Federal Reserve preview: job done

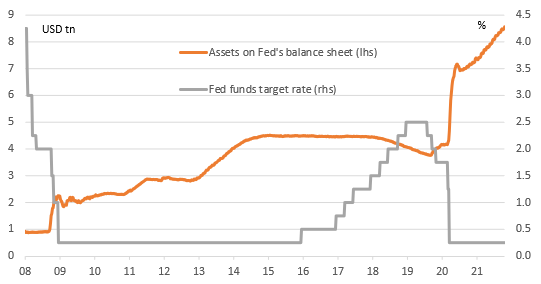

Fed officials agree that “substantial further progress” has been made on both the inflation and employment mandates. With the QE program having done its job and Covid cases subsiding, it is time to announce a slowing in the rate of asset purchases. QE will end in 1H 2022 with attention already switching to rate hikes. We expect a minimum of two next year

Time to draw QE to a close

A November 3rd taper announcement looks a forgone conclusion after recent supportive comments from officials and the minutes to the September FOMC meeting which outlined a potential timetable. It seems set to start in November with asset purchases reduced by $15bn each month, split $10bn Treasuries and $5bn Agency MBS. The plan is for it purchases to be reduced to zero by June, but with the economy growing, creating jobs and likely experiencing elevated inflation through to at least the middle of next year we think it could be concluded more swiftly.

Federal Reserve Balance sheet and the Fed funds target rate (upper bound)

Soft patch gives way to stronger growth

It’s clear that the US economy entered a soft patch in the third quarter as the Delta variant of Covid spread across the country and led to heightened caution amongst households. The steep declines in restaurant booking and travel were a prelude to today’s soft 3Q GDP reading. Thankfully, Covid case numbers have fallen sharply since peaking in mid-September and we are seeing a rapid rebound in the willingness of consumers to get out and about and spend money.

We are confident that the fourth quarter will experience much better growth despite concerns surrounding the rising cost of living. The combination of strong labour demand amidst a dearth of supply will keep incomes rising while households have extra resources to weather this storm due to the fact that nationally their wealth has increased by more than $26tn since the end of 2019.

Adding in anticipated government spending on infrastructure and social policy, more corporate capital expenditure, inventory rebuilding and the return of foreign visitors in significant numbers means we feel the economy can expand by more than 4.5% next year.

Inflation pressures set to intensify

At the same time inflation pressures continue to build. Strong demand, full order books and a lack of inventories in the economy means that higher input costs are increasingly being passed onto consumers. Rising wage pressures and rents are also being passed onto customers in the service sector with consumer price inflation set remain above 5% through to the beginning of 2Q 2022. In fact, we could see headline inflation get close to 6% and core head to 5% in December given a renewed spike in used car prices and the intensifying inflation pressures emanating from the housing market.

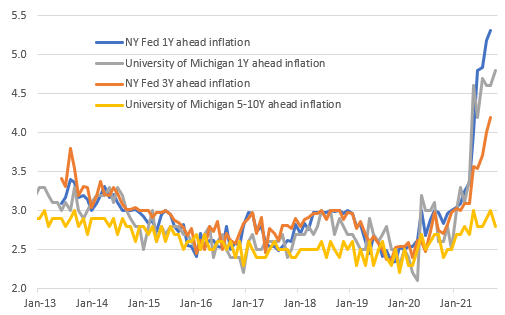

Household inflation expectations are climbing

An early QE end with at least two rate hikes in 2022

Consequently, the Fed’s belief that inflation is largely reflecting “transitory factors” is difficult to reconcile with the data. Moreover, with market and consumer inflation expectations moving higher the Fed’s assertion that “longer‑term inflation expectations remain well anchored at 2 percent” is also increasingly being brought into question. Hence our reasoning that while asset purchases may initially be reduced by $15bn each month they could be cut in larger steps in the first quarter of next year and cut to zero by early 2Q.

We don’t think interest rate increases will be far behind. We have been forecasting two interest rate increases in the second half of 2022 for quite some time – once in September and once in December. However, given the evident intensification of inflation pressures the risks are increasingly skewed towards the Federal Reserve taking a more aggressive position and hiking three times, starting in July.

The anticipated taper is not just about less bond buying, it's about reserves management too

Some argue that the tapering announcement that we anticipate from this meeting has minimal effect, as it simply means less Fed buying, and eventually no additional buying. While true, it misses the bigger point.

There will also to be a re-balancing between liquidity and collateral

The conclusion of Fed buying is an important morph from the Fed contributing to bank reserves to one where the Fed is taking reserves out of the system. This is important. The Fed could, relatively quickly over number of months, take USD1tn out. This would have a much bigger effect than the headline taper numbers point to. It is this that really places upward pressure on market rates, and it can have wider ramifications too, even out the credit curve as the excess in liquidity dissipates.

There will also to be a re-balancing between liquidity and collateral through additional relative issuance, which should place upward pressure on market repo rates. This is also an important precursor to eventual rate hikes, as these need to get executed against a market backdrop that is more geared to hikes. The Fed can’t just hike at will. The price of liquidity (e.g. fed funds rate) needs to reflect actual circumstances, and that’s why the bank reserve story is key.

FX: Fed story to keep dollar supported

The September and early October rally in the dollar has stalled – arguably as many central bank policy trajectories have been re-priced hawkishly over recent weeks to play catch-up with the Fed. Yet the Fed probably has some of the most compelling reasons to normalise policy and a confident tapering next week – which very likely leads to tightening in summer/autumn 2022 – should keep the dollar supported against the dovish low yielders of the EUR and the JPY.

As in Europe, there does seem to be a narrative developing in US money markets that early central bank tightening means that the terminal rate for the tightening cycle is lower. Thus while the 1m USD OIS priced 1 year forward has risen 40bp over the last month, the 1m OIS priced 3 years forward is only 5bp higher over the last month and is actually 12bp lower of the last week.

Indeed there is much uncertainty over the terminal rates for policy cycles around the world. Yet it certainly seems dangerous to second-guess the top in the Fed cycle at this stage. That is why we prefer to see the dollar knocking on the door of big levels in November, such as 1.1500 in EUR/USD and 115.00 in USD/JPY. US energy independence should also underpin the dollar over coming weeks too.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article