Fed hikes 50bp with much more to come

The Fed has hiked 50bp and is formally starting quantitative tightening as it seeks to get a grip on inflation. The Fed acknowledges that “ongoing increases” will be required with Chair Jay Powell giving the green light to a series of 50bp+ rate hikes. We look for a 3.25% peak given the prospect that inflation will be far stickier than in recent cycles

| 50bp |

First 50bp hike in 20 years |

Fed steps on the accelerator to combat inflation

The Fed has shrugged off the surprise 1Q GDP contraction and pushed ahead with a 50bp interest rate increase and announced Quantitative Tightening (QT) as it belatedly seeks to get a grip on inflation. The Fed is now "highly attentive" to inflation risks and amid “robust” job gains "ongoing increases" in the Fed funds rate will be "appropriate". It is starting QT at $47.5bn per month on June 1st ($30bn Treasuries and $17.5bn agency MBS) before getting to a "max" of $95bn in September ($60bn Treasuries, $35bn agency MBS).

This is the first 50bp move since May 2000 and underlines the new urgency the Fed has in an environment where inflation is 8.5% and a tight labour market and surging employment costs risk making inflation much stickier than in previous cycles. After all, oil and food prices can eventually fall. Wages and employee benefits don’t.

Moreover, corporate pricing power remains strong and with China lockdowns continuing and geopolitical tensions staying high, there seems little immediate prospect that the Fed will get any help in its fight against inflation from falling commodity, freight or component costs.

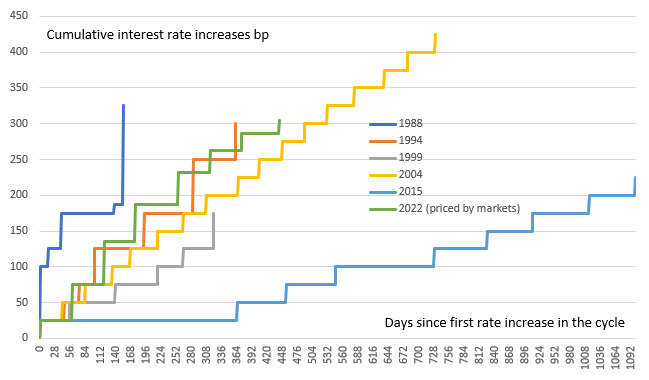

Market pricing isn't especially aggressive relative to history - cumulative hikes versus days since first rate increase

Risks are skewed towards swifter and harder policy tightening

The chart above shows what is currently priced for Fed rate hikes versus previous cycles. It doesn’t look especially aggressive given the position the economy is currently in. In the press conference Chair Powell suggested ongoing 50bp rate hikes are "on the table" for the next couple of meetings. Nonetheless, despite Chair Powell's caution on the matter, we would not rule out a 75bp rate hike in June – the market has been midway between 50bp and 75bp over the past week and Powell also admitted the need to be "nimble".

The Fed minutes to the March FOMC meeting admitted were it not for the uncertainty caused by Russia’s invasion of Ukraine they would have likely raised rates by 50bp rather than 25bp in March. Today’s 50bp move followed by 75bp in June, it could be argued, will allow the Fed to “catch-up” and leave the Fed in a position that it is more comfortable in.

We then expect a further 50bp hike in July before the Bank moves to 25bp increments at the final three meetings of 2022 as quantitative tightening gets up to speed and contributes to the tighter monetary conditions.

The Fed has said that $95bn per month is the maximum QT they will do. $95bn per month reduction in the balance sheet is a little over 1% of the outstanding right now. In comparison the Bank of Canada is more aggressive and is not incorporating caps in the amount of bonds that are allowed to mature each month and will see their balance sheet shrink by around 40% over the next two years. There is also some talk the Bank of England could directly sell assets. Should US inflation fail to slow as hoped we cannot entirely rule out the possibility of the Fed accelerating its QT at a future meeting

Cuts to come in 2023?

Looking further ahead faster, sharper interest rate increases come with a greater risk of an adverse economic reaction. This is indeed already prompting some talk of an economic slowdown and even a recession. We are not in the recession camp, but if we see the Fed move interest rates quickly into restrictive territory and growth slow markedly and inflation heads towards target, the Fed could quickly reverse course. Between 1970 and 2000 the average length of time between the last rate hike in a cycle and the first rate cut was only three months. Over the past 20 years, it has been three quarters. We are currently looking for a 1Q 2023 peak in the Fed funds rate with policy starting to move to a more neutral footing from 4Q 2023.

ING Forecasts for the path of the Fed funds rate and the Fed's balance sheet

Mixed implications for markets on inflation expectations and repo

While the Fed likely won’t admit it, we’re convinced they will be taking a close look at the impact on long run inflation expectations post the FOMC. Currently in the 2.8% area, the 10yr inflation expectation is just about tolerably below a 3% handle. The Fed would like to keep it that way. Ideally the 10yr inflation expectation would trend back down to the 2.5% area. That would imply that the Fed has control of expectations. The risk, however, is for inflation expectations to break above 3%. Should that occur, the case for a 75bp hike in June would build. The immediate reaction has been muted, on both real rates and inflation expectations, but we need to continue to monitor this important space.

The repo market has struggled with market conditions that are to a significant extent a legacy of the Fed’s bond buying program. The market has been left with an excess of liquidity over available collateral, pushing down on repo rates, and making it difficult to compete with the 30bp on offer at the Fed’s reverse repo window. While strong tax receipts are exacerbating this through less bills issuance, the sooner the Fed rolls off a chunk of its balance sheet the better from a repo market perspective. Here there has been mixed news, with a USD 95bn per month roll-off confirmed, but starting at a more gradual space. Based off this, material impact on repo is a number of quarters away.

FX: Dollar unlikely to turn lower anytime soon

As we expected, the initial knee-jerk “sell-the-fact” reaction in the dollar as the Fed delivered the 50bp hike was very short-lived, and the greenback is now trading around or moderately higher than the pre-announcement levels.

In a longer-term perspective, the FOMC’s focus on fighting inflation and front-loading rate hikes continues to point at a supported dollar in the summer months. The Fed is not going to be the only factor keeping the dollar strong in the coming weeks, as an external environment dominated by unstable risk sentiment, lingering geopolitical risk in Ukraine, generalised lower appetite for EM assets as the Fed tightens and Covid-related risk in China all suggest markets will be reluctant to unwind their long dollar positions anytime soon.

EUR/USD remains at risk of moving below 1.0500 in the coming days, especially if US jobs data on Friday fuel expectations around potentially larger than 50bp rate hikes in the future, or if more negatives related to geopolitics/implications for the energy market end up being priced into the euro.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article