Eurozone: Italian turmoil returns

With a proposal to refrain from any deficit reduction over the next three years, the Italian government has put the markets on high alert again. We still believe that a compromise with the European Commission can be found, but the lack of further Eurozone integration means that this kind of tension will return

The budget situation has put markets on high alert

The Italian government's decision to deviate from last fiscal year’s stability program was more or less anticipated, but the scope and, more importantly, the persistence of the deviation is a reason for concern. Where until recently it was assumed that the target deficit for 2019 could be set at just below 2% of GDP and that the subsequent decline would be slower than agreed by the previous government, the current Italian government announced a deficit of 2.4% for three years in a row. With a debt-to-GDP-ratio above 130%, this clearly increases risks to medium-term debt sustainability.

While the fine print of the deal isn’t clear yet, the European Commission is unlikely to accept this without any alterations

On top of that, credit rating agencies will be tempted to cut Italy’s rating. Of course, the current proposal is not necessarily going to be the outcome (it seems that the Italian government is already backtracking a bit), but markets have been put on high alert as the 10-year bond spread with Germany climbed above 300 basis points.

We believe that the European Commission, while not playing hardball, is going to try to direct the Italian spending plans to the most productive expenditures, finding a balance between giving Italy some leeway to boost economic growth, while at the same time keeping debt sustainability in mind and an outcome might have to wait until December.

| 2.4% |

Proposed Italian budget deficit for the next three years |

The politics in Europe is hardly conducive to a stronger monetary union

Although we don’t think we’ll see extreme tensions in the Eurozone, but at this point, political developments in Europe are hardly conducive to a stronger monetary union.

Indeed, the German chancellor Angela Merkel is clearly weakened, and elections in Bavaria might put further pressure on the current coalition while the popularity of the French President Emmanuel Macron has dived. And unfortunately, European leaders have been devoting a lot of time to the Brexit puzzle and immigration problems, leaving little time to make the Eurozone structurally stronger.

The cohesion of the monetary union might once again be tested when the next downturn comes

So while the current stand-off between the Italian government and the European Commission might end in a draw, things could get even more difficult next year, especially if the Italian government feels vindicated by strong results in the European elections.

We, therefore, remain wary of the situation in Italy, even if things (temporarily) cool down a bit before the end of the year.

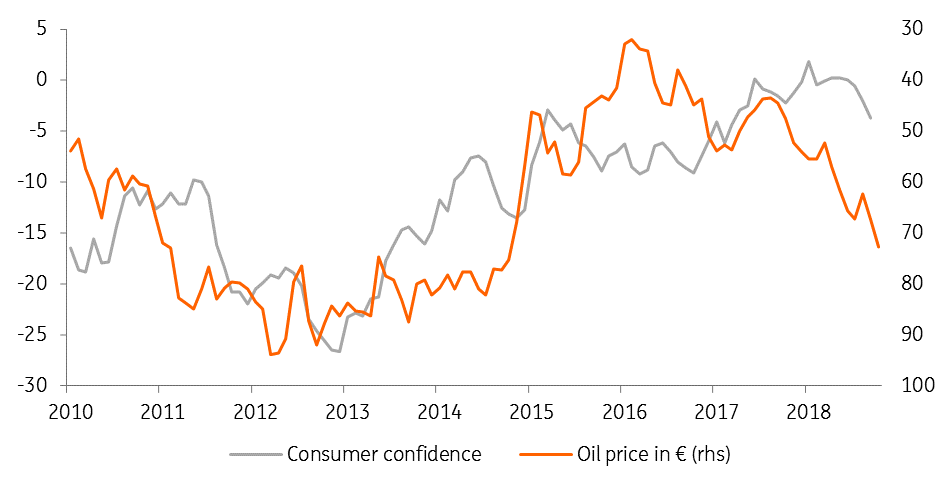

Higher oil prices sap purchasing power

The market turmoil comes at a time when the Eurozone expansion is already showing some signs of tiring. The European Commission’s economic sentiment indicator fell in September for the ninth month in a row. To be sure, at 110.9, the level is still comfortably above the long-term average, but it is somewhat worrying that consumer confidence has been falling back over the summer months.

The rise in energy prices might be one of the culprits, but apparently, the confidence in the job market has taken a hit, despite the falling unemployment rate. Of course, every expansion goes through soft patches, and the overall environment still looks OK. The Eurocoin indicator, which tracks the underlying quarterly growth pace of the Eurozone, actually increased in September to 0.52%. But as we’ve said before - the best of the expansion is now behind us, and we feel that the downward risks to the outlook have clearly increased.

The 2.1% headline inflation in September remains an oil story largely. Energy prices increased 9.5% YoY on the back of higher oil prices. Looking at the oil price dynamics over the past 12 months to assess the base effects, it’s very likely that energy will continue to keep headline inflation close to 2% for some time to come.

Rising inflation remains an oil story

However, the European Central Bank looks through these temporary effects and pays more attention to the underlying price dynamics.

ECB president Mario Draghi recently mentioned his belief in a 'relatively vigorous' pick-up in core inflation on the back of tightening labour market conditions. But in September, underlying inflation actually fell back to 0.9%. The fact that services price inflation, which typically has a substantial wage component, remains at 1.3% is a testament to the fact that tight labour conditions are not creating much inflation for the time being. We only expect a painfully slow upward trend in core inflation.

We still believe the ECB will try to abandon of negative interest rates by the end of 2019. However, with the global economy likely to slow, the scope for further rate hikes remains limited.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains 8 Articles