Federal Reserve preview: Lower for even longer

Having announced the conclusions to their monetary policy strategy review, we will be looking to see what that means in practice for the Fed's decision making. The conclusion can only be interest rates will be held lower for even longer

The new normal – “averaging” 2%

Under the Federal Reserve’s old regime, the policy was to pre-emptively raise interest rates before inflation reached 2%.

This was based on the belief that the time lags between policy announcements and the impact on the real economy meant delaying action risked allowing inflation pressures to get out of hand. This could mean that either the competitiveness of the US economy would be undermined or that interest rates would need to rise sharply to control price pressures, which could threaten an economic downturn.

Numerous inflation downside misses over the years has since led to a change of thinking. The conclusions of last month’s Federal Reserve strategy review showed that under their assessment of the “new normal” for the US economy both the long-run trend rate of US economic growth and the estimates for neutral interest rates is lower than previously thought.

In consequence, the point at which declines in the unemployment rate start to generate inflation has fallen, limiting the scope for a meaningful pick-up in inflation.

This can be seen in the numbers. Since the beginning of 2010 the Fed’s favoured measure on inflation, the core personal consumer expenditure deflator, has been at or above 2% in just 13 months – so a hit rate of one in 10 – posting an average of 1.6% year on year over the past decade.

The Fed to tolerate periods of inflation modestly in excess of 2% 'for some time'

Significantly, the Fed acknowledged inflation shortfalls can be just as bad as inflation overshoots – through dragging down inflation expectations and creating “an adverse cycle of ever-lower inflation and inflation expectations” that lead to lower market interest rates, which gives the Fed “less scope to cut interest rates to boost employment” during a downturn. Therefore, to offer some compensation they will now tolerate periods of inflation modestly in excess of 2% “for some time” – hence the shift to an average inflation target of 2%.

The conclusion is that the Fed is now acknowledging they ran policy too tight in recent years.

What does it mean for Fed policy?

While there is unlikely to be any policy change at this meeting given the decent activity and employment backdrop and the recent rise in inflation, we are assuming there will be a change of language within the statement given the Fed’s shift in thinking. There will also be new updated economic and interest rate forecasts and a clear message from the press conference that interest rates will remain lower for longer than would otherwise have been the case.

We are assuming there will be a change of language within the statement given the Fed’s shift in thinking

Currently, the language in the FOMC statement reads as “the Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals”. In its new form it will take on board the emphasis on “shortfalls” from maximum employment levels and “average” for 2% inflation.

Officials have also been mulling whether to formally adopt time guidance, such as saying interest rates will not be raised for two years. Alternatively, they could use outcome-based assurances, such as saying they will not raise rates until inflation has sustainably hit 2% and perhaps adding a figure for the unemployment rate.

However, there is little real need at the current juncture given interest rate expectations are on the floor for the next few years and the Fed’s dot diagram of individual members rate hike projections is signalling nothing before the beginning of 2023. We are shifting to the view that we are quite a way off before the Fed needs to step in with more forceful language on the timing of rate hikes.

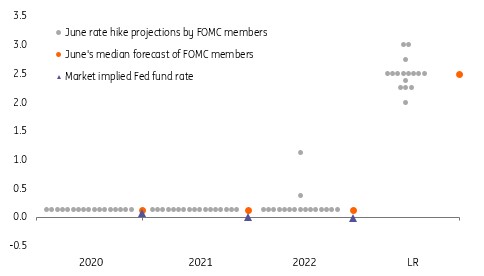

Fed "dot plot" from June

As for the updated forecasts we are likely to see growth expectations revised higher to reflect the recent stronger data, with unemployment revised lower. However, we don’t expect to see much change in the inflation projections nor to the interest rate predictions out to 2022 – the June Fed dot plot diagram only had two of sixteen members predicting a rate rise before end-2022 and we don’t see anyone joining them.

The interesting thing will be what they have to say about 2023 as they extend out their forecast range by another year. We tentatively suggest there is a consensus behind one rate hike before the beginning of 2024, but this is not a strong conviction call. We also wouldn't be surprised to see the long-run expectation for the Fed funds rate revised lower given the new thinking within the Fed.

ING's expectations for Federal Reserve's new forecasts

Low for a very long time

Either way, Jerome Powell will use the press conference to reinforce the message that the Fed has no interest in raising interest rates anytime in the next couple of years, which should help to anchor the short-end of the yield curve even more.

We also see little meaningful upside pressure on the long end of the curve coming from this week’s meeting. There had been some recent upward pressure on longer-dated treasuries given anxiety about the Fed’s renewed focus on delivering higher inflation would mean for fixed coupon payments over many years. Nonetheless, saying they want higher inflation and delivering it are very different things.

With the US economy continuing to face numerous challenges and the slack in the labour market meaning little prospect of wage inflation, the chances of the Fed meaningfully improving on its hit rate for 2% inflation anytime soon don’t look great.

Either way, Jerome Powell will use the press conference to reinforce the message that the Fed has no interest in raising interest rates anytime in the next couple of years

In any case, Powell will leave the door open to further potential action, most likely involving additional QE, but will once again emphasise that the Fed can’t generate demand. For that, we will need to see additional fiscal stimulus, but that is looking only a remote possibility ahead of the 3 November elections.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 September 2020

What to expect from the Fed today? This bundle contains 3 Articles