Fed may be nearing a pivot, but inflation pressures remain strong

The Fed's favoured measure of inflation is heading higher, rather than lower while employment costs continue to rise at double the rate experienced over the past 15 years. The market is probably right to expect the Fed to slow the pace of rate hikes from December, but this is by no means guaranteed

| 5.1% |

Annual rate of core inflation |

Underlying inflation still heading higher

US market interest rate hike expectations have been scaled back in recent days as caution on the economic and market outlook have heightened expectations that the Fed would follow other central banks and rein in their aggressiveness. Yet, while we may well get a “step down” in the pace of tightening from December onwards it is clear that inflation is far from defeated and the risks are that rate hikes could continue for longer.

That view has been backed up by today’s data which show the Fed’s favoured measure of inflation rose 0.5% month-on-month in September, the same as in August (although it was revised downwards from 0.6%). This leaves the year-on-year up at 5.1% versus 4.9% previously. Remember that to get the annual rate of inflation trending back down to the 2% target we need to see MoM figures closer to 0.2%, so there is little sign of us heading in that direction yet.

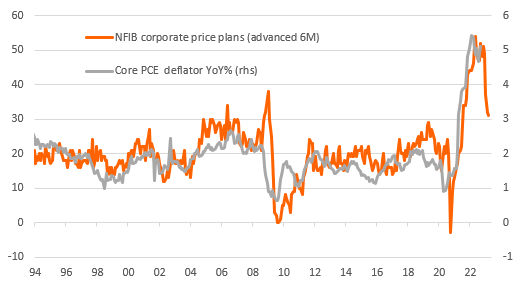

Nonetheless we are hopeful that it will slow next year. The chart below shows the relationship between the National Federation for Independent Business’ data series on price plans – the proportion of companies looking to raise their prices in the next three month and the core PCE deflator. It hints that weakening demand, the deteriorating economic outlook and rising inventory levels are making businesses more cautious and suggests pricing power is waning. If so this indicates inflation could slow rapidly through the first half of the year.

Core PCE deflatior and the NFIB survey of corporate price plans

Labour costs still running hot

That said, the Fed appears focused on the here and now with another of their favourite indicators highlighting the strength in near-term inflation pressures. The Employment Cost Index showed that labour market inflation pressures remain strong, rising 1.2% quarter-on-quarter in the third quarter after a 1.3% increase in the second quarter. This is double the 0.6% QoQ average over the past 15 years, indicating that this is still going to be an issue for the Fed given its increase prominence in how the central bank is assessing the risks. Wages rose 1.3% while benefits increased 1% with government labour cost increases outstripping private sector costs for the first time in several years – government wages rose 2.1% QoQ versus 1.2% in private industry.

Better spending momentum, but GDP growth is still likely to slow in the fourth quarter

Meanwhile, the personal spending numbers have seen some quite big revisions so that after a contraction in real consumer spending in July we got some pretty firm figures for August and September with 0.3% MoM growth. As such this positive momentum heading into the fourth quarter makes us a little more optimistic on fourth quarter GDP than we had been. But even so the intensifying headwinds from the downturn in the housing market, high borrowing costs and the strong dollar mean that we think it will slow to something around the 1.5% mark.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 October 2022

Scream if you want to go faster This bundle contains 7 Articles