Eurozone: Finally, ready for take-off

With the accelerated reopening of the economy, the eurozone is heading for a strong upturn. While price increases are grabbing headlines, core inflation remains subdued. Although the European Central Bank is in wait-and-see mode, we think the PEPP is unlikely to be lengthened beyond March 2022, but too strong a drop in bond purchases will be avoided

Open for business

With vaccination rates rising steadily, Covid-19 infection rates are falling rapidly, leading many European governments to reopen the economy.

As parts of the economy that were partially closed begin to reopen, the second quarter should show decent growth. On top of that, European Union member states are putting schemes in place that should allow for a better tourist season this year, although we don’t expect things to go back to 2019 levels just yet. There are indeed supply disruptions in several manufacturing sectors that are hampering production, but this will probably be compensated by the robust activity in services sectors.

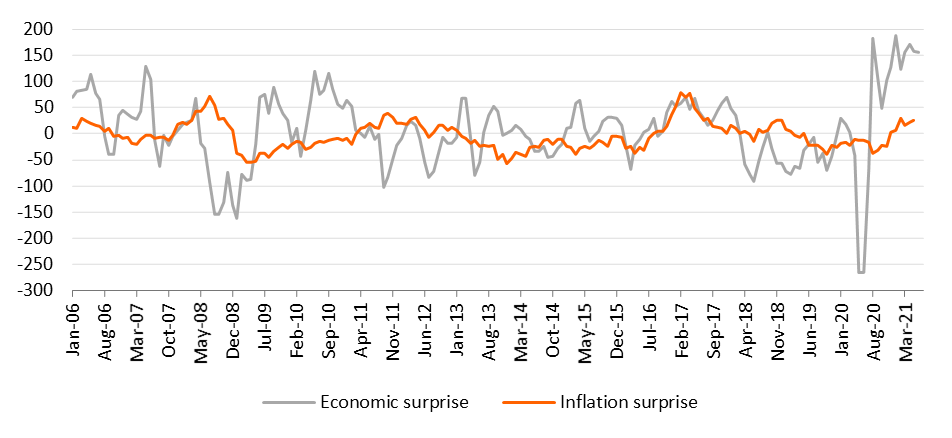

Economic and inflation surprise index

Reasons to be cheerful

There is still very little hard data for the second quarter, apart from disappointing April eurozone retail sales in April and a weak German industrial production reading. But then again, April was a month of tighter lockdown measures.

In May, the sentiment indicator in the retail sector rose to the highest level since December 2019, probably reflecting healthy consumption growth. The same goes for most recent confidence indicators, like the PMI or the European Commission’s economic sentiment indicator - all showing strong readings for May. Admittedly, in extreme circumstances, these indicators, mostly based on a balance of opinion between optimists and pessimists, should be interpreted with some caution, but it seems safe to say that the recovery is gaining speed.

We are now looking at 4.4% growth this year and 4.0% next year

There might be some concern that unemployment might rise again once the furlough schemes end, but we believe that this effect will remain limited. Hiring intentions are strong, and employers are already beginning to complain about labour shortages in many subsectors. The unemployment rate is more likely to rise because people are returning to the labour market enticed by better job prospects. When forecasting eurozone GDP prospects, we have been disappointed many times, but now we think there are genuine reasons to be cheerful.

Considering the upward revision of GDP growth in 1Q, we are now looking at 4.4% growth this year and 4.0% next year, with a balanced risk profile around these forecasts.

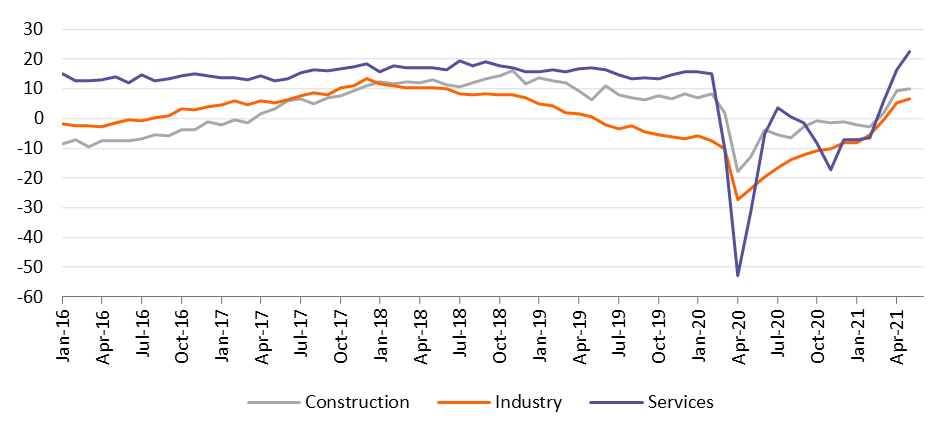

Employment expectations improve

The inflation riddle

The bigger debate is on the inflation outlook. While the flash estimate of the HICP inflation rate came in at 2.0% in May, this was largely an energy story, as core inflation was only 0.9%. To be sure, the commodity scarcity and supply chain disruptions are front-page stories, but this does not necessarily have a direct impact on consumer prices.

According to PMI surveys, the upward price pressures are still more upstream in sectors like chemicals, forestry, machinery and engineering, while most sectors closer to the consumer report more subdued price increases. Moreover, the biggest part of the cost base for most companies is wages, and we don’t see much happening there just yet.

Moreover, over the next 12 to 18 months, we expect a pick-up in productivity, keeping unit labour costs at bay. To be sure, the opening of the economy and the current supply chain problems will lead to higher inflation over the course of this year. Still, those price increases are unlikely to be repeated to the same extent in 2022, which will lead to some moderation next year. In the course of 2023, a tightening labour market might gradually start to cause upward wage pressure, but even then, we don’t expect core inflation to settle above 2%.

The waiting game

The ECB is still in wait-and-see mode.

As we've said before, the Pandemic Emergency Purchase Programme is unlikely to be extended beyond March 2022, though we expect the ECB to increase purchases under the Asset Purchase Programme to €40-50 billion a month to achieve a more gradual decline in bond purchases. In this scenario bond yields are expected to slowly increase.

We expect the 10-year Bund yield to reach 0.5% by the end of 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 June 2021

ING Monthly Update: Looking for freedom This bundle contains 14 Articles