Federal Reserve fires the starting gun

While monetary policy was unchanged the new Federal Reserve forecasts signal officials are not so confident in their transitory inflation narrative. With growth also revised up the Fed are now indicating we should be braced for 50bp of rate hikes in 2023 with the prospect of an earlier QE taper that potentially has an earlier conclusion

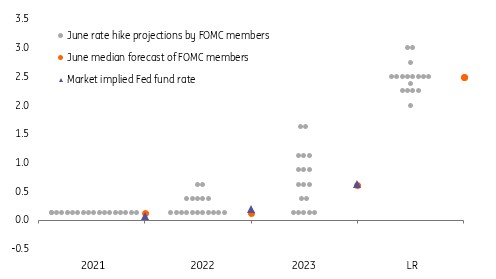

All about the dots - 2023 rate hike start

No shock surprises on the monetary policy front (rates held at 0-0.25% and QE purchases maintained at $120bn per month split $80bn Treasuries and $40bn agency mortgage backed securities), but the forecast changes are highly significant. There are now 50bp of Fed hikes by 2023 as the median forecast of officials with 13 out of 18 going for some form of move in 2023 versus just seven when they were last polled in March. Previously they were signalling that it was more likely to be 2024 before the first hike. There are now 7 out of 18 going for a 2022 rate hike versus four previously. The Longer run forecast remains 2.5%.

Federal Reserve "dot plot" of individual forecasts for the Fed funds target rate

The Fed’s 4Q YoY GDP forecast for 2021 was revised up to 7% from 6.5%, 2022 stays at 3.3% while 2023 has been revised up to 2.4% from 2.2%, which presumably reflects some optimism on President Biden’s spending plans. There are even more substantial inflation changes with Core PCE now to end the year at 3% year-on-year versus 2.2% previously predicted with the 2022 and 2023 forecasts revised up a tenth of a percentage point. It appears therefore that the narrative remains that inflation will be transitory, but it is clear from the press conference they are less confident in that assessment than they were a couple of months ago – Jerome Powell certainly talking about the risks it stays elevated for longer. The revisions to unemployment are tiny (see table below).

Federal Reserve June forecasts versus previous March predictions

Despite these major moves the accompanying statement is little changed – merely some descriptives around vaccinations with an acknowledgement that inflation is no longer running "persistently" below the long run goal of 2%, which is pretty obvious to everyone.

A clear hawkish shift

The forecasts are the big story today and signal a more hawkish shift than generally thought was likely with the yield curve steepening and moving a higher. The 50bp of hikes the Fed are now pencilling in is merely in line with what the Fed funds futures market was pricing, but it clearly fires the starting gun on the prospect for a QE tapering discussion that could start a little earlier than thought and conclude more quickly – hence the wake-up call for the Treasury market.

This will be more formally acknowledged at the Federal Reserve’s Jackson Hole conference in late August with the September FOMC (the next forecast update from the Fed) laying out the path. We had been expecting the tapering announcement to come at the December FOMC and be concluded before the end of next year, but the timeframe could certainly be brought forward.

ING view: Three 25bp hikes in 2023

Like the Fed, we are very upbeat on US growth prospects given the scale of stimulus injected into the economy, the improvement seen in consumer finances coupled with anticipated pent-up demand for leisure, travel and entertainment services and the red hot property market. The result is that we strongly suspect that the US economy will end the year larger than what would have been the case had the pandemic not happened and the activity continued along its pre-pandemic trend (see chart below).

US GDP levels - ING forecast versus pre-pandemic path

We are nervous that scarring from the pandemic means that the supply capacity of the economy may not be able to fully meet that demand. There are clear re-opening frictions already compounded by a shortage of suitable workers. Manufacturers also have a record backlog of orders while they know their customers are running the lowest inventory levels on record, according to the ISM. This provides a decent pricing power environment that allows companies to pass higher costs on more easily.

Then there is the housing market, which is seeing booming prices, which will inevitably feed through into higher housing components of CPI. In consequence we see inflation remaining well above the 2% target for much of the next three years. If wages start responding more meaningfully the risks of inflation remaining higher for longer will be even greater.

We look for three 25bp rate rises in 2023.

While the Fed has shifted its stance to focus more on the labour market to ensure more people in society feel the benefits of a growing economy – through jobs and wage increases – we doubt they will tolerate an overheating economy. We look for three 25bp rate rises in 2023, starting in the first quarter.

IOER: A technical move, but still the effect and marginal direction of policy is clear

The 5bp hike in the rate on excess reserves (from 10bp to 15bp) is a technical move, and is being downplayed by the Fed as being just that. At the same time, it is certainly not a loosening in policy, and in fact fits with a series of moves of late that have been of a tightening ilk. Remember in recent months, the Fed decided not to extend the leeway granted to banks in the treatment of reserves and bonds on their leverage ratios. That was a tightening. The decision to sell its (small) corporate bonds portfolio is also a tightening. The 5bp hike today is in a similar vein of a gradual chipping away at stimulus. A technical move, but all of this is pointing in the same direction.

The 5bp hike in the rate on excess reserves is a gradual chipping away at stimulus.

The Fed also hiked the rate at its reverse repo window by 5bp (from zero to 5bp). This, together with the 5bp hike in the IOER, is designed to coax up rates on the front end of the curve. This has been a policy choice that could have been executed for a number of months now, but became more front and centre given the large flight of cash back to the Fed at this window in recent weeks. The hike in the rate itself is not going to be a trigger a lower use of this facility. But the combination of this elevation plus the one of excess reserves changes the dynamic on the ultra-front end. It should directly push up the SOFR rate (likely also by 5bp; market driven), and will impact higher alternatives in this space ranging all the way into the bills market.

Market rates are higher generally in consequence. The 10yr is back up towards 1.55% and the 2yr is approaching 20bp. That’s the highest for the 2yr in about a year, which makes sense as it is now sniffing out a rate hike before it matures. And there’s been an even bigger move on the 5yr, as the 5yr underperforms on the curve (still a tad rich to the curve, but more neutral now than it was). This is a classic bearish reaction and one that can act as a momentum change as the market being to pivot towards rate-hike preparedness, from a point of neglect of that as an imminent risk.

A big move has been seen in real yields too, practically a 10bp gap higher, and forcing inflation expectations down (a tad). Still deeply negative (at c.-80bp in the 10yr), but moving higher again. This is important too. If the recovery higher in rates is to have legs, it should ideally come from less negative real yields. The fall in inflation expectations also tells us the market place is pricing in a better protection from the Fed. Not much, but certainly more than was in evidence before the FOMC meeting outcome.

Hawkish surprise gives the dollar a lift

The Fed has quietly set the cat amongst the pigeons with the median expectation of the Dot Plot shifting to two hikes in 2023 from none previously. That lends itself to a narrative – even though this is still more than eighteen months away – of a slightly faster Fed tightening cycle. This has seen Dec 2023 Eurodollar contract fall a relatively sharp 10 ticks and even yields at the short end of the US Treasury curve start to edge up. The dollar tends to take more notice of the short end of the curve, being more sensitive as it is to Fed policy.

The FX market reaction has seen the high beta NOK, ZAR and MXN take the lion’s share of the losses ($/NOK is nearly 2% higher on the day), while the rest of the $/Majors are up around 0.6%. Given the news that we are perhaps marginally closer to Fed tightening than we thought, dollar sensitivity to US data releases and Fed-speak look likely to increase. Perhaps EUR/USD 1 year implied volatility does not break below 6% after all?

But the August Jackson Hole Fed symposium is still over two months away and it may be hard for investors to ignore the appeal of yield this summer – especially in light of some very aggressive and front-loaded tightening cycles in the likes of Brazil and Russia.

EUR/USD testing and perhaps breaking 1.25 later this year could be harder to achieve.

What it may mean, however, is that investors think twice about funding carry trade strategies out of USD and instead the JPY and the EUR may be increasingly favoured. Certainly, today’s Fed news makes our forecast of EUR/USD testing and perhaps breaking 1.25 later this year a little harder to achieve. And for the short term a correction to 1.1920 area looks the risk.

This Fed move also comes on a day when a report suggests Chinese authorities are preparing to intervene in commodity markets by releasing some of their strategic stockpiles in industrial metals. This can add to the correction in the strongly-backed commodity FX complex.

Unless a bond market sell-off really gets out of hand, it is not clear that equities need to suffer a deep correction on this. And given that the Fed’s balance sheet is likely to still be expending well into 2022 – albeit it a slower rate – it looks too early to call a significant turn in the risk asset cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 June 2021

Surprise, surprise This bundle contains 5 Articles