Federal Reserve preview: Stepping on the gas

A rebound in US growth and rising inflation pressures mean the Fed will concentrate on domestic issues rather than be distracted by emerging market woes at the forthcoming meeting

Emerging markets favour policy restraint...

Brazil, Turkey, India and Argentina have all been in the spotlight as authorities try to stem volatility in FX markets. Domestic imbalances - widening fiscal and current account deficits - together with political uncertainty have been compounded by higher dollar borrowing costs and a stronger greenback. Consequently, there have been calls from some quarters for the Federal Reserve to consider the implications for the broader global economy when it sets interest rate policy on Wednesday. This was what happened under Alan Greenspan 20 years ago following the Russia/LTCM crisis and more recently in 2014 and 2016 in response to market volatility.

But it's America First at the Fed

However, the Federal Reserve today is a different beast and as with its political leaders, the focus is very much America first and foremost. Fed Chair Jay Powell said last month that “there is good reason to think that the normalisation of monetary policies in advanced economies should continue to prove manageable for emerging-market economies… The role of U.S. monetary policy is often exaggerated." Indeed, a less aggressive Fed will do nothing to resolve the fundamental challenges facing these economies. As such, we have to look at what is going on domestically in the US and in that regard, it all points in the direction of higher rates.

Growth is great

After experiencing its “typical” soft patch in 1Q18, growth looks set to rebound sharply in 2Q with the Atlanta Fed Nowcast model based on data already published suggesting we could see growth as high as 4.8%. We think this is probably too optimistic, but believe something around the 3.5% mark is looking probable. At the same time, the jobs market is going from strength to strength with unemployment at a 49-year low and payrolls growth accelerating from an average monthly increase of 182,000 in 2017 to 207,000 per month so far in 2018.

There is also growing evidence of wage pressures, with the National Federation of Independent Businesses reporting that a net 35% of businesses are raising worker compensation – the highest since records began 32 years ago. Admittedly, average hourly earnings growth is still fairly soft at 2.7%, but the employment cost index is showing faster growth. Add in the effects of the $1.5 trillion of tax cuts, equivalent to around $900 per household, and we find real disposable incomes are increasing 2% YoY. As such, households have plenty of cash in their pockets to go and spend.

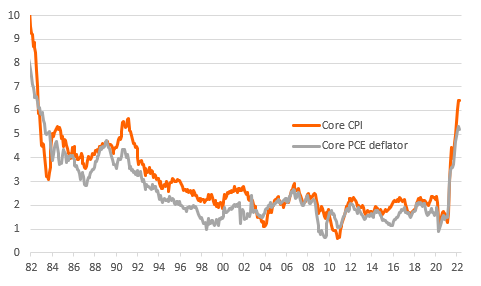

With rising inflation pushing the Fed to hike

Inflation is also pushing higher with only the core personal consumer expenditure deflator below 2% out of all the major inflation measures the Fed watches. Rising wages should keep the upward momentum going. So with the economy set to expand 3% this year, we look for the Fed to hike rates again on 13 June with two further rate rises in the second half of the year.

US inflation measures on the rise

Fed "dots" to move higher

Also look out for the median Fed “dot diagram” of individual policy rate expectations creeping higher – potentially signalling that a majority of Fed officials favour two further rate hikes this year rather than the current even split between one and two in 2H18. It will also be interesting to see if the 2020 forecasts push higher, too, given comments from both John Williams and Lael Brainard that the outlook suggests “a policy path that moves gradually from modestly accommodative to neutral – and, after some time, modestly beyond neutral.” Consequently, there is scope for the language in the statement to become a little more robust, which could push longer-dated Treasury yields higher as well.

Trade could yet play a part...

Nonetheless, trade fears could yet influence Fed policy. Should protectionism escalate this could weaken sentiment, investment and hiring amongst businesses, while also putting up costs. Fed officials have made it clear they are more concerned about potential negatives for growth rather than upside risks for inflation resulting from tariffs, implying that it could result in slower policy tightening from the central bank. For now though, consumers and businesses are brushing aside the concerns of financial markets and we think the Fed will too.

Fed commentary becoming more hawkish

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 June 2018

In case you missed it: Big week ahead This bundle contains 8 Articles