Eurozone: Reality check

Growth expectations had become too optimistic though weaker 1Q growth is partially due to one-offs

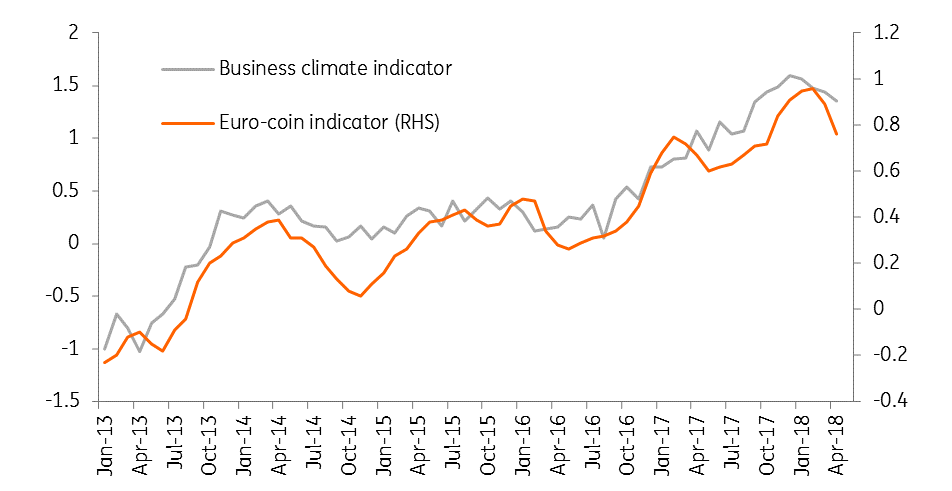

Growth is strong, but no longer accelerating

In 2017, the Eurozone surprised the markets to the point that expectations for 2018 were scaled up continually. However, news since the beginning of the year has brought back some realism. As we have already signalled, peak growth for the Eurozone now seems behind us, though the first quarter could have been slightly stronger if there hadn’t been a number of one-off effects. At the same time, core inflation has unexpectedly fallen back to only 0.7%, which increases the probability that monetary policy will stay loose for longer than markets had anticipated.

First quarter GDP growth came in at 0.4% quarter-on-quarter, a clear slowdown from the 0.7% pace seen in the last quarter of 2017. There have certainly been one-off effects dragging down growth. An unusual cold spell in March might have affected construction activity negatively in the first quarter, while the flu epidemic probably also hurt activity. Apart from that, strikes in Germany and the timing of the Easter holiday had a dampening effect.

Cutting back our growth forecast

High oil prices which turned out to be more persistent than we anticipated, probably weighed on consumption. While some of these elements are bound to disappear, it’s not as if the first indicators for the second quarter point towards an acceleration of the growth pace. Some of the more forward-looking components of the confidence indicators, like new orders, have softened signalling that a somewhat slower cruising speed seems a more realistic assessment or that it could take a bit longer before a rebound emerges. Taking all of this into account, we’ve decided to cut our growth forecast for 2018 to 2.2% from 2.4% and to 1.8% from 1.9% for 2019.

On the political front, the news is not really encouraging either. The French president continues to struggle with protests at home against his reform plans, while his ambitious agenda for Eurozone reform doesn’t resonate much with the new German government. In Italy, we are now at the point that new elections have (almost) become inevitable, only prolonging the stalemate. While Greece has been over-performing in terms of budget consolidation, there has been no decision on further debt relief, though we still see it likely before the programme ends in August. According to recent reports, Greece could still fall short of implementing all required measures before exiting the bailout.

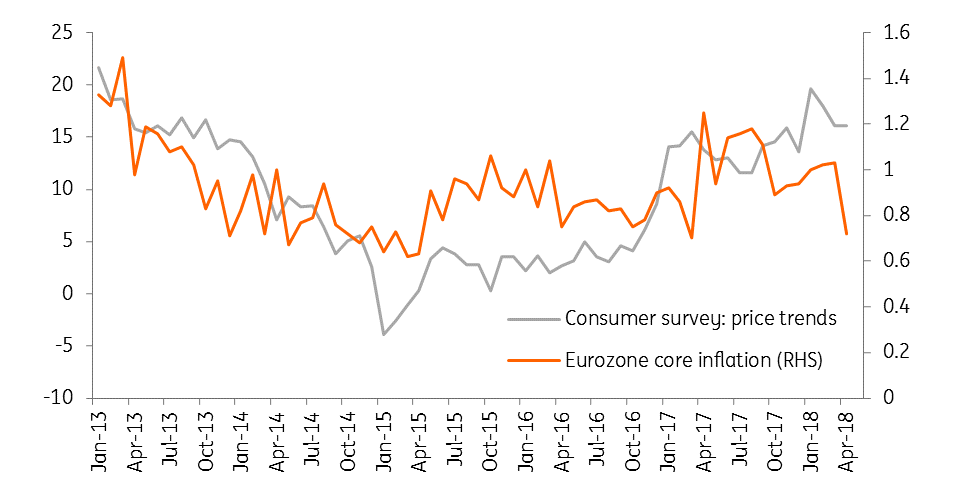

Inflation falls back more than expected

From an economic point of view, the real shocker was the inflation report for April, with core inflation falling back to 0.7%. To be sure, some decline was expected because of the early Easter holidays, which drove up prices in March. But if we take the average of March and April to correct for this distortion, we still end up with core inflation below 1.0%.

Inflation is still going nowhere

Even if higher oil prices and the somewhat weaker euro could lead to higher headline inflation forecasts for 2018 and 2019 in the next ECB staff projections in June, it remains clear that the ECB’s Governing Council expectation that inflation will sustainably converge to target in the medium run is ambitious. Actually, the minutes of the most recent meetings of the Governing Council show that the Council members themselves see plenty of reasons why inflation might undershoot.

Timing of first rate hike delayed

In this regard, we believe that even though the net purchase of bonds might still end in December, the probability of a rate hike in June 2019 is getting smaller. We now think that a first rate hike will have to wait until September 2019. At the same time, the ECB is likely to put more emphasis on the reinvestment programme of maturing bonds. Given the fact that the Bank has been closely monitoring the unwinding of the QE programme in the US, it seems likely that the ECB will keep its reinvestment programme in place for another three years after the end of net purchases.

Interestingly, the ECB staff has tried to quantify the impact of its unconventional policy on the 10yr bond yield. For 2018, this drags down long yields by about 110bp. For 2021, the ECB still sees a downward impact of about 75bp, meaning that the upward pressure of the unwinding of QE will only be very gradual.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

ING’s May Economic Update This bundle contains 8 Articles