US Federal Reserve preview: trapped between a rock and a hard place

A 50bp hike is widely expected given high inflation and a tight jobs market, but the market is pricing in a recession, and falling Treasury yields and a weakening dollar are undermining the Fed’s efforts to dampen price pressures. A hawkish Fed message will likely fall on deaf ears unless the data start proving the central bank right

| 50bp |

Expected Federal Reserve interest rate hike |

A step down to a higher peak

A 50bp hike at the 14 December Federal Open Market Committee (FOMC) meeting is the strong call from both financial markets and economists. After implementing 375bp of rate hikes since March, including consecutive 75bp moves at the previous four meetings, Federal Reserve officials are of the view that they’ve made “substantial progress” on tightening policy so it is time to “step down” to lower increments. Nonetheless, Fed Chair Jerome Powell and the team have been at pains to point out that despite smaller individual steps, the “ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting”.

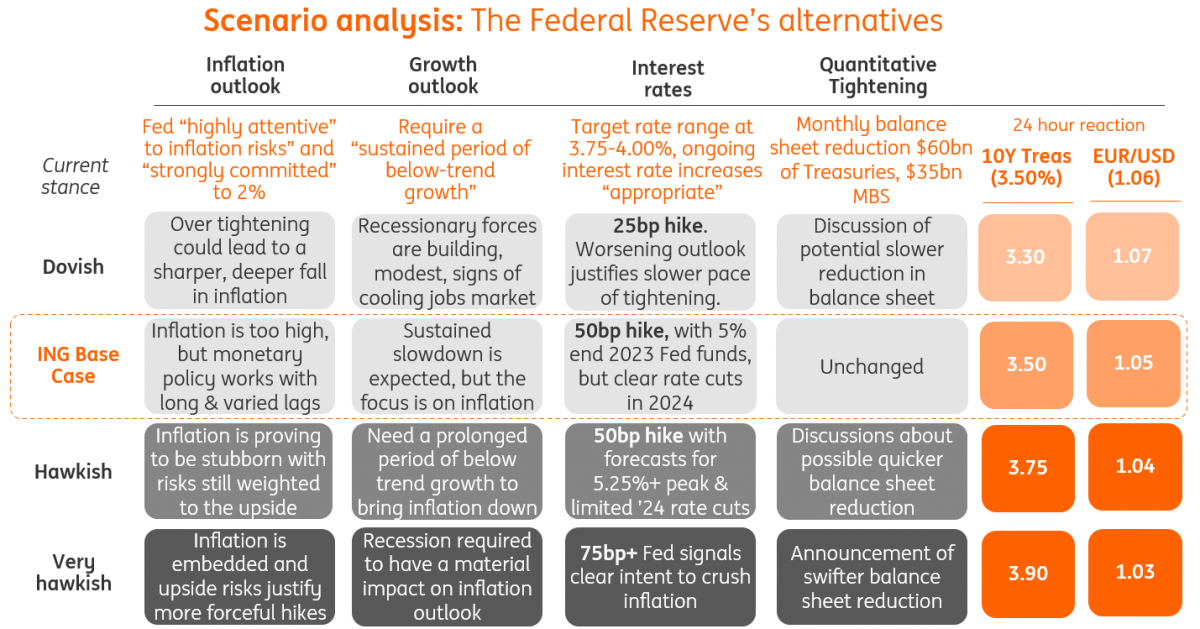

Scenarios for the 14 December FOMC meeting

Signalling could fall on deaf ears

In this regard, the Fed will be concerned by the recent steep falls in Treasury yields and the dollar, coupled with a narrowing of credit spreads, which are loosening financial conditions – the exact opposite of what the Fed wants to see as it battles to get inflation lower.

These moves were themselves triggered by a weak core CPI print for October that came in at 0.3% month-on-month versus a 0.5% consensus expectation, while the Fed’s favoured measure of inflation – the core personal consumer expenditure deflator – was even softer, rising just 0.2%. The market reaction seems excessive to us given this is just one month of data, annual core inflation is still running at triple the target, and to hit 2% year-on-year the month-on-month readings need to average 0.17% over time – and we aren’t there yet. The Federal Reserve will need to see several months of core inflation readings of 0.1% or 0.2% to be confident that inflation is on its way back to target and this is likely to be a key plank of its messaging.

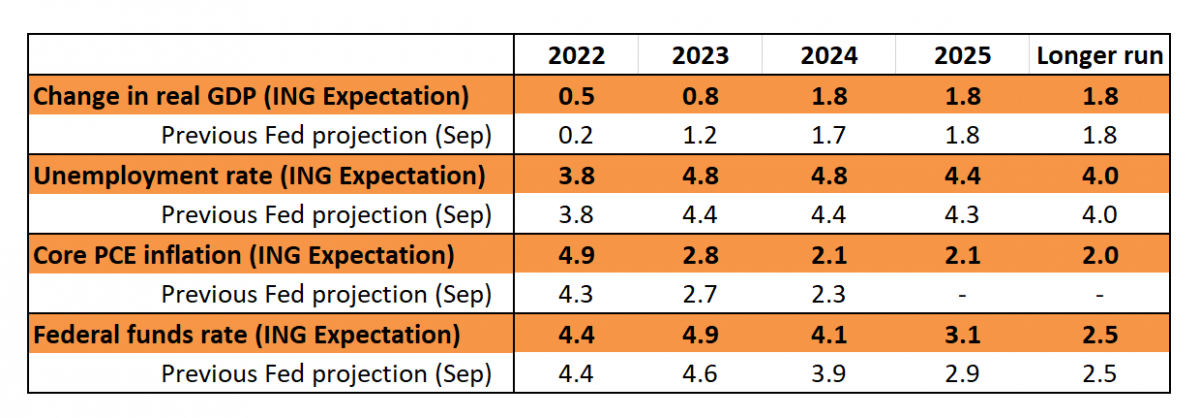

With that in mind, we think the Fed is not finished with its rate hikes and its new forecasts will indeed indicate a higher path for the Fed funds rate to 5% with potential slight upward revisions to near-term GDP, and persistently high inflation forecasts used to justify this. Certainly, the consumer sector has been holding up better than many – including ourselves – expected, with strong jobs and income gains supporting spending.

ING's expectation for what the Fed will predict

Looking further ahead, several officials such as James Bullard and John Williams have suggested the Fed may not be in a position to cut interest rates until 2024, and we suspect Powell and the forecasts will echo this sentiment. However, we strongly suspect that this is more tied to the Fed trying to get longer-dated Treasury yields higher rather than a conviction call that recession and lower inflation over the medium-term will be avoided.

Inflation makes things tricky

Now, it is important to remember we get November inflation on 13 December – the day before the FOMC meeting – and the outcome will be important for what the Fed has to say. If core CPI comes in at or above the 0.3%MoM consensus forecast, its messaging as outlined above will probably prevail. If inflation is softer and yields tumble further then the Fed may have to be more forceful and perhaps raise the possibility of accelerating a run-down in the size of its balance sheet via reduced reinvestment of proceeds from maturing assets. The central bank will stick with the hawkish messaging until it is confident inflation is beaten.

5% in the first quarter but rate cuts from the third

In terms of our view, we look for a final 50bp hike in February, taking the Fed funds ceiling to 5%. But like the market, we think a recession will dampen price pressures and the composition of the US inflation basket, which is heavily weighted to shelter and vehicles, will facilitate a far faster drop in annual inflation readings than elsewhere. Remember too that the Fed has a dual mandate which includes an employment dynamic. This offers the Fed greater flexibility versus other central banks to respond with stimulus and we believe it will from the third quarter of 2023 onwards.

Market rates have dropped like a stone – time for the Fed to sell bonds?

If the Fed wants to re-tighten financial conditions by enough, it needs to engineer a hawkish hike. Longer dates, in the wake of the recent falls in yields, are trading as if the Fed is done post the December hike. Assuming the Fed is not done, the first quarter of 2023 should sustain a rising rates theme to it. That should force yields back up, commencing a dis-inversion process on a curve that is now heavily inverted. We’ve likely seen the peak in market rates, but that does not prevent market rates from moving higher, at least for as long as the Fed is still hiking and the end-game is not fully clear.

The Fed has not said too much about the circumstances on the money markets. We still have in excess of $2tr going back to the Fed on the reverse repo facility, reflecting an excess of liquidity in the system. This in turn is driven there as a counterpart to the volume of bonds still sitting on the Fed’s balance sheet. The Fed is rolling off some $95tr per month, but there is always the option to do more, or more pertinently to sell bonds back to the market outright. While it may be a tad premature to suggest this, it’s an option should the Fed really want to see longer-dated market rates revert higher.

FX markets: Short-end rates hold the key for the dollar

Dollar price action over the last two months has been very poor. The dollar has tended to sell off sharply on signs of softer price data but has struggled to rally on any positives – such as the November US jobs reports. That price action suggests a market caught long dollars at higher levels after a five-quarter dollar rally. The hope for dollar bulls now is that positioning is much better balanced after an 8% drop in the trade-weighted dollar and a 12% drop in USD/JPY.

Preventing an even sharper dollar sell-off has probably been the view that the Fed will continue to hike into 2023. The terminal rate is still priced not far from 5% and only 50bp of rate cuts are priced in the second half of 2023. As long as the FOMC statement, Dot Plots, and press conference do not generate any more dovish pricing – and that seems unlikely – we doubt the dollar has to sell off much further.

Our baseline view would see EUR/USD holding around the 1.05 area as the Fed validates the current pricing of its trajectory in money markets. A more dovish turn would be a surprise and with seasonals against the dollar in December, EUR/USD could spike above resistance at 1.06 towards the 1.07 area in thin year-end markets.

Our multi-week preference, however, is that the Fed is still going to talk tough, and heading into January the dollar starts to make a comeback – where 4.5%+ deposit rates look increasingly attractive amid a global slowdown.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article