Italy: Budget test for the 5SM/League government

The inconsistencies between a challenging 5SM/League attitude on budgetary issues and finance minister Tria’s reassuring statements finally seem close to a solution. The compromise will unlikely be able to shift a gear in the current modest recovery, but we still expect the Italian economy to expand by 1.1% in 2018 and by 1% in 2019

Unconventional governance for an unprecedented government

The first three months of prime minister Giuseppe Conte's government, backed by the unprecedented alliance between the Five Star Movement and the Northern League, have been unconventional.

Matteo Salvini and Luigi Di Maio, the leaders of the two parties which signed the government “contract”, have been continuously holding the scene, while prime minister Conte has played the role of the incidental notary, settling disputes when deemed necessary.

Salvini, the interior minister, set the scene on the migrant's issue, often challenging the European Union and European partners on burden sharing instances. While Di Maio, one of Italy's two deputy prime ministers and in charge of both economic development and the labour and welfare ministries, concentrated mostly on labour-related issues and has so far managed to gain parliament's approval to tighten labour laws and curb temporary job contracts.

Fiery rhetoric spooks markets

The duo's challenging rhetoric on budgetary issues is in apparent contradiction with the reassuring statements coming from the finance minister Giovanni Tria and has been a cause of concern for markets during the entire summer.

Market pressure and the outlook downgrade by the credit rating agency Fitch at the end of August apparently had an effect on Salvini’s and Di Maio’s stances, and, as a consequence, on PM Conte. More recently, they radically changed their tones, professing their commitment to approve a budget which will introduce pro-growth measures while respecting European fiscal rules.

Tria now talking about a piecemeal approach to promises

Subsequent refinements by Tria and EU Commission representatives seemed to point to a possible agreement foreseeing some form of structural adjustment and a decline in the debt to GDP ratio in 2019.

Matching this with the reiterated commitment to start implementing economic electoral agenda pledges, i.e. the flat tax, universal basic income and softening the strict pension rules introduced by the Monti government (the so-called Fornero reform) will prove challenging.

As all of this will add to the promise to sterilise the €12.4 billion worth of value-added tax increases budgeted for 2019, it is no surprise that minister Tria and, importantly, PM Conte have recently referred to these three themes as an objective for the entire legislature, de facto anticipating a piecemeal approach.

Headline deficit target for 2019 due no later than 27 September

With negotiations between Salvini, Di Maio and Tria still ongoing, we still lack a precise indication on the target headline deficit numbers which will be put black-on-white in the updating note to the DEF, the economic and financial document which sets the macro framework to the following budget law.

The deadline for publication is 27 September, that of the submission of the draft budget law to the EU Commission is 15 October. If domestic political considerations push the fiscal slippage above what minister Tria would like, we still believe the deficit/GDP target would at most be set slightly above the 2% mark. Political opportunity considerations given the 2019 European Parliament elections might induce the Commission not to take a rigid stance on Italy.

Meanwhile the economy remains in a soft growth spell

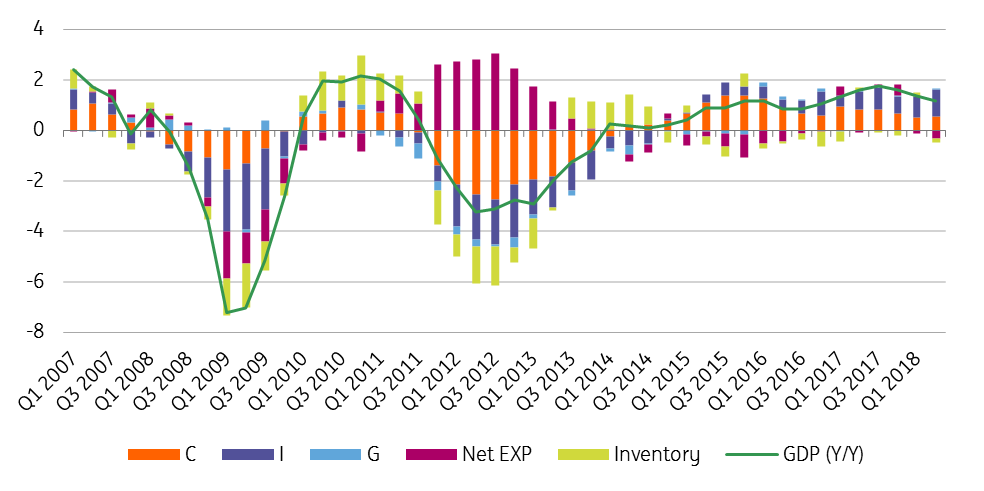

The discussion on the Italian budget comes at a time when the Italian economy is experiencing a prolonged soft spell, well anticipated by soft confidence data.

Having expanded by 0.3% quarter on quarter in 1Q18, GDP growth slowed to 0.2% QoQ in 2Q18, driven by domestic demand. Interestingly, the main driver turned out to be private investments, which contributed 0.5% to quarterly growth on the back of strong machinery and plant and transport equipment components. Inventories contributed another 0.2%, and national consumption added a meager 0.1%.

As expected, net exports were a drag, subtracting 0.5% from growth, on the back of softening exports and sharply increasing imports. Soft consumption was a bit of a surprise, given the underlying developments in the labour market.

Domestic demand driven recovery slowing down

Confidence data point to no acceleration in 3Q18

Looking forward, we believe the soft growth spell might continue into 3Q18.

In August the composite index of business confidence set a new 18-month low, driven by a soft manufacturing component, which confirmed a weak spot. The marked decline in orders in the investment goods producers aggregate was particularly worrying, as it seems to dim hopes of an acceleration in investment activity in the last part of 2018.

To be sure, given the uncertainty surrounding the future fiscal stance of the League/5SM government, a prudent investment strategy with domestic businesses was far from surprising at the time the survey was run. The relevant PMI reading confirmed manufacturing softness at 50.1, which was consistent with near stagnation. Business confidence turned soft-ish also in the market service sectors aggregate, while it edged up with retailers and in the construction sector.

Manufacturing PMI close to contraction territory

Private consumption more resilient on favourable disposable income

The small decline in consumer confidence isn't a reason for concern for the time being. It remains close to recent highs and looks backed by recent developments in the labour market.

The July labour market report, the first batch of hard data on 3Q18 confirmed positive, with an unexpected decline in the unemployment rate to 10.4%, admittedly resulting from a contraction in the labour force rather than from new job creation. When read in conjunction with accelerating June hourly wages data, labour market data point to a possible marginal improvement for private consumption over 2H18.

All in all, we expect the Italian economy to expand by 1.1% in 2018 and by 1% in 2019.

The Italian economy in a nutshell (% YoY)

Download

Download article17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more