Federal Reserve meeting: Inching towards action

The Fed won’t change monetary policy at next week’s meeting, but with the economy re-opening, jobs returning, activity booming, and inflation climbing, a sense of anticipation is starting to build. This won't stop USD remaining under pressure

A statement of the obvious

Next week, we expect the Federal Reserve to leave monetary policy unchanged – rates remaining in the 0-0.25% range and quantitative easing monthly asset purchases maintained at $120bn – and policymakers will re-affirm there will be no shift in stance until “substantial further progress” on the recovery has been made.

Recent comments indicate that officials think this is some way off with the March forecast update, suggesting that most FOMC members still think 2024 will be the start-point for lift-off in interest rates. None of this will change next week.

We also expect the usual script from Fed Chair Jerome Powell speaking of his cautious optimism on the recovery in the press conference while downplaying any talk of meaningful medium-term inflation pressures. He will then serve up the (usual and obvious) comment that the unemployment rate overstates the improvement in the jobs market given steep falls in worker participation.

Fed to come under pressure

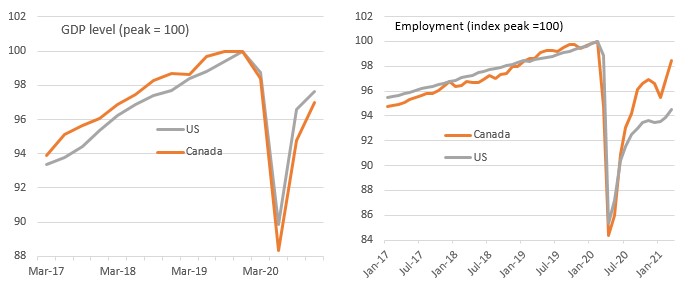

That said, the Bank of Canada may have thrown a slight spanner in the works by announcing another tapering of their QE this week and also saying they're prepared to hike rates within the next 18 months. Given the Canadian economy is lagging behind the US there is more and more reason to question why the Fed thinks it will be 2024 before they will hike. OK, Canadian employment has rebounded more than the US job market, but a lot of this has been part-time rather than full-time workers.

Moreover, the US' 1Q GDP report is likely to show another fantastic growth figure next week (we forecast 7.4% annualised), led by stimulus fueled consumer spending. With the vaccination program meaning more than 135 million Americans have had at least one dose and the economy opening up more and more each day we expect to see more than a million jobs created in April. Given this situation, we believe GDP growth is likely to be in double figures for the second quarter.

We look for the first-rate hike to come in 1H23, but the odds are increasingly moving in the direction of a possible December 2022 rate hike

With inflation likely to hit close to 4% in May and prove to be somewhat stickier than the Fed is publicly acknowledging – largely due to house price developments and ongoing supply capacity issues – we continue to think that the Fed could start tapering asset purchases before the end of the year. We look for the first-rate hike to come in 1H23, but the odds are increasingly moving in the direction of a possible December 2022 rate hike. None of this will be acknowledged by the Fed next week though.

Canadian curveball - why are they preparing to hike next year?

Market rates are proving to be good listeners as expectations are tamed, for now

Having said the above, it appears that the Fed has managed to convince the rates market, not to over anticipate future rate hikes. This can be seen on both ends of the curve.

On the front end, only a few weeks back the Fed funds strip had briefly flipped into attaching a reasonably high probability to a rate hike by December 2022. But this has been steadily pared back over subsequent weeks. Now you have to go to the end of the first quarter of 2023 to really see the pendulum swing in the direction of a rate hike.

On the back end, or let’s say the 10-year, there has been a steady drift lower in market rates. The 10-year had looked like it was about to jump all the way to 2% some weeks back, but has doubled back and is now much closer to 1.5%. The curve shape has flattened in tandem, and a flatter curve implies a reduction in the discount for higher market rates in the months and quarters ahead.

The Fed will likely be content with all of this as their steady approach to policy has helped achieve this. A steady-state at the very easy end of the scale of monetary policy, which has been the unwavering stance, blinkered to the clear pop in contemporaneous macro data. And the Fed continues to stare down the inflation risk with remarkable confidence.

Given that, more of the same tone from the Fed would not come as a surprise for market rates.

The ultra-front-end is backed right up to zero (and negative); the Fed is relaxed, it seems

One area where Fed policy could garner some attention is on the ultra-front-end. SOFR has been steady at a mere 1bp now for well over a month, backstopped by a reverse repo window impliedly at the zero floor to help cater for the posting of idle liquidity. And there is lots of it. It does not all show up at this window, but it does show up in many guises across many asset classes.

One area where Fed policy could garner some attention is on the ultra-front-end

This excess of liquidity is of the Fed’s own making, of course. A chunk comes from ongoing Fed bond buying. By definition, players who sell bonds to the Fed are left with liquidity employed elsewhere, with some filtering out the credit curve for more yield. This is fine, as this is what the Fed wants to see, as it supports the wider credit environment, making for cheaper corporate re-financing conditions.

So this can (and will) continue, at least till the Fed decides to taper. But as the policy persists, it adds to an excess of liquidity, pressuring its lower price (SOFR at 1bp). We still feel it is in the Fed's interest to coax the various liquidity buckets away from pricing at zero, or indeed negative as chunks of the repo market find themselves at. Here a hike in the IOER is not a direct remedy, but it is a perfectly sensible indirect one.

The Fed may or may not address this issue directly, but we have no doubt it has been a point of discussion. If it's just talk, we’ll hear more about that from the subsequent minutes. We still think an eventual 10bp hike in the IOER, which would take it to 20bp, would represent a welcome technical re-calibration of the price of liquidity on the ultra-front end. The odds suggest nothing just yet, though.

FX markets: Little reason to go defensive

Having found support during the first quarter, the dollar has traded softer through April. Driving that story has been the levelling off in US yields, expectations that Europe is finding a way through this crisis and the synchronised decline in cross-asset class volatility, which is encouraging a return to the carry trade.

Assuming the Fed makes few, if any, substantive changes to its statement, we would expect the dollar to stay on a softening path. We say this because there would be few reasons to hold the dollar for defensive reasons and that seven weeks – until the next FOMC meeting – is a long time to be missing out on growth and carry trade opportunities in currencies outside of the dollar.

Assuming the Fed makes few, if any, substantive changes to its statement, we would expect the dollar to stay on a softening path

FX positioning is also a lot more balanced on the dollar now than at the start of the year. In effect, this gives investors a blank canvass to express core FX views this summer.

One such view should be a window where the Fed’s experiment with very negative real rates continues, and a benign environment sees the dollar fall across the board.

Our preference would still be to back commodity-linked currencies, where both CAD and MXN look to be substantial beneficiaries in the forthcoming US domestic demand boom. And after a sluggish start to the year, there could also be some catch-up of the north Asian trio of CNY, TWD and KRW, as low volatility encourages flows back into emerging markets.

This environment should also allow EUR/USD to make a move into the 1.22/23 area over coming weeks and prove fertile ground for EMEA carry trades, such as the ZAR and even now the RUB, given the sanctions event risk has hit and that tension in eastern Ukraine seems to be diminishing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Federal ReserveDownload

Download article