Eurozone: Tentative green shoots

First-quarter Eurozone growth was weak, but March data seems to suggest a rebound is in the offing. With improving consumer sentiment and international trade off lows, the second quarter could come a bit stronger, provided that a ‘hard Brexit’ is avoided

The first quarter saw hardly any acceleration in eurozone growth momentum. Although economic indicators have been equivocal lately, we see sufficient reason to expect a stronger second quarter, unless a sudden shock would hit the economy.

It has been a rather difficult month for economic pundits. A number of indicators have been rather disappointing. Both the composite PMI and the European Commission’s economic sentiment indicator fell unexpectedly in March, with the services sector now also weakening. In that regard, the weaker global environment and slowing international trade, that had already hit the manufacturing sector in the course of 2018, is now seemingly starting to have second-round effects on the services sector.

However, this rather sober assessment does not chime with a number of national economic sentiment indicators. Both the French INSEE indicator and the German IFO indicator improved in March, with the services sector actually doing very well in Germany.

What to make of this? The contradictory data at least suggests that it is certainly too soon to pencil in a strong upturn. But at the same time, there are some green shoots, suggesting that even manufacturing is likely to bottom out. The DHL global trade indicator signalled a mild improvement in international trade for Germany in March.

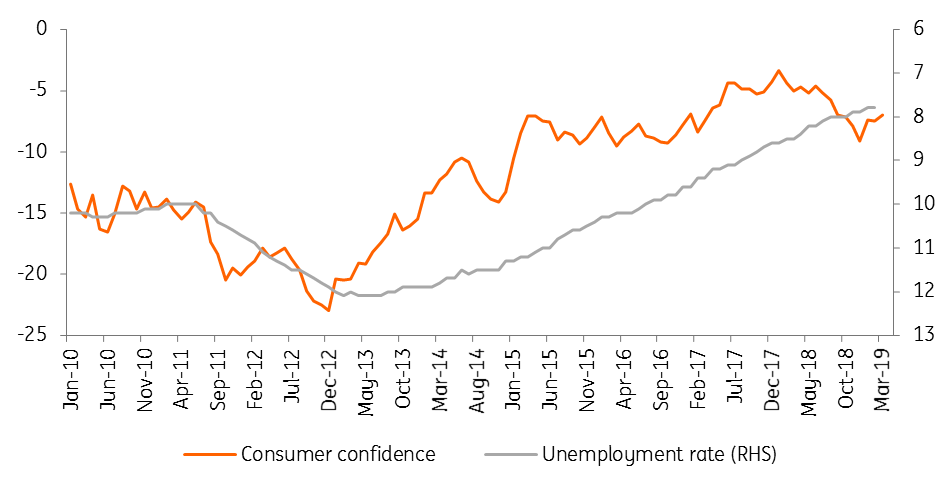

At the same time, domestic demand is still supported by growing employment and the gentle upward trend in wages. In March the European consumer showed himself rather upbeat about his household finances over the next 12 months, which bodes well for consumption.

Eurozone consumer more upbeat again

Also, bear in mind that fiscal policy is slightly more expansionary this year compared to previous years. In that regard we continue to expect some growth acceleration in the second quarter, resulting in 1.2% for the whole of the year. For next year we currently forecast the same growth rate, which is clearly below the ECB’s expectation for 2020 (1.6% GDP growth).

Of course, Brexit remains the elephant in the room. If a hard Brexit were to materialise over the next few weeks, then we can forget about a growth pick-up. It looks quite likely that a hard Brexit would strongly distort trade flows and international value chains. Also, depending on the financial markets and confidence impact, annual GDP growth could be cut by 0.3 percentage points, with the biggest impact in the second and third quarters.

A hard Brexit could cost 0.3 percentage points of growth

Another potential worry is the political situation in Italy. On the back of the recession, there is clearly a deterioration in the budget deficit which will have to be addressed in the course of the year. As we think that Lega will win big at the European parliamentary elections, with 5star losing, we don’t exclude elections just after the summer. This would imply that the current government would not have to decide on the more difficult budget for 2020, which would probably result in a further deterioration of public finances.

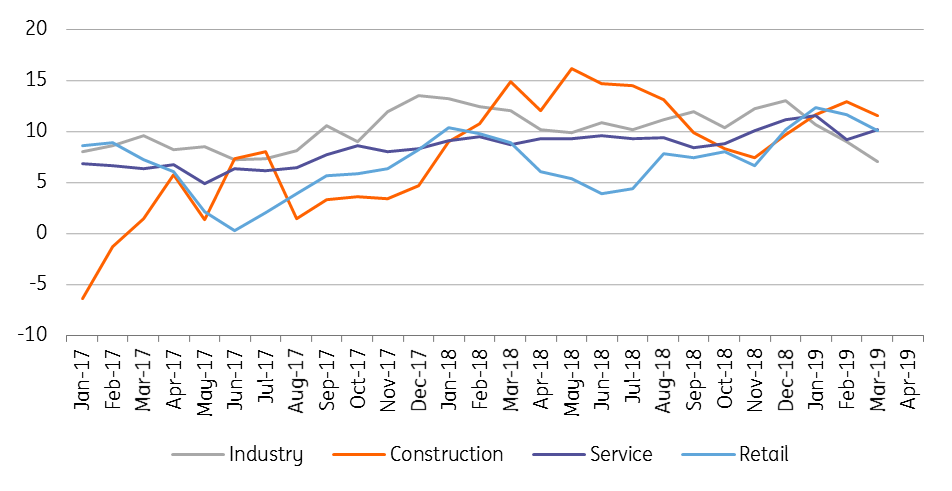

In a recent speech Mario Draghi, the president of the ECB, remained confident that the inflation would pick up. However, survey results are still ambiguous. Selling price expectations increased in services in March, but remained stable in retail trade, while they strongly declined in construction and industry. Consumer price expectations also fell in March. And although the late Easter has distorted inflation figures, one cannot deny that core inflation currently remains below 1%.

We therefore downgraded our inflation forecasts to 1.2% in 2019 and 1.6% in 2020. We wouldn’t be surprised if headline inflation fell temporarily below 1% in the course of this year.

Price expectations moving sideways

All of this explains why the ECB will want to keep in place sufficient accommodation. The discussion surrounding monetary policy is now even starting to focus on the question of whether the ECB will still have some ammunition, should the expansion come to a standstill. Off course there are the new TLTROs. The ECB conveniently hasn’t announced the conditions yet, and according to chief economist Peter Praet, this will only happen in June, which gives the ECB still some time to assess the economic developments. The interest rate will likely be generous if in the meantime the economy slows further.

Another issue that created some excitement in the markets was Mario Draghi’s remark that the ECB would monitor the banks’ health in the wake of compressed interest margins. This opens the possibility of a two-tier system for excess liquidity, which would neutralise a part of the side-effects of the negative interest rate policy. However, we would caution against any premature expectation for this to happen. As a matter of fact, it's only likely to be put in place if the ECB would be forced to cut negative rates even further in the wake of adverse economic developments.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 April 2019

April Economic Update: Cheer up! The gloom is mostly set to fade This bundle contains 8 Articles