The eurozone’s Japanification - more to come

With the eurozone economy stuck in a low growth, low inflation and low rates environment, it's really hard not to make 'Japanification' comparisons. If we're honest, the eurozone is probably already in the thick of it, which means rates are likely to remain lower for longer and every new crisis or recession will bring the bloc closer to more Japanification

A brief history of Japan’s lost decades – Japan’s first crisis

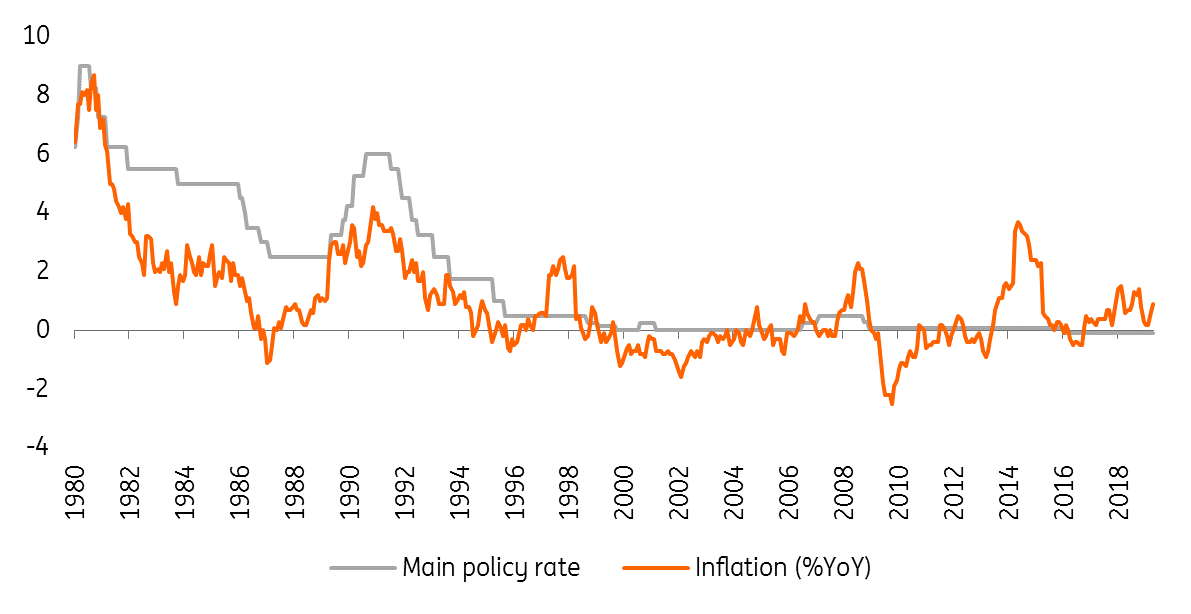

The roots of Japan’s subdued economic performance can be traced back as far as the late 1980s.

In September 1985, following the Plaza Accord – an agreement by Japan, the United States, France, West Germany and the UK to depreciate the US dollar against the Japanese yen and the German Deutsche mark, the Japanese yen appreciated sharply. Being highly export-oriented, Japan’s exports and GDP growth dropped considerably in 1986. Because of the deteriorating economy, to stop speculative capital inflows and limit the yen’s appreciation, the Bank of Japan lowered interest rates from 5% to 2.5% between January 1986 and February 1987. Furthermore, fiscal packages were compiled in September 1985 and May 1987 to support the economy. Although the economy rebounded significantly in the second quarter of 1987, the central bank kept its policy rate at 2.5% until May 1989.

Fuelled by a mixture of declining lending standards, financial regulation in the years before, low interest rates, cheap money and the belief, that the only way was up, Japanese stock and real estate prices grew at a staggering speed towards the end of 1986 and until 1990, pushing the Nikkei index from 13,000 points to an all-time high of 39,000 points in December 1989. [1]

The lending standards of banks became more cautious

In May 1989, the central bank raised interest rates from 2.5% to 6% in just 16 months as it became concerned about asset price increases, banks’ lending behaviour and upward pressure on prices. At the beginning of 1990, stock prices started to decline with the yen depreciating and long-term yields increasing. However, the BoJ kept raising rates until August 1990 – also in the wake of the Gulf war leading to an increase in oil prices. Subsequently, the lending standards of banks became more cautious, money supply growth decelerated sharply and the pace of economic growth started to slow.

When the stock market and real estate bubble started to burst in 1990 and 1991, the Japanese banking sector faced a pile of non-performing loans with Japan’s corporate sector being characterised by excess debt. According to the IMF’s systemic banking crises database, Japan’s non-performing loans (NPLs) peaked at 35% (of total loans) during the banking crisis - a level which neither Greece nor Italy reached during the European sovereign debt crisis. However, the magnitude was not immediately recognised and authorities were slow in reacting. Only in the second half of the 1990s, when large institutions started to fail, the full extent became visible. [2]

The Bank of Japan's courageous monetary policy

Meanwhile, the Bank of Japan was quite brave with introducing new monetary policy measures beyond textbook knowledge. In October 1999, the interest rate was lowered to zero and ZIRP (zero interest rate policy) was born. Japan's central bank started to use quantitative easing policies, back in 2001, setting the outstanding balance of current accounts at the Bank as the operating target [3] . But the monetary stimulus didn't result in higher inflation as the authorities had waited too long before taking decisive action. Initially, the BoJ had raised rates during the burst instead of lowering them and it was only in 1999, a comprehensive disclosure requirement for bad loans was put in place.

Japan’s low inflation seems to be more structural

Japan’s low inflation seems to be more structural, causing low-interest rates, for which numerous factors can be cited. Research has identified factors like the “zero-lower bound on nominal interest rates, public attitudes toward the price level, central bank communication, weaker growth expectations coupled with declining potential growth or the lower natural rate of interest, risk-averse banking behaviours, deregulation in the distribution chain and the rise of emerging economies” as possible factors depressing inflation.[4]

The Federal Reserve Bank of St. Louis (2018) adds to that technological progress, globalisation and demographic transitions [5]. Another factor weighing on inflation might actually be deleveraging. After the bursting of the bubble, the private sector deleveraged, cutting borrowing and spending.[6]

Japan’s main policy rate and inflation (%)

Eurozone’s lessons from Japan – the same causes or only similarities?

By now, an environment of low inflation has also reached the eurozone. It probably is structurally low inflation, driven by globalisation and digitalisation. However, the question is whether Japan-specific factors can help to explain the current low growth and low inflation situation or whether the eurozone and Japan are ‘only’ experiencing similar external factors.

Savings glut, central bank credibility, globalisation, the 1990s and 2000s saw a general decline in inflation and interest rate levels, which go beyond Japanification. But right now, the eurozone is showing similarities with Japan of the early 1990s. A financial crisis turns into an economic crisis, which then turns into a banking crisis, and finally into an existential crisis.

- Leveraging and deleveraging: In fact, the eurozone’s development between 2009 and 2018 has a high degree of Japanification. Government debt increased by more than 25% GDP in Japan during the bust period of the 1990s while in the eurozone, on average it increased by some 20% of GDP. Credit to households on the back of loose monetary policies increased by 7% GDP in the eurozone and by around 9% in Japan. At the same time, however, credit to the corporate sector increased more significantly in the eurozone (+20% GDP) than in Japan (+6% GDP).

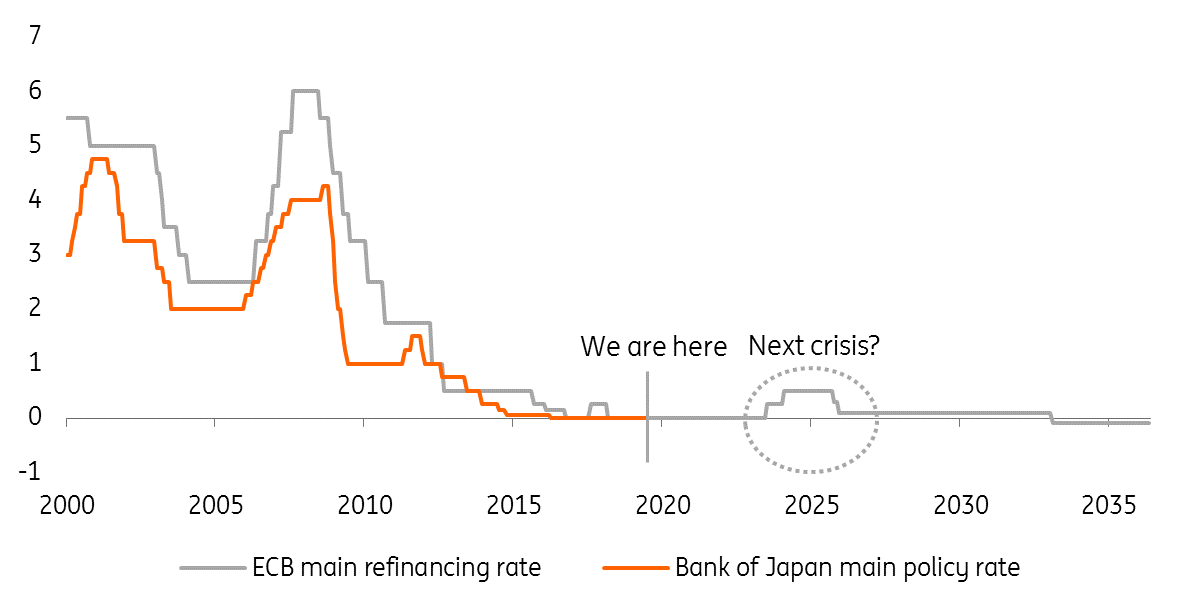

- Central bank action: The Bank of Japan and the European central bank behaved similarly during the crisis years. The BoJ didn't only cut rates to the zero-bound in 1999, it cut interest rates by 600bp in the 1990s while the ECB cut rates by 425 bp. However, the ECB started to use its balance sheet extensively as a policy instrument earlier than the BoJ.

- Financial sector: Both Japanese and eurozone banks accumulated a huge pile of non-performing loans during the crisis years, with Japan’s NPL ratio at 8.4% in 2001 and the eurozone’s NPL ratio at 8.1% during the height of the sovereign debt crisis in 2012. In both countries, the financial sector had to be supported by large capital injections.

- Demographic change: An often-mentioned structural factor for the slowdown of Japan is ageing. In fact, Japan’s working-age population (aged 15-64) has been on a declining trend since the mid-1990s, while the population as a whole started to decline from 2011 onwards. Although the eurozone still has some breathing room, the working-age population is also on a declining trend since 2009.

So why should we care? Because of the next downturn…

While Japan’s experiences in the 1990s were engraving, they are not enough to explain Japan’s prolonged subdued economic growth environment up until today. Timing was not on its side.

The recovery of the Japanese economy was thrown back by three major events: the Asian crisis in 1997/1998, the dot-com bubble burst in 2000/2001 and finally and most importantly the global financial crisis of 2008/2009. Whenever it looked as if the Japanese economy had finally bottomed out, the next external shock came along. With the economy growing by 1.8% on average between 2003 and 2005, the Japanese central bank cautiously raised its main interest rate in July 2006 by 25 basis points to 50 basis points in September 2008.

But then, the financial crisis hit and the hiking cycle was over before it really began.

GDP growth in Japan and inflation (%)

This is an important lesson for the Eurozone: the next crisis can always be just around the corner. Without a strong recovery, it is difficult to escape the low growth, low inflation and subsequently low rates environment. An economic upturn could quickly be over and monetary policy might not have enough ammunition up its sleeve, with interest rates remaining stuck at the zero lower bound for years to come.

Japan's central bank hasn’t raised main interest rate more than 50 basis points for over 24 years now and still has the largest central bank balance sheet measured as a percentage of GDP compared to the US and the eurozone. So, for the eurozone, the most important lesson is probably not so much the root cause of Japanification but the desperate attempts to get out it.

What are the developments the Eurozone could be facing soon?

- Deleveraging of the private sector: Over the last ten years, the balance sheet problems of financial institutions and non-financial corporations have been one of the most important factors keeping the economy subdued for a long period of time, prolonging the subdued inflation environment [7]. Both credit to corporates and households have actually shrunk.

- Ballooning of central bank balance sheet: Over the last ten years, the balance sheet of the BoJ has increased by more than 75% of GDP. In the Eurozone, the ECB’s balance sheet is currently some 18% of GDP bigger than in 2009.

- Fiscal policy to the rescue: Over the last ten years, Japanese government debt increased from 183% GDP in 2008 to 236% in 2018. The fiscal budget has been running deficits for 26 years, implementing countless fiscal packages to stimulate the economy.

- Higher retirement ages: While there has been a drop in the working age population of people aged 15 to 64, older employees and women have remained in or joined the workforce in Japan. Employment in Japan has actually been growing for seven years as the effective retirement age has moved up to close 70. Also, robotics and automation is well-advanced in Japan, keeping GDP per capita at high levels. All of this means that the expected wage-price spiral as a result of a shrinking labour force has never happened. Important lesson for the Eurozone: without these developments or measures, stagnation could easily turn into stagflation.[8]

Economic developments in Japan and the Eurozone

(mean values over respective periods, %)

Why Japanification might be worse for the eurozone than for Japan

Having said all of this, Japanification doesn't have to be a bad thing, instead, it is rather a description of the state of an economy.

Despite Japan’s prolonged period of subdued economic performance, the economy is still the third largest in terms of nominal GDP and is one of the most innovative and digitally conscious economies in the world and thanks to the government’s fiscal packages, Japan continues to enjoy a modern and well-maintained infrastructure. At the same time, however, Japan is also a relatively homogenous society.

On the contrary, in the heterogeneous eurozone, political tensions within and between countries might rise given differing interests, economic developments and the controversial use of fiscal policies among members, making forward-looking reforms more important than ever. Particularly, the discussion about the role of fiscal policy in attempts to stabilise or kick-start the economy clearly have the potential for greater conflicts in the eurozone than in Japan.

For the eurozone, the lessons from the future from Japanification are more important than the lessons from the past. The Japanese experiences show that it will be very hard to actually escape a low growth and low inflation environment without reverting to loose fiscal policies and policies aimed at increasing productivity growth. For the ECB, this means that even looking beyond the short-term horizon with economic and trade uncertainties, the possibility of Fed rate cuts and the ECB’s easing bias, there will not be much room for rate hikes in the coming years.

Main interest rates Eurozone Japan (%)

References

- IMF World economic outlook: tensions from the two-speed recovery, 2001; Nakaso, H., Japan's Economy and the Bank of Japan: Yesterday, Today, and Tomorrow, Speech at the Economic Conference in Tokyo, 2016; Ito, T., Japanization: Is it endemic or epidemic? NBER Working Paper, 2016

- Nakaso, H., The financial crisis in Japan during the 1990s: how the Bank of Japan responded and the lessons learnt, BIS Papers, 2001; Hoshi, T., Kashyap, A., The Japanese Banking Crisis: Where did it come from and how will it end?, NBER Working Paper, 1999.

- Nakaso, H., Evolving Monetary Policy: The Bank of Japan’s Experience, Speech at the Central Banking Seminar, 2017.

- Nishizaki, K., Sekine, T., Ueno, Y., Chronic Deflation in Japan, Bank of Japan Working Paper, 2012.

- Sanchez, J. M., Kim, H. S., Why is inflation so low, https://www.stlouisfed.org/publications/regional-economist/first-quarter-2018/why-inflation-so-low#endnotes

- Borio, C., Low inflation and rising global debt: just a coincidence?, 2018: https://www.bis.org/speeches/sp180802.htm; Kushinov, D., Müller, G. J., Wolf, M., Deleveraging, deflation and depreciation in the euro area, 2015.

- Nakao, T., Japan’s experience with fiscal policy in the 1990s in the aftermath of the bubble economy, 2002.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 June 2019

What’s happening in Australia and the rest of the world? This bundle contains 8 Articles