Falling real US incomes raise doubts about the outlook for spending and inflation

US inflation remains somewhat sticky, but intensifying concerns are now coming to the fore over the path for real household disposable income – the key driver of consumer spending. Unless this turns around rapidly, recession will start to look more likely and inflation will fall more rapidly than the Federal Reserve expects

Sticky inflation, but the Fed doesn't need to hike again

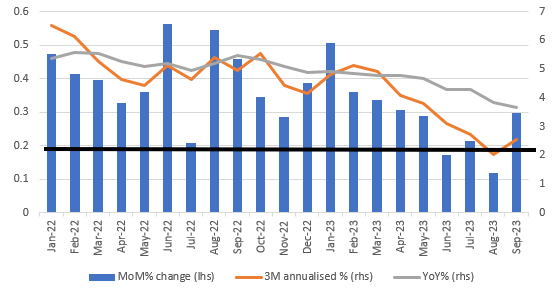

The September personal income and spending report shows that US inflation remains somewhat sticky, with the core personal consumer expenditure deflator coming in at 0.3% month-on-month/3.7% as expected. This follows three months where it has averaged 0.17% MoM, which is exactly what we'd need to see over time to take us back to the 2% year-on-year rate that the Federal Reserve is targeting.

As such, it's a little disappointing – but with the Fed acknowledging the recent tightening of financial conditions brought about by the spike in Treasury yields and Fed Chair Jerome Powell’s recent comments that “given the fast pace of the tightening, there may still be meaningful tightening in the pipeline”, we continue to believe the Fed is finished hiking rates.

Core PCE deflator MoM, 3M annualised & YoY% change

Falling real incomes means weaker growth ahead

Meanwhile, the report shows that incomes were weaker than hoped, rising 0.3% MoM versus the consensus 0.4%. Spending was stronger at 0.7% MoM versus 0.5% predictions. Adjusting for inflation, spending was up 0.4% MoM versus the 0.3% consensus, suggesting decent momentum as we head into the fourth quarter. Nonetheless, the challenges for the consumer are mounting.

Consumer spending is 70% of US economic activity (versus 50-60% in Europe) and there are four ways to finance spending: incomes, savings (either save less each month or run down savings balances), borrowing (on credit cards, car loans etc) or selling assets. Income is the worrying one as it's the main source of funds. Today's report shows real household disposable income falling for a fourth month in a row, which the chart below shows. It has effectively been stagnant for the past two years and is well down on where the pre-pandemic trend suggests we should be.

Real Household Disposable Income Levels (2017 $bn)

We have therefore been running down our savings and borrowing more to fund this spending growth through the recent period, and that is not sustainable. Savings are finite and are being exhausted at a rapid rate, with various estimates suggesting that excess savings accrued during the pandemic could be exhausted in the first half of next year.

At the same time, credit card borrowing rates are at all-time highs and student loan repayments saw consumer credit growth turn negative in the most recent report. For a recession to be averted, we need to see real household disposable income starting to move higher. If it doesn’t, then activity will soften rapidly in coming quarters, helping to dampen inflation. That fundamental weakness suggests no more rate hikes and the likelihood of significant rate cuts next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article