Telecom Outlook: Fibre roll-out to reach 60% of European households in 2022

This year will see the accelerated rollout of fibre to the home in countries such as Germany, the UK and the Netherlands

Fibre roll-out moves up a gear in 2022

In countries where the deployment of full-fibre was slow in the past, there has been a significant increase in pace since 2020. In countries such as Belgium, Germany, the Netherlands and the UK, the number of homes passed will grow at an even greater pace in 2022. Multiple factors are driving this increase in pace. Incumbents are ready to deploy fibre to the home (FTTH) now that there is a bigger appetite for bandwidth at home for video calls, streaming and gaming. There is also more capital available, as many joint ventures with infrastructure investors and pension funds are in place. EU funds are also expected to become available in 2022.

Six in 10 European households will have access to full-fibre internet in 2022

Last year marked more than 100 million homes passed, and more than half of European households had access to full-fibre networks. With the roll-out pace expected to further pick up in 2022, more than 60% of households are forecast to have access to full-fibre internet by the end of the year. As for subscriptions, there are about 60 million European households that subscribe to full-fibre broadband. This means more than half of households that have access actually subscribe to fibre. This take-up rate is also expected to increase.

Increasing number of households have access to full-fibre internet

Incumbents drive growth in Germany and the UK

In Germany, homes passed by FTTH are expected to increase by four million in 2022. Deutsche Telekom plans to expand its fibre network by two million homes this year, with other companies contributing the other half. At year-end, some 16 million homes could have fibre to the home or fibre to the building (FTTB) access. In the UK more than 20 million homes could be connected to full-fibre by the end of the year. Openreach, Virgin Media O2 and Altnets all contribute to a footprint expansion of six million homes. Openreach is expected to connect more than two million premises in 2022. In these countries, and across Europe in general, the main downside risk to these expectations is limited construction capacity due to, among other things, a shortage of engineers.

Number of homes passed by fibre to rise significantly in 2022

Fibre roll-out to pick up pace across Europe

In the Netherlands, the pace of fibre roll-out has really picked up. Homes passed will increase by some one million in 2022. Telecoms company KPN expects to pass 0.6 million homes in 2022. Altnets such as Open Dutch Fiber, Delta Fiber and E-Fiber contribute the remainder. In Belgium, Proximus is also ramping up deployment with more than 300,000 homes passed in 2021. In Italy, Open Fiber outlined investment plans, starting in 2022. This will mean both an acceleration of plans and increased expansion on already planned coverage.

EU funds can add extra dimension to rollout pace

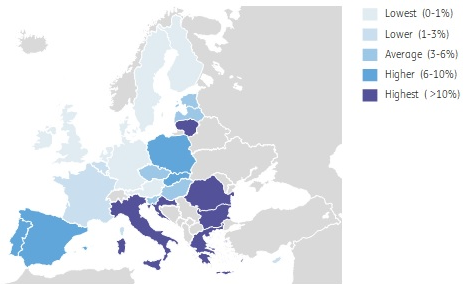

A new dimension to the expansion of fibre deployment is the fact that EU funds are likely to become available in 2022. A fifth of the €723.8bn EU Recovery and Resilience Facility (RRF) plans to improve digital capabilities, with a prominent role for fibre deployment. Subsidies to bolster fibre network rollouts could support the telecom sector's capital spending. Allocation of the funds per country is based on real GDP loss due to Covid-19, population size and unemployment. This means Southern and Eastern European countries receive the largest share relative to their GDP.

Southern and Eastern European countries allocated most funding

Funding allocated under recovery and resilience plan as a share of GDP*

Spain, Poland and Italy claim largest sums for roll out of rapid broadband

Within the RRF, one of the flagship areas defined by the European Commission is called “Connect”. Looking at the relative size of grants and loans requested specifically directed at this rollout of rapid broadband services (including 5G), a somewhat different picture emerges. Although Eastern and Southern European countries are again top of the list, different countries are within the top three. Spain, Poland and Italy have requested the largest sums dedicated to “Connect”, both absolute and relative to their GDP. Telcos in these countries may be best positioned in the coming years to benefit from the EU recovery fund, starting in 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 January 2022

Telecom Outlook 2022: innovation and M&A This bundle contains 8 Articles