Federal Reserve preview: A nod to November

Covid caution and a jobs data miss mean the Federal Reserve will leave policy on hold next week, but with inflation staying elevated and the growth outlook remaining good we expect a more explicit acknowledgement that QE tapering will start this year

Fed on hold due to Covid caution and weaker jobs

A no change decision at the upcoming FOMC meeting looks a foregone conclusion. The Fed funds target range will be kept at 0-0.25% and monthly asset purchases maintained at $120bn per month despite decent activity data and elevated inflation readings that are running at double the Fed’s 2% target.

Just six weeks ago this wasn’t necessarily going to be the case. Several regional Fed presidents were openly questioning the need for quantitative easing stimulus, including St. Louis Fed President James Bullard who argued “it’s not clear to me that we’re really doing anything useful here”. Dallas Fed President Robert Kaplan agreed, stating “these purchases are not well suited to the environment we’re in now… I think the best thing to do is, early, begin weaning off that medication”. Several others spoke of it being at least “appropriate” to start the discussion of “dialling back” the stimulus.

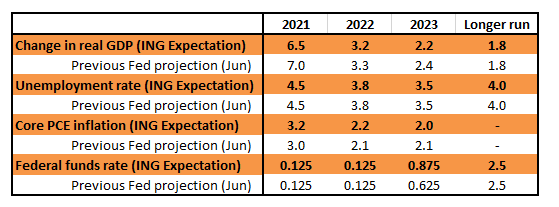

New Fed forecasts

However, the subsequent Jackson Hole Symposium showed the Board of Governors were more cautious given the resurgence of Covid while Fed Chair Jerome Powell made it clear he wants to see more progress on the employment aspect of their mandate.

He argued that “we have much ground to cover to reach maximum employment” and with 5.3mn fewer people in work than in February 2020 and August payrolls clearly disappointing (235k versus the 733k consensus) the majority view at the Fed has swung back to favour delaying a taper decision until there is better news.

The taper is coming – expect a November announcement

With Covid cases seemingly peaking out and the jobs market being more constrained by a lack of workers than any softness in demand, we think the QE taper announcement will come in November. For now, the most we can expect is cautious optimism in the statement with a bit more explicit support for tapering this year from Jerome Powell’s press conference. We also expect to hear it emphasised that this decision is completely separate from any decision to hike rates – there is no automatic path to higher interest rates.

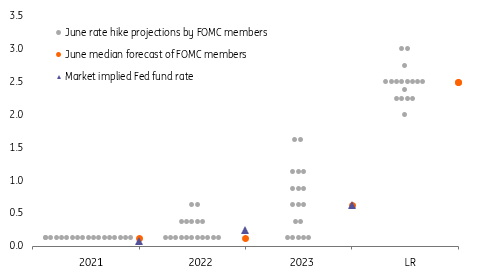

Dot plot to inch towards earlier hikes

New Fed forecasts will show a slight downward revision to growth with an upward inflation revision. The big story could be the Fed individual dot forecasts for interest rate increases. Currently 7 out of 18 officials are going for 2022 as the starting point for increases and we could conceivably see one or two more bring their forecast forward to 2022. We suspect the median stays at 2023 for now, but it will be a close call.

Federal Reserve dot plot for where the Fed funds target rate is heading

Rate lift off set for late 2022

We continue to believe the taper will be conducted swiftly, starting in December and concluding in around six months with asset purchases reduced proportionally between Treasuries and Agency MBS by $20bn per month. There will then be a gap, but with the supply capacity of the economy set to remain constrained by bottlenecks and labour market shortages we think a strong demand environment with elevated inflation means the Fed starts to raise interest rates from late 2022 onwards. By moving earlier this will mean a lower terminal Fed funds rate – we see it peaking at 1.5% versus the 2.5% figure projected by the Federal Reserve.

Market impact likely to be most acute on a re-shuffling of the dots

The rates market will focus on three things. First, on any hint of an imminent taper. Second, on any re-shuffling of the dots. Third, on any finessing in repo operations. The first is all about the back end. While a taper announcement is not expected, any nod at all towards it would likely pressure long end rates higher. The second is more of a front end influence. Currently the 2yr yield in the 20bp area contains only a minimal rate hike risk, and that extends right into 3Q 2023. Bring forward the dot by one year and that 2yr discount looks wrong. Upward pressure on the 2yr yield should obtain. This is the most likely outcome from this meeting to have a material effect.

The rates market will focus on any hint of an imminent taper, any reshuffling of the dots and any finessing in repo operations.

The third element is all about the technicals of money market liquidity. The Fed does not routinely opine on this, but given the persistent USD1tr per day going into the overnight reverse repo facility it is something that may be addressed. The tone so far is that this is nothing short of what the Fed had expected, and it is acting as the safety valve that it was intended to be. Where we go to in terms of excess liquidity is in part outside the Fed’s control. To the extent that the US Treasury has practically spent down its balances at the Fed there is reduced upward pressure on volumes. At the other extreme, the debt ceiling is preventing a mop up of liquidity through bills issuance.

Then there is the planned permanent repo facility which the Fed is currently finessing. This is something that will come to the fore when the Fed tapers, and ultimately takes reserves from the system. Here, the Fed would be adding liquidity (as opposed to draining it as they do with the reverse repo facility). The biggest talk here is on counterparty eligibility, where as wide as a net as possible would minimise potential future pressures. At the same time, there is a body of opinion that suggests limiting this to the domestic insiders. It is unlikely this becomes a large talking point at the press conference, but it will in all probability show up as one in the subsequent minutes.

FX: Dusting off the June playbook

As above, it will be any adjustment in Fed Dots that delivers the biggest impact to FX and money markets. The 16 June FOMC meeting proved something of a shock to these markets, where the move to a median expectation of a 2023 rate hike saw the 1m USD OIS rate priced two years forward spike 15bp higher and the dollar broadly rally 1% across the board.

The biggest FX losers on 16 June in the G10 FX space were Norway's krone (-2%), Sweden's krona (-1.5%), and in the emerging markets space, the South African rand and Mexican peso, both falling 1.8%. Notably, outperformers were the Japanese yen (-0.5%) and the Chinese yuan (+0.13%).

Going into this meeting, speculators remain slightly long dollars. The most stretched dollar long positions are seen against the Australian dollar and to a lesser degree, the yen. Certainly, JPY outperformance on the crosses would be a popular trade were the median Fed Dot to shift to 2022 – which presumably would hit equity markets both through lower earnings expectations and higher discount rates.

The June experience really saw high beta FX hit and of these, we would think the rand would be the most vulnerable to a hawkish Fed meeting on Wednesday. That's because it lacks the interest rate protection of some of its EM peers and doubts may soon emerge about the longevity of its current account surplus.

But as mentioned above, a shift to a 2022 median rate hike is far from certain and if the FOMC meeting can pass without much fanfare, a neutral dollar environment and a neutral EUR/USD environment amidst low volatility can see continued demand for those currencies backed by hawkish central banks. That will favour NOK in the G10 space (Norges Bank to hike 25bp on Thursday). And in the Central and Eastern Europe space, it will favour currencies like Hungary's forint and the Czech koruna, both backed by central banks expected to hike by at least 25bp over the next fortnight.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article