Fed: Countdown to March lift-off!

The Federal Reserve admits rate hikes are coming “soon” and this will be the primary tool to tighten monetary policy. They are also laying the groundwork for shrinking their bloated balance sheet, yet are actually adding to it until March! Policy changes will continue to be well flagged with four rate hikes our expected minimum this year

Inching towards action despite ongoing QE

The Federal Reserve has left policy unchanged, but signaled “it will soon be appropriate to raise the target range for the federal funds rate”. They are also continuing to buy assets as part of their QE plan until early March, which seems a strange decision to us. Fed Chair Jerome Powell had said earlier this month that “we’re mindful the balance sheet is $9 trillion. It’s far above where it needs to be”. Why on earth are they adding to it? This seems even more peculiar given they have released a document titled “principles for Reducing the Size of the Federal Reserve’s Balance Sheet”. We can only conclude that the recent volatility in financial markets has led them to tread cautiously and not surprise.

In terms of the press release the Fed talks of strengthening activity and “solid” job gains while acknowledging that “supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation”. Consequently, we are expecting a 25bp rate rise at the March FOMC meeting and in the press conference Powell admits FOMC members are "of a mind" to do so.

Minimum of four rate hikes, but it could be more

The data between then and now isn’t going to be pretty though with a clear risk that December’s awful consumer spending numbers are repeated in January given all the Covid caution around. The January jobs number could also be very subdued for similar reasons and this is likely to dampen the very niche calls for a 50bp rate hike in March.

Nonetheless, we are hopeful of a second quarter rebound given solid income fundamentals and this will set us up for at least four rate hikes in 2022. Indeed, in the press conference Fed Chair Jerome Powell did not rule out raising rates at every FOMC meeting, arguing that the Fed has plenty of room to raise interest rates without hurting the jobs market.

The balance sheet will contribute too

In the second Fed document regarding the balance sheet they confirm that the primary monetary policy tool is changing the Fed funds target rate and that "reducing the size of the Federal Reserve's balance sheet will commence after the process of increasing the target range for the federal funds rate has begun". Balance sheet reduction will be done "in a predictable manner primarily by adjusting the amounts reinvested of principal payments". It also wants its balance sheet "in the longer run" to be "primarily" composed of Treasury securities.

It is fairly vague stuff and there is nothing in there that is surprising. It will be a similar pattern to past times. The Fed hikes a couple of times (March and June) and then presumably in July/August starts allowing a capped amount of maturing assets to run off its balance sheet. It will start slowly, probably at around $10bn for Treasuries and $8bn for MBS and then be accelerated, assuming economic conditions allow, up to around $50bn and $40bn respectively per month. Given the Fed states it primarily wants to hold Treasury Securities "in the longer run”, agency MBS may be allowed to run off at a slightly quicker rate than Treasuries.

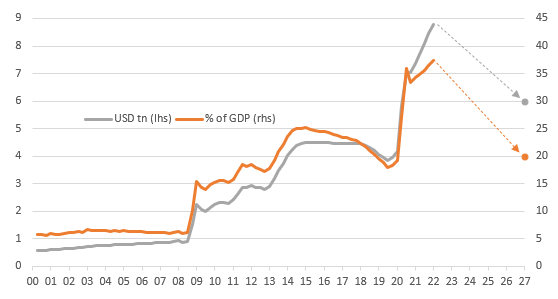

Assets on the Federal Reserve's balance sheet and the potential path to "normalisation"

They don’t give us a figure for the size of balance sheet that they think might be warranted in the medium to longer term, merely stating the Fed “intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively”. Currently we are at $8.75tn, equivalent to around 36% of nominal US GDP. Board of Governor member Chris Waller has suggested he thinks the balance sheet should over the long run be around 20% of GDP. Assuming they aim for a 5-year run down this would imply $2.8tn of assets leaving their balance sheet. The longer the time frame, the less reduction required, obviously.

Market rates choose to edge higher, on a calming influence for risk assets

A small uptick in rates along the curve has been the impact reaction from the Fed’s statement. This has been driven by a nudge higher in real rates; inflation expectations remain steady.

The lack of new news from the Fed’s statement allows the market to latch back on to the path of least resistance, which right now is up in market rates, a bit. Risk assets have not seen any new shock from the Fed, which is supportive. There is arguably a window of tranquility now for risk assets as we roll forward to the March meeting, which is quite some distance away.

In the meantime the Fed has cut nothing and continues to build its balance sheet (no tapering yet). No panic tightening here. No overreaction, despite the market talk. Relief for risk assets leaves room for market rates to re-test higher. But overall, we are back to monitoring the pulse of the economy.

Notwithstanding the headwinds that come from Omicrom, and can come from Ukraine-related issues, the bond market is minded to look up in yield rather than down. The counter to this is ongoing Fed and external buying of Treasuries. The Fed’s statement has done little to change that narrative, at least for today.

FX: All very orderly

The initial reaction in FX markets to today’s FOMC statement has been relatively muted – since the market had already priced the start of the Fed tightening cycle in March. If there has been a slight movement, it has come from the dollar moving higher against the low-yielders, such as the JPY, EUR and CHF – currencies most susceptible to higher US interest rates.

Marginally outperforming have been the high beta currencies. Here one can argue that surprises in neither the FOMC statement nor the Fed’s balance sheet down-sizing guide support views of an orderly rate normalisation cycle – reducing the risks of shocks to risk assets.

Given the current tension in Ukraine, which should demand a geopolitical and macro risk premium of European currencies, and the looming Fed cycle, we would continue to back North American currencies in 1H22. Those currencies in the orbit of the strengthening Renminbi should also be better able to withstand Fed and geopolitical risks over coming weeks and months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 January 2022

Looking forward to looking back This bundle contains 7 Articles