Eurozone: The ECB takes it slowly

After a strong 2017, political instability and trade tensions within the eurozone are pointing towards more moderate growth rates for 2018

The ECB is looking through mixed messages on the economy

Political tensions have ebbed away, at least for the time being. The eurozone is back to what it does best: muddling through. At the same time, the mist of weakening soft indicators and solid hard data is thickening. While this has increased downside risks for the growth outlook, it did not prevent the ECB from taking a huge step towards the end of quantitative easing (QE).

Economic data released over the last few weeks still leaves policymakers and forecasters a bit in the dark. How strong is the eurozone recovery? As 2017 ended at record highs, with almost endless upward revisions of growth forecasts and a general feeling of europhoria, the middle of 2018 has seen diminished expectations, dented enthusiasm and even concerns about the beginning of the end. The gradual decline of confidence indicators since the start of the year as well as erratic and often disappointing hard data contributed to increased nervousness about the state of the eurozone economy. Soft patch, severe downswing or simply the transition towards normalisation? What is it?

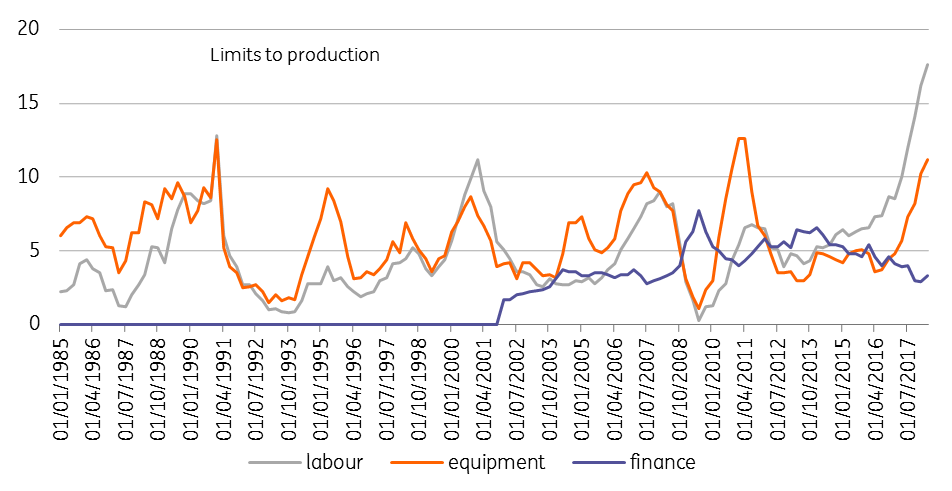

Limits to production

We believe the eurozone is transitioning towards moderate growth rates

In our base case scenario, the eurozone economy is neither on top of the world nor in the depths of despair. It is simply in a transition period towards more moderate growth rates. Despite the gradual decline since the start of the year, the absolute levels of confidence indicators remain high and point to continued solid growth. At the same time, sound domestic fundamentals, low interest rates and the renewed weakening of the euro exchange rate should support the eurozone recovery in the coming months. In fact, there could even be some positive surprises, simply given that expectations have dropped so sharply over the last six months. The bar to a positive surprise has clearly been lowered.

Unfortunately, the downside risks to the growth outlook have increased in recent months. Political tensions in several eurozone countries, fading efforts to further reform the monetary union and trade tensions are the three most prominent potential risk factors.

Politics at centre stage with Italy in the spotlight

Political tensions in Italy and Germany have clearly spooked financial markets. However, the latest developments point to typical European solutions to these tensions: a fudge, soothing short-term fears without fully taking away long-term concerns.

In Italy, the new government has so far avoided a collision course with Europe on fiscal and economic policies. The coalition partners seem to agree on at least keeping the nominal fiscal deficit below 3% of GDP in the coming years. Finance Minister Giovanni Tria suggested that the structural fiscal deficit would not worsen significantly in the near term. At the same time, however, let’s not forget that Prime Minister Giuseppe Conte had already promised to implement both a flat tax of two rates and a guaranteed income of €780 per month. It remains to be seen how these two measures can be moulded into a budget plan which stays within the boundaries of Europe’s fiscal rules. Here, things could heat up again after the summer.

Migration continues to dominate German politics

In Germany, the tensions on how to deal with migrants almost led to a collapse of the government. Even though Chancellor Angela Merkel made first steps towards a European solution at the last European Summit, the Bavarian sister party CSU pushed for more concessions. By announcing possible transit zones for asylum seekers, the German government seems to have avoided a full-fledged government crisis. However, trust within the government has taken a severe hit and tensions could easily flare up again at any time, on almost any topic.

The political instability in Germany will make it even harder for eurozone leaders to agree on anything substantial with respect to further eurozone reforms any time soon. While France and Germany seem to have found some common ground, even including a budget line for the eurozone, other governments are extremely reluctant to agree on anything that only remotely smells like transfers. Consequently, beyond making the European Stability Mechanism (ESM) a financial backstop for bank resolutions, it is hard to see how the eurozone will become more integrated in the coming years.

Trade tensions increase our nervousness on the economic outlook

Finally, a further escalation of the trade tensions hangs like a Damocles sword over the growth outlook for the eurozone. Even though the direct impact from a further escalation should be manageable (the Ifo institute estimates that 25% import tariffs on European cars could lower eurozone GDP by less than 0.1%) and even be offset by the weaker euro exchange rate, the pure impact on confidence could hit the eurozone already in the coming months.

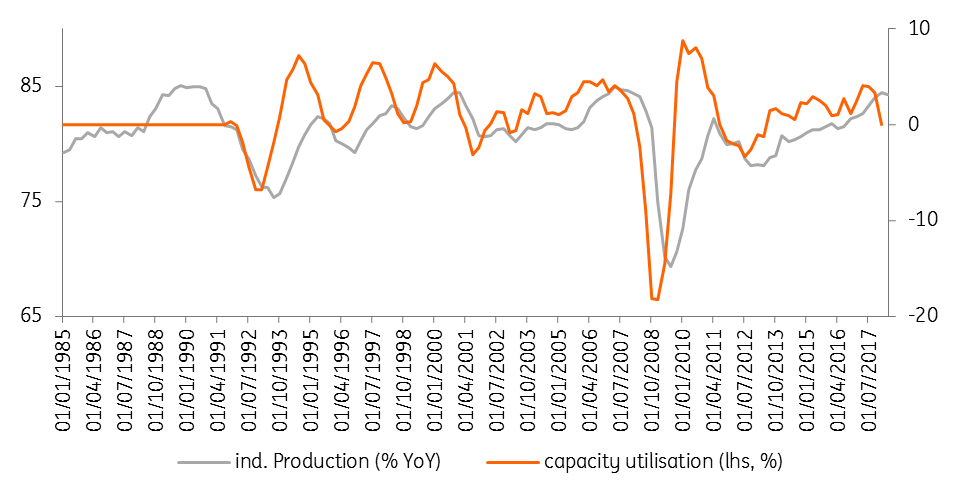

Production and capacity utilisation

Nonetheless, the ECB seems intent on concluding its QE programme

Unless any of the above risks actually materialise into a tangible and significant downswing of the economy, the ECB looks determined to bring its QE programme to a conclusion at the end of the year. The announcement after the June meeting that the ECB anticipates a lowering of the monthly purchases from €30 billion to €15 billion after September and an end of the net purchases in December delivered a very clear message.

At the same time, however, the ECB has started to put more emphasis on its forward guidance, stating that it expects interest rates “to remain at their present levels at least through the summer of 2019”. It is obvious that the ECB would like to return to interest rates, instead of QE, as the main policy instrument. Against the background of only a very gradual increase in core inflation and growth remaining close to, but probably below, potential, we expect the ECB to first hike the deposit rate and then the refi rate before the end of 2019. A very dovish ‘tapering’…

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

EurozoneDownload

Download article

6 July 2018

Global Economic Outlook: Trump’s Trade Gamble This bundle contains 7 Articles