Federal Reserve preview: Take a deep breath

The Federal Reserve will leave monetary policy unchanged this week but its finger remains on the trigger

| 3 |

Number of additional Federal Reserve rate hikes we expect this year |

Growth & gradualism

Having raised interest rates only last month the Federal Reserve will pause for breath this week; consistent with its policy stance of “gradual increases”. Nonetheless, the case for tighter monetary policy remains strong with the recent data flow likely to give the Fed the confidence to raise rates another three times this year.

1Q GDP growth was softer relative to previous quarters, as is usually the case despite extensive seasonal adjustments. On this occasion we attribute it primarily to bad weather and equity market volatility/protectionist trade rhetoric unsettling sentiment and spending. However, the prospects for 2Q activity look good with consumer confidence and business surveys having rebounded. The combination of rising wages and employment together with huge tax cuts means the domestic demand story looks robust while the softer dollar gives US exporters a competitive edge to benefit from stronger global demand.

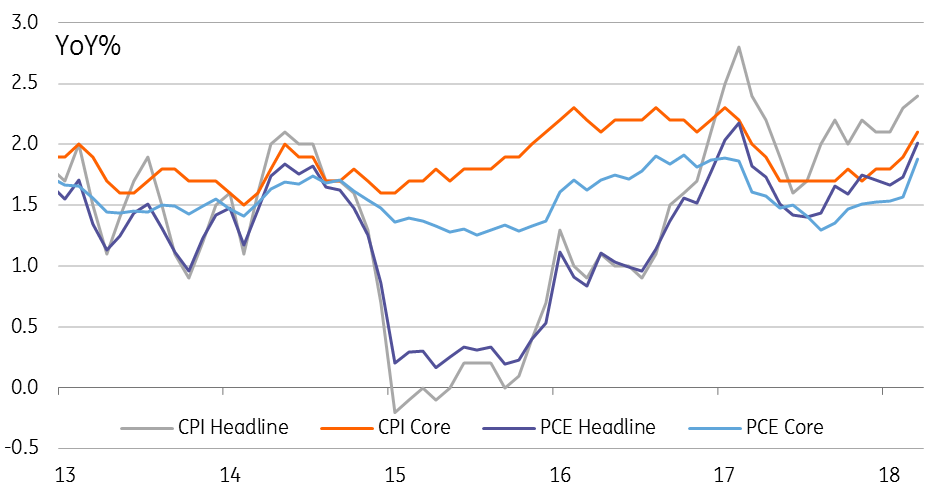

Inflation no impediment to rate hikes - all are at or close to 2% Fed target

Inflation pressures are building

At the same time, inflation readings continue to firm with both headline and core CPI above the Fed’s 2% year-on-year target while the headline and core personal consumer expenditure deflators will almost certainly join them next month. Add in the tight jobs market, which resulted in last Friday’s Employment Cost Index showing wages and salaries rising at their fastest rate since 3Q 2008 and the case for ongoing “gradual” rate hikes remains strong.

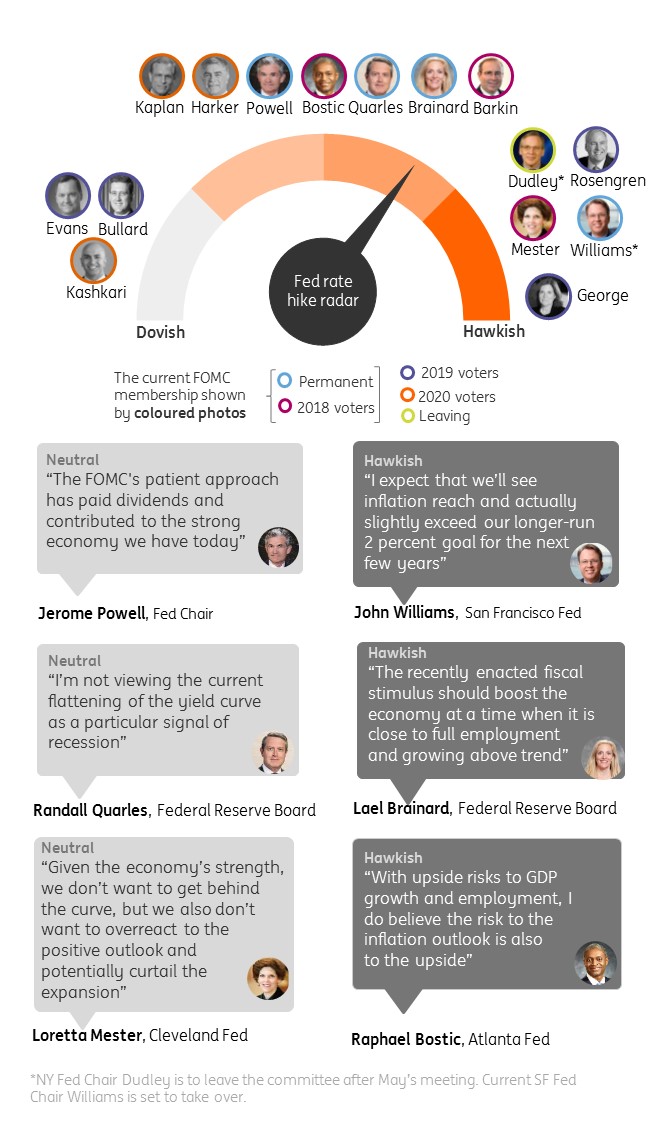

Interestingly, there has been a growing hawkishness to much of the commentary from Federal Reserve officials. Even arch-dove, Minneapolis Fed President Neel Kashkari, who had been arguing for no further rate hikes, has swung behind the Fed’s own projected path of two to three more rate rises this year. As such, the accompanying statement is likely to retain an upbeat bias and we continue to see the balance of risks skewed towards a more aggressive Fed response to combat fears of economic overheating.

Trump's trade tensions remain the risk

Trade protectionism remains the main threat to our view. Treasury Secretary Steven Mnuchin is in China this week for preliminary talks to try and get a deal that will make trade between the nations “fairer” in the minds of the US administration. This will be a tough ask and at this early stage is unlikely to deliver anything significant.

Relations with Europe could also become increasingly strained despite recent meetings with Emmanuel Macron of France and Angela Merkel of Germany. Exemptions on steel and aluminium tariffs for EU nations will expire on Tuesday (1 May) and while Commerce Secretary Wilbur Ross has suggested some nations could be spared the tariffs, not all will. As such, Europe’s response will have to be carefully crafted – do too little and their own credibility will be hurt with their domestic electorates. Do too much and it could quickly escalate into a hugely damaging all-out trade war that will almost certainly make the Fed think again on rate hikes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article