Federal Reserve tiptoes to the taper

The minutes to the June Federal Reserve FOMC meeting reinforce the message that we are set for a tapering of QE asset purchases this year, but the form and speed it takes will be driven by the data

Recovery on track, more inflation concerns, but slow jobs hold the Fed back

The minutes go into more detail on why Fed officials are sounding more upbeat on the economic outlook with an acceptance that “indicators of economic activity and employment had strengthened” and even parts of the economy most impacted “had shown improvement”. There was an acknowledgment of the higher inflation readings, but the Fed is still of the mindset that this is “largely reflecting transitory factors”.

Nonetheless, “a substantial majority of participants judged that the risks to their inflation projections were tilted to the upside because of concerns that supply disruptions and labour shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed”.

The key interest though is surrounding the discussion on the tapering of the Fed’s QE asset purchases that are currently running at $80bn of Treasuries per month and $40bn of Agency mortgage backed securities. The FOMC’s position was that "substantial further progress was generally seen as not having yet been met”, but they “expected progress to continue”.

What is holding them back seems to be the labour market with “many participants” noting that the “economy was still far from achieving the Committee’s broad-based and inclusive maximum-employment goal”.

The taper is coming

While not imminent, the likelihood of a taper announcement this year is growing. The minutes tell us that “various participants” believe the conditions required to justify tapering look set to come “somewhat earlier than they had anticipated at previous meetings in light of incoming data”. Nonetheless, “some participants saw the incoming data as providing a less clear signal about the underlying economic momentum” and preferred to see more data over “coming months”.

As for the discussion on what form the taper takes “several participants saw benefits to reducing the pace of [agency mortgage backed securities] purchases more quickly or earlier than Treasury purchases in light of valuation pressures in housing markets.” There was not universal agreement though with “several other participants” believing that reducing the pace of Treasury and MBS purchases “commensurately was preferable because this approach would be well aligned with the Committee's previous communications or because purchases of Treasury securities and MBS both provide accommodation through their influence on broader financial conditions”.

Keep it simple, make it swift

With the taper now on the table it really is down to the data that will determine the path forward. We remain optimistic on the demand side of the equation, but it is clear from the majority of business surveys that corporate America is facing bottlenecks in supply chains while also suffering from a lack of suitable workers. These supply side weaknesses are likely to mean output doesn’t reach its potential and that inflation is likely to be a more significant and prolonged issue.

Given this backdrop we think the pressure to taper asset purchases will build over the summer with the taper potentially announced as soon as September, although today’s minutes would likely favour December. As for the form it takes, we suspect a majority will favour using the template from the 2013/14 tapering program as it is simple and predictable and can be accelerated easily if the data justifies it. Moreover, we don’t see the need to focus on MBS given the housing transactions are slowing on limited housing supply with buyers already starting to walk away as prices become extremely elevated. In any case, mortgage rates respond similarly to Treasury yields so there seems little need to be too clever in the taper process.

Consequently, we expect to see consistent $15bn reductions per meeting with $10bn cut per month for Treasuries and $5bn for agency MBS. This may be accelerated in 2022, with it brought to a conclusion before the end of 2Q22. This could pave the way for interest rate hikes as soon as 2H22.

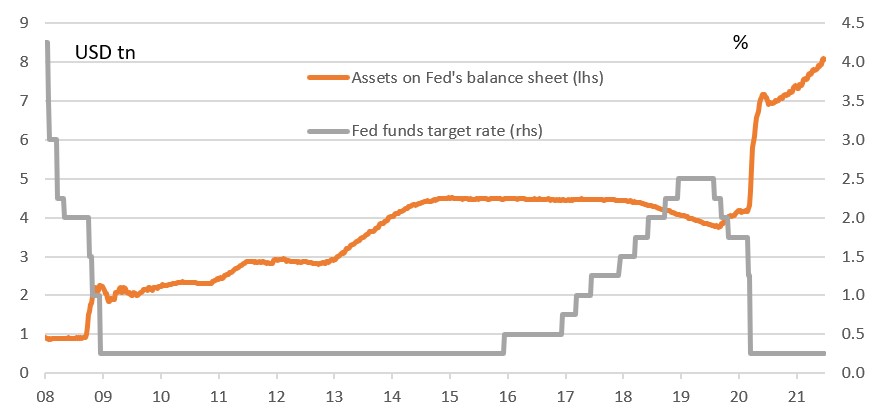

Federal Reserve balance sheet now exceeds $8tn

Treasury market takes it in its stride

We would have been a tad confused if there had been a big (in fact any) reaction to the Fed minutes on the bond market, as the Fed did not know that the bond market would do what it did when they met in mid-June. The bond market discount in itself is an important input for the Fed, and will impact what they do on both tapering and rate moves (in particular the latter), so if they met today it might well have been quite a different discussion. Hence the minimal move in bonds from the minutes makes complete sense.

More liquidity discussions, on both ends of the spectrum of the repo market

The minutes contained further discussion on the establishment of permanent repo facilities, one for domestics and one for foreigners. The genesis of this is the ongoing desire to improve the architecture of liquidity circumstances. The domestic version for example would be at 25bp, flat to the fed funds ceiling, with eligible collateral restricted to US Treasuries. Similar terms would be in place for the foreign version, but both are open to change and still in draft form.

This framed a discussion on the currency liquidity circumstance, where in contrast the reverse repo facility has featured as a taker of liquidity (not a provider, as the permanent repo facility would). Circumstances were driven by banks encouraging some non-operational deposits to shift into money market funds, a rump of which went back to the Fed's reverse repo window. Lower bills supply and a spend down by the Treasury too were contributory factors to the liquidity boost. More of the same was expected ahead.

The minutes noted that a moderate technical adjustment in rates was warranted, with a view to coaxing the effective funds rate a tad higher as it had fallen to 6bp. Hence, the 5bp hikes in the rates on excess reserves (10bp to 15bp) and the reverse repo facility (zero to 5bp), although there was little material discussion on any preferred outcome here in terms of liquidity circumstances. At the press conference Chair Powell was equally non-committal on this.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article