Federal Reserve preview: A bold statement of intent

A rapid economic expansion, above-target inflation and a slice of better news on trade could mean a more forceful statement of intent from the Federal Reserve on Wednesday

Still growing strong

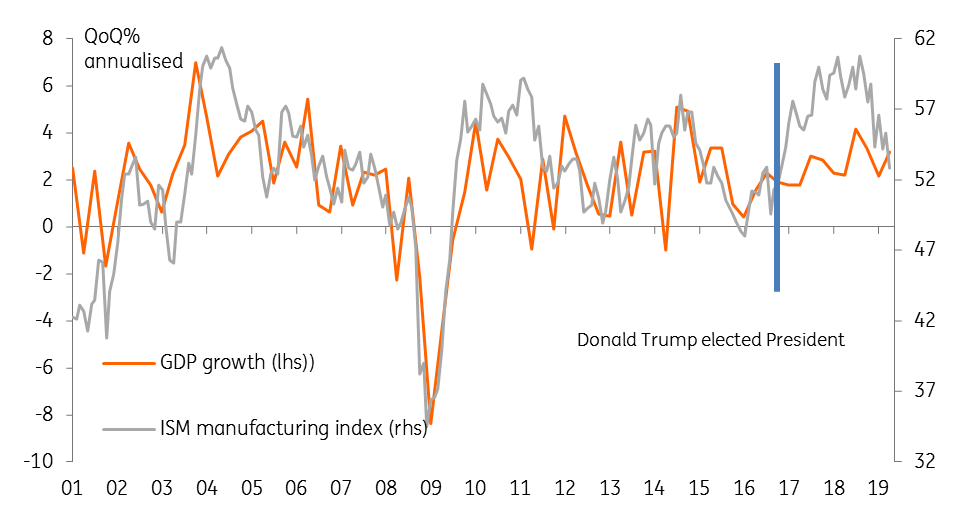

Friday’s blockbuster second-quarter GDP release underlined the strength of the US economy. The 4.1% annualised growth was the strongest for four years with great numbers throughout the report. It's clear the $1.5 trillion of tax cuts that were passed last December are boosting both household incomes and company cash flows, which is translating into robust consumer spending and business capital expenditure numbers. While growth rates in the second half of the year are unlikely to match that of 2Q we still expect the economy to expand a full 3% this year. Durable goods orders suggest ongoing healthy capex spending while consumer and business surveys remain very firm.

US surveys remain on a high

With a jobs market to match

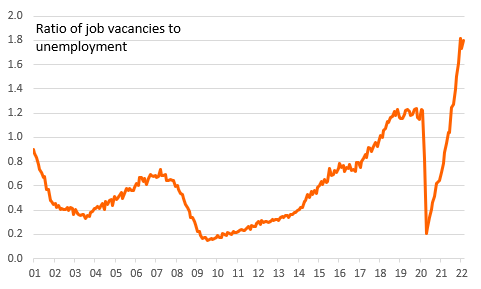

This robust economic performance means the jobs market goes from strength to strength. Payrolls growth has averaged 215,000 per month in the first six months of 2018, up from an average of 182,000 per month in 2017. This means the search for qualified labour is getting tougher with JOLTS data suggesting there is fewer than one unemployed person per new job opening.

The latest Federal Reserve’s Beige book acknowledged there were worker shortages in every district and consequently there are growing signs firms were “raising compensation to attract and retain employees”. This message is seemingly supported by the National Federation of Independent Businesses monthly survey. 21% of small businesses say finding quality labour is the biggest constraint they face while at 36%, the proportion of firms with positions to fill has not been higher in the past 45 years.

With the unemployment rate set to drop back below 4% on Friday the tightness of the jobs market is an issue that should result in higher wages, but we’ve been saying that for a while now. Nonetheless, compensation surveys and the employment cost index certainly suggest they are in the pipeline.

The jobs market continues to tighten

Inflation pressures are building

Headline and core readings of both consumer price inflation and the personal consumer expenditure deflator are already at or above the Fed’s 2% medium-term target with headline inflation figures set to breach 3% soon. Should wage growth finally accelerate then the risk is that these inflation readings will move even higher and that inflation expectations within the economy could become less well anchored.

And the trade risks may be tentatively receding

The fact that President Trump and European Commission President Jean-Claude Juncker have agreed to start talks to reduce tariffs and other trade barriers rather than increase them offers hope that a damaging trade war can be avoided. China and NAFTA remain concerns, but the US-EU ceasefire suggests a willingness to deals.

In any case, the direct impact from tariffs so far (measured in tens of billions of dollars) is tiny when set against the scale of tax cuts and fiscal spending increases experienced this year. However, we cannot rule out the prospect of another flare-up. As such trade remains an issue that could still weigh on sentiment and subsequently dampen investment and hiring among businesses.

A more forceful statement of intent from the Fed?

Given the Fed hiked rates only on June 13, there is virtually zero chance of another move this week, but the Fed will certainly acknowledge the positives outweigh the negatives in the accompanying statement. Fed Chair Jerome Powell’s testimony on Capitol Hill has made it clear that the Federal Reserve remain comfortable with the idea of ongoing “gradual” policy tightening, which we interpret as one 25bp hike per quarter (at September and December FOMC meetings most likely). The strong growth and rising inflation environment suggest in our view the risks remain skewed towards a slightly more aggressive interest rate hike path than implied by market pricing. A thawing of the trade tensions between the US and European Union may also give the Fed greater confidence to push on with its strategy so we could see a bolder statement of intent on rate hikes on Wednesday.

A side note

Interestingly, at this FOMC meeting, there will only be seven voters versus the twelve that should be in place. President Trump’s picks for the vacancies on the Board of Governors (Marvin Goodfriend, Richard Clarida and Michelle Bowman) are still stuck in committee hearing stages. This means that Fed Chair Powell is likely to have even more influence over the statement and outcome of future policy decisions.

If Trump’s picks do eventually get on the committee, it will be a much more pro-industry and deregulation supporting FOMC than that of 2017 under Janet Yellen. Given they are Trump’s picks, we will be closely watching for signs they share his sentiment of not being “thrilled” by interest rate hikes. If so this would dent rate hike expectations for 2019 and beyond and potentially lead to a slight flattening of the yield curve.

Fed hawk-meter

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article