The eurozone’s been saved, in part, by the weather

The significant fall in natural gas prices has probably sheltered the eurozone from a winter recession, though there are still some headwinds that will keep growth subdued in 2023. Sticky core inflation is likely to keep the European Central Bank in tightening mode in the first half of the year

Sentiment is improving

Looking at recent economic sentiment indicators and the stock market rally in Europe, it looks as if the projected winter recession is not happening after all. Eurozone GDP surprisingly grew by 0.1% in the fourth quarter of 2022. Meanwhile, the composite PMI has been creeping up since November to reach 50.2 in January, a level that can no longer be associated with an economic contraction. At the same time, consumer confidence rose for the fourth consecutive month after having reached a historic low in September.

Much of the improvement in sentiment is, of course, attributable to the significant fall in natural gas prices. With inventories still close to record highs on the back of the relatively mild winter, natural gas prices have nose-dived and are back at pre-war levels. While we don’t believe that they will remain so low, they probably won’t return to the growth-choking levels that we saw in the autumn of 2022. Another tailwind is the opening up of the Chinese economy, which is likely to support eurozone exports in the coming quarters, although this might be partially compensated by a weaker US economy.

Not all headwinds have disappeared, however

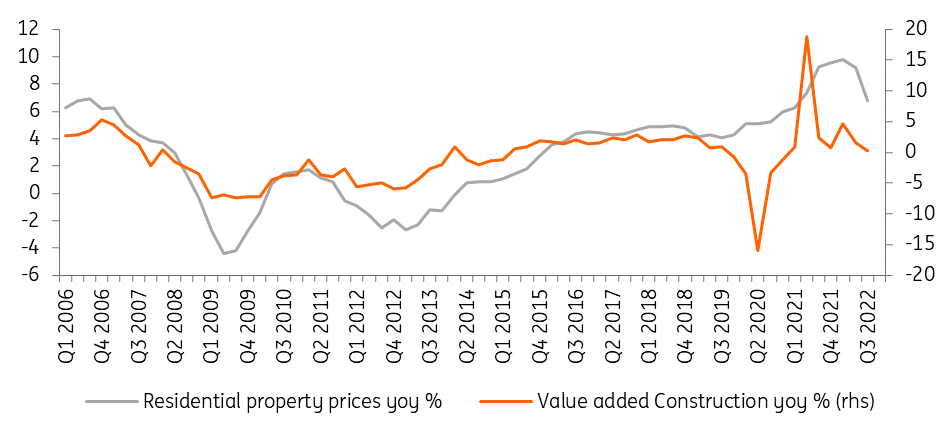

So, no worries then? Not so fast. While consumption is less depressed, it is far from strong. Because of weak demand, there is an inventory overhang in many sectors that might weigh on production in the short run. The ongoing ECB tightening cycle is wreaking havoc on the real estate market, and construction is also likely to feel the pain. The signs are already apparent in the weak credit growth figures in December and the downbeat bank lending survey, while house prices have started to fall in a number of member states.

While the current growth deceleration may lead to barely any weakening in the (tight) labour market, the corollary is that the subsequent upturn will not benefit from rapidly growing employment. We also think that fiscal policy will become tighter in the wake of the still-high budget deficits. The bottom line is that we are revising our growth forecast upwards to 0.6% for this year, but for 2024 we are sticking to the 1.1% growth projection.

Higher interest rates will weigh on the housing market and construction sector

Inflation problems not over yet

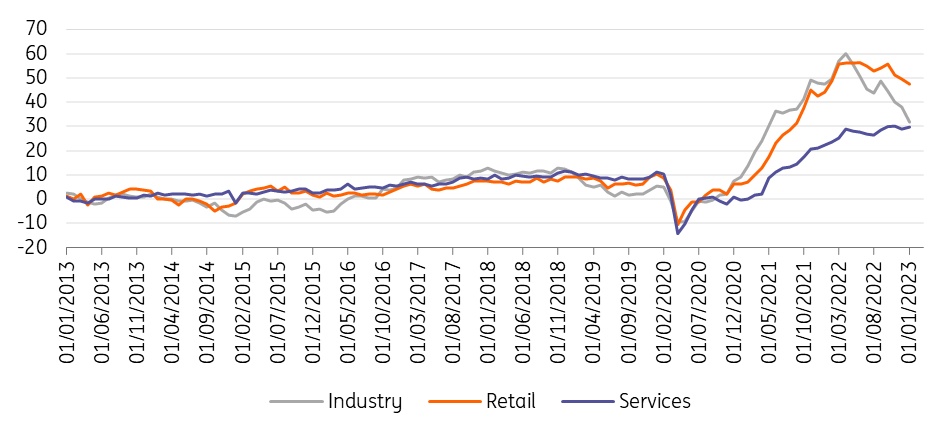

HICP headline inflation fell in January to 8.5% on the back of the lower energy prices. However, core inflation remained stuck at 5.2%. Looking at the business surveys, intentions to raise prices in the coming months remain high. You might even say that less adverse economic circumstances contribute positively to businesses' pricing power, especially in the services sector. We now expect average headline inflation of 5.7% in 2023, while core inflation is projected to average 4.6% over the year. A return to the ECB’s 2% inflation objective will probably have to wait until the fourth quarter of 2024.

Selling price expectations remain high

More monetary tightening to come

A 50 basis point rate hike both in February and March now looks like a done deal. The question is how much more tightening the ECB will add after that. While we anticipated a final 25bp rate hike in May, we must admit that the probability of an additional 25bp tightening is increasing by the day. At the same time the bank might also decide to increase the amount of maturing bonds that will no longer be reinvested in the second half of the year. As for a first rate cut, we probably will have to wait until the end of 2024 at the earliest.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 February 2023

ING’s February Monthly: This could well be a ‘fool’s spring’ This bundle contains 12 Articles