Portugal: On track for another good year

The government continues to focus on reducing public debt and the deficit however strong house price growth is becoming a concern. We expect the economy to continue to perform well in 2018, although growth will be slower than last year and forecast annual growth of 2.1% in 2018 and 1.8% in 2019

The discussion about the 2019 budget is ongoing, but it seems the Portuguese government continues to focus on limiting the budget deficit and public debt.

The prime minister António Costa recently said the country should continue to do this to protect itself from external risks, such as a further escalation of the US-China trade war. In 2017, the Portuguese government debt in terms of GDP was the third highest in the Eurozone (125.7%), after Italy (131.8%) and Greece (178.6%). Costa recently said that the aim for 2019 is a deficit of 0.2% of GDP, which is even lower than last year’s 0.9% excluding the one-offs such as the recapitalisation of the public bank Caixa Geral de Depósitos.

The draft budget is expected to be given to the parliament and the European Commission by 15th of October, after which it will be discussed in parliament, while the vote on the bill would take place at the end of November.

In 2017, the Portuguese government debt in terms of GDP was the third highest in the Eurozone (125.7%), after Italy (131.8%) and Greece (178.6%)

In the second quarter, the economy grew by 2.3% year on year, compared to 2.1% in the first quarter. Like the first quarter, net exports contributed negatively to growth, but domestic demand, and in particular consumption and investment, more than compensated. Consumption remains supported by a strong labour market. The unemployment rate continues to drop sharply and reached 6.8% in July. Employment growth has been declining since the beginning of the year but managed to stay above 2%. Soft data, such as consumer confidence and the Economic Sentiment Indicator (ESI) remain at high levels.

The unemployment rate continues to drop sharply and reached 6.8% in July

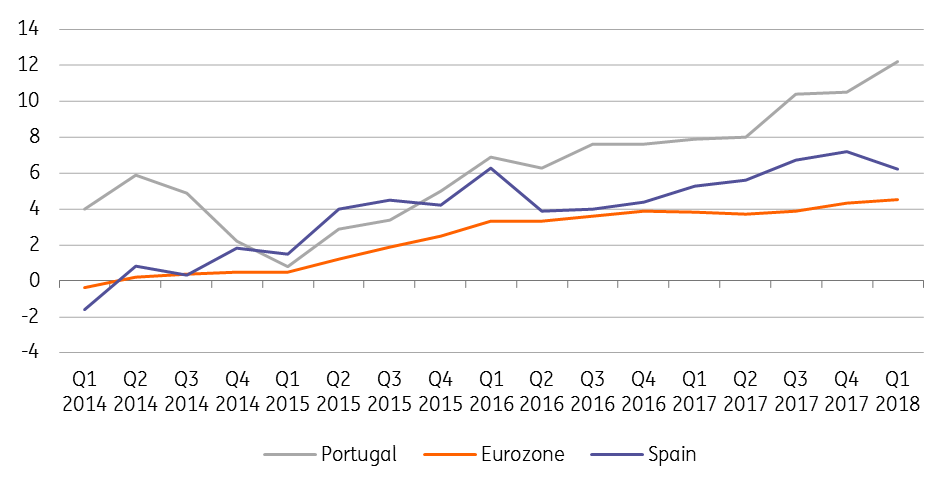

One issue that gets more and more attention is the sharp increase in house prices, which have been accelerating since early 2015 and reached 12.2% in the first quarter of 2018. This is almost twice as fast than Spain and three times as fast as the Eurozone. The strong growth rate is caused by surging domestic and foreign demand, while supply cannot keep up.

The government could take some measures in its 2019 budget to alleviate the pressure, for example curbing foreign demand by adjusted programs such as the golden visa and the non-habitual regime. However, the prime minister has recently announced that people who return to Portugal in 2019 and 2020 could get a reduction in income tax and discounts on their return trip and housing, which is likely to further exacerbate the problem.

House price growth accelerates

We expect the Portuguese economy to continue performing well in 2018, although growth will be slower than last year. We forecast an annual growth rate of 2.1% in 2018 and 1.8% in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains 13 Articles