €1500 and above (suburban areas Germany) requiring large investments. Connecting the remaining 34 million German homes without fibre, for instance, would imply an investment of at least €34 billion. We, therefore, see many telcos entering into partnerships with investors. For less densely populated areas, subsidies may be needed.

Labour shortages are the biggest constraint for fibre building

Although chip shortages also have an impact in the short-run (e.g. shortage of fibre optic modems) the key limiting factor for the rollout is likely to be construction capacity. Civil engineering works account for up to c. 75% of FTTH CapEx spend. Shortages in construction capacity can therefore have a major impact on FTTH deployment costs. In Germany, the labour market situation in civil engineering is considered tense, although more foreign companies are now offering their services. According to the number of jobs listed on the website glasfaserausbau.org, there currently are around 3,000 vacancies in Germany for skilled professionals in fibre construction and the amount of people required is likely to rise in the coming years. Looking at the UK, Manpower estimates 15,000 new workers are needed in the coming years to deliver gigabit speeds to everyone. Given the limited labour supply in the coming years, companies are likely to try and secure this limited capacity, as this guarantees that a company can build out its network while making it more difficult for competitors.

For FTTH rollout, the hardest part is yet to come. The rollout speed needs to be very high in the countries that are lagging behind if they want to meet their objectives. This requires a significant investment and many new workers. In the countries leading the fibre rollout, the areas with a low commercial attractiveness remain to be covered. For networks to become future-proof, however, further fibre deployment is necessary (also in support of 5G-rollout). Building speed is also of importance, as the network that comes first may also be the one that actually gets to serve the majority of clients.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 November 2021

European fibre rollout ramps up This bundle contains 2 Articles