Federal Reserve: Corporate buying lite

The healing process on credit markets has been impressive. So much so that when the Fed has been ready to deliver on corporate buying, the need has been downsized. The buying, while not insignificant, is far lower versus volumes that could have been imagined when the program was first dreamt up. This is thematic, and captured in the continued easing in Libor

Fed buying of ETFs and commercial paper support has been less than expected. But no need to go in big

So far Federal Reserve buying of corporate ETFs is running at USD 1.8bn. That equates to some USD 260m per day (rounded). Annualize that and we hit USD 60bn. That can be compared with the bond ETF market capitalisation at USD 900bn, equating to about 6.6% of it.

That said, the corporate buying program is due to end by September, so extrapolation through to September at the latest pace equates to 2.75% of the bond market capitalization in ETF. Not a nothing number by any means, but also not massive by any stretch.

Note also that the Fed’s program has a total potential size of USD 750bn (including help for the primary market), so based off that it is running at well below what could have been expected if the Fed had to go in hard and heavy. But that’s the thing; there has been no need to go in big.

On many fronts the stress has been de-elevated. Continued falls in 3mth Libor is indicative of this (now down to 35bp versus 1.45% at end March at a time when the Fed had already cut the funds rate to “zero”).

More support for mainstreet and off-shore dollars contrasts with less support needed for the domestic financial system

A healing process had been underway in advance of the launch of the corporate buying program. The same happened ahead of the initiation of the commercial paper program, which to date has had just a little over USD 4bn spent on it. A busy primary market has meant that help for primary issuance generally has not been as needed compared with when shutdown crisis first broke.

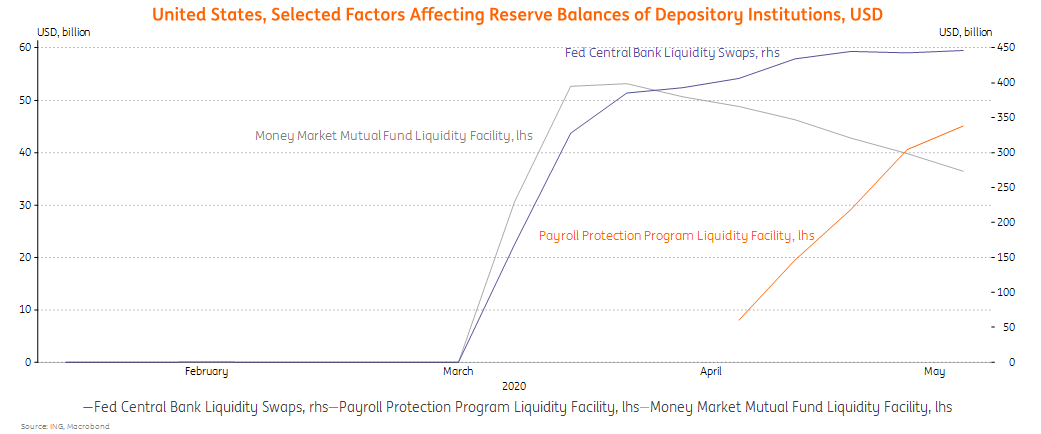

We have also had another reduction in deployment of the money market liquidity facility to the tune of USD 3bn, which is now down to USD 36bn in cumulative terms. Credit allotted to primary dealers is also down, by another USD 3bn. At the other extreme, take-up of the paycheck protection program for smaller corporates is up another USD 7bn to a cumulative USD 45bn.

Different drivers: Off-shore and mainstreet help up, while domestic support is down

Apart from outright buying of Treasuries and mortgage-backed securities, the other big expansion element on the Fed’s balance sheet has been in central bank liquidity swaps. These rose again by a further USD 3bn, bringing the cumulative amount to USD 446bn. The change here is not significant, but it does reverse the small fall that we had seen in the previous week.

On many fronts the stress has been de-elevated, in particular in the functioning of the financial system. Continued falls in 3mth Libor is indicative of this (now down to 35bp versus 1.45% at end March at a time when the Fed had already cut the funds rate to “zero”). The risk-on mood in equity markets has helped too, gelling with a tightening in credit spread generally.

So the Fed is under far less pressure to go in big from here. We are not aware that the Fed has bought any corporate bonds as of yet, as it seems the concentration has been in ETFs.

That makes life a bit simpler. Going into corporate bonds direct would require making choices by name, and would be more applicable where there needed to be large size done.

That is not where we are right now. Thankfully. We doubt the wider angst is structurally behind us, but the significant ramping down of systemic stress is an ongoing feature that we are happy to take.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article