Why the ECB has little to fear from inflation divergence in the eurozone

Inflation differences in the eurozone keep on mounting. But what was a problem for the European Central Bank in the past can almost be ignored right now. The ECB’s ‘one-size-fits-all’ policy currently suits better than before

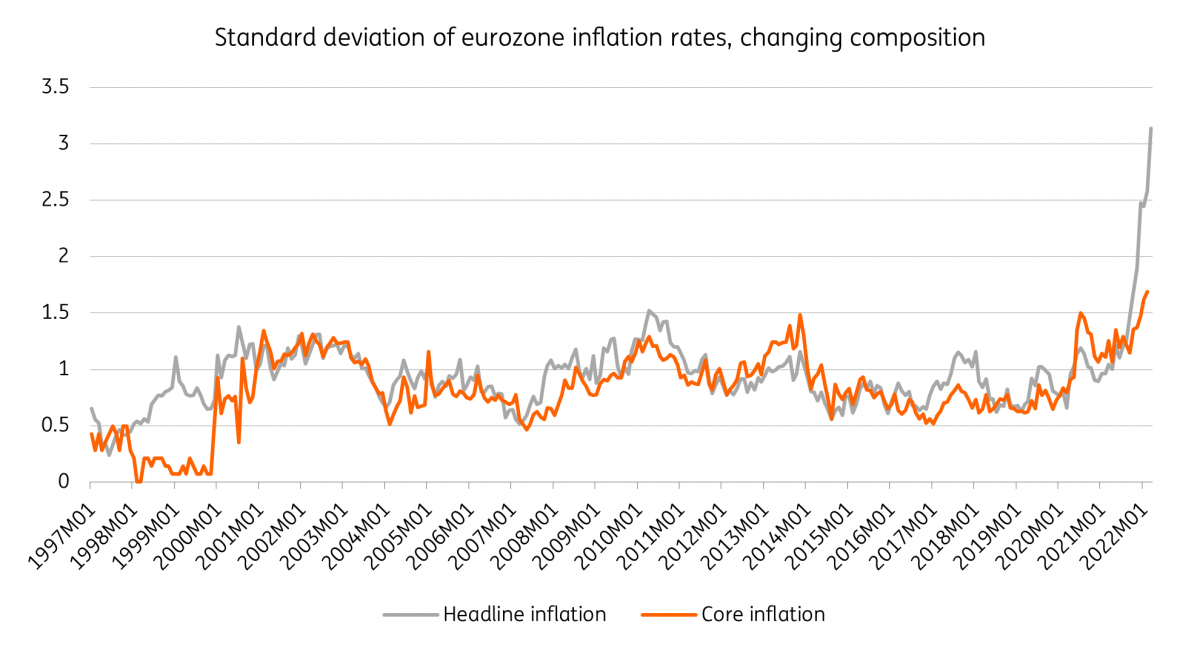

A few weeks ago, we wrote about how the divergence in inflation between countries in the eurozone is not a problem for the ECB. Since then, differences have become even more apparent now that we have seen another spike in inflation. In fact, March headline inflation ranged from 4.6% in Malta up to 15.6% in Lithuania. Measured in standard deviation, inflation divergence in the eurozone has never been higher than it is now.

In the past, inflation divergence was an additional problem for the ECB as it complicated its ‘one-size-fits-all’ policy. In fact, this problem occurred mainly in the first years of the monetary union when monetary policy was too loose for high inflation and catching-up economies, such as Spain and Ireland, eventually leading to asset bubbles. Since the financial crisis, monetary policy was often too loose for a country like Germany but partly still too tight for countries going through structural adjustments. Now, we have to consider whether much higher inflation divergence than in the past could once again complicate the ECB’s life.

Divergence in inflation between countries has only increased

Energy inflation still dominant in driving inflation differences

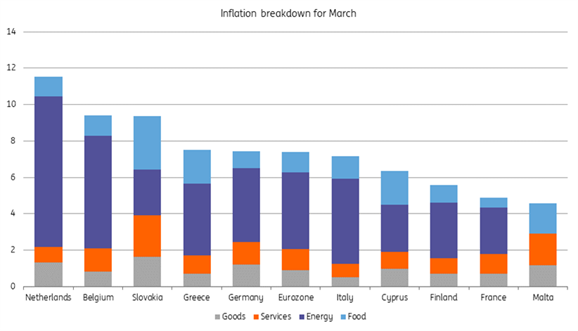

The recent jump in inflation has been predominantly seen in energy prices, coming on the back of the price shock seen in early March when the war in Ukraine started. Concerns about energy availability, especially for oil and gas, have resulted in another spike. Mind you, core inflation has also been rising due to supply chain problems, reopening effects and second-round consequences from the energy crisis, but to a much smaller degree. That makes energy the main driver of the divergence between countries at the moment.

The differences in energy inflation are mainly determined by the energy mix of countries – more fossil use makes consumer prices increase more quickly, the speed with which market price changes are translated into consumer prices and government interventions. While divergence of headline inflation surged like a rocket, divergence of core inflation remained relatively well behaved, though it is still slightly above previous peaks.

Inflation breakdown for March shows energy is the dominant driver of total differences

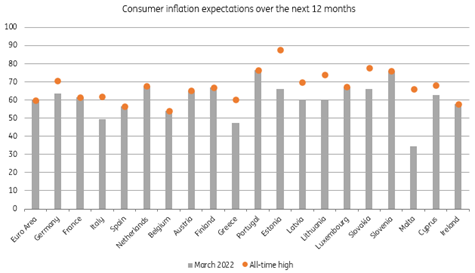

Inflation expectations remain moderately similar between countries

As energy prices are the main driver behind current inflation divergence, the ECB will not really be too concerned. In fact, the divergence of core inflation is much smaller, although it has now also surpassed the corona crisis peak. In any case, what matters most for the ECB and its future monetary policy path are inflation expectations and wage developments.

As for inflation expectations, the risk is that high current inflation becomes engrained in expectations moving forward, resulting in diverging paths between countries, making the ECB's job harder anyway. For the eurozone as a whole, inflation expectations from both consumers and professional forecasters have been soaring across eurozone countries since 2021. However, we cannot detect any growing divergence across countries.

When looking at consumer expectations for prices, we see that they have been rising sharply in most eurozone economies. We also note that price expectations are mainly correlated with current inflation rates, but the most important thing in determining divergence in inflation expectations is whether we see different developments across countries. This is not the case. All countries see marked run-ups in inflation expectations for the coming year – longer-term expectations are not available – and most countries are seeing all-time highs since the start of the series in 1985. So even if you have to take the data with a grain of salt, at least it is moving in tandem between countries.

Consumer inflation expectations are high across the eurozone

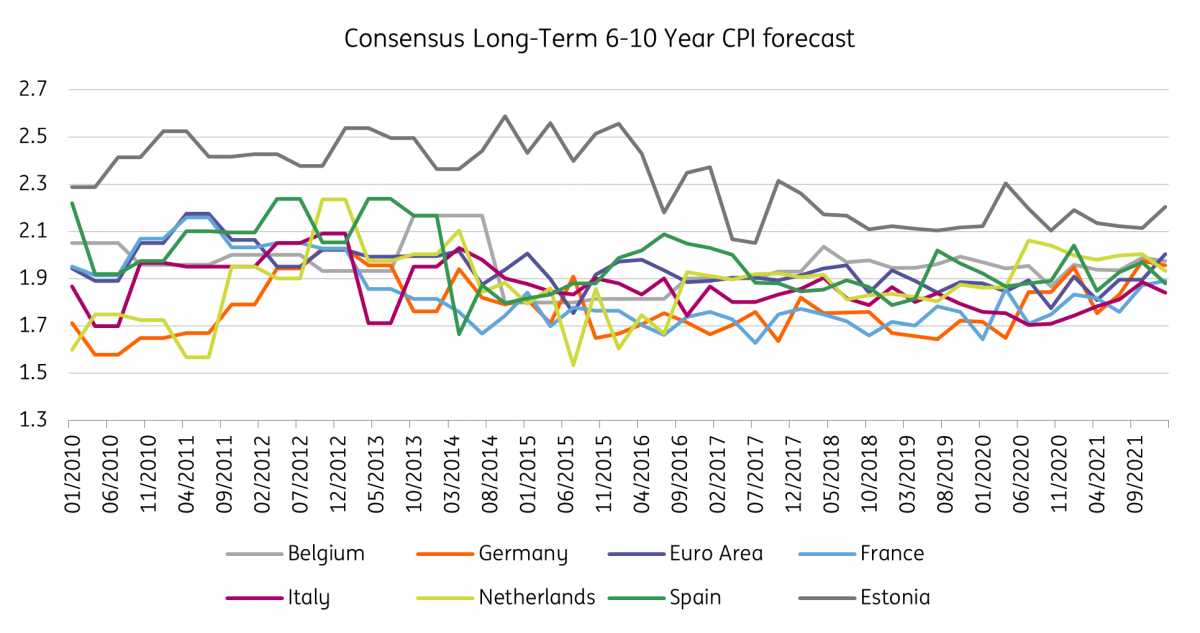

Surveys among forecasters show that longer-term inflation expectations have been rising modestly in eurozone countries. The trend is similar between countries here, and expectations have been converging towards the 2% target for the larger countries. Smaller – mainly CEE – member states see higher inflation expectations for the medium-term as economic convergence also comes with faster-rising prices. Overall though, the convergence in inflation expectations means that we don’t see expectations of faster current inflation resulting in rising medium-term inflation between countries. Once more, this means that the ECB’s life is not made more difficult by diverging current inflation. Economic outlooks have been converging, and so are longer-term inflation expectations.

Longer-term inflation forecasts for eurozone countries have been converging

In terms of divergence, bond yields remain the ECBs Achilles’ heel

The ECB’s job has become increasingly tough in recent months, where an error on both the hawkish and dovish sides could prove costly for the economy. While divergence in inflation rates between countries only seems to add to this problem, we’re actually seeing that key medium-term indicators for monetary policy continue to converge. That helps in making policy somewhat easier to set for the ECB and focuses the discussion on how monetary policy in the eurozone should react to looming stagflation, potentially distinguishing between normalisation and tightening (see also our ECB Preview for Thursday's meeting here).

There is, however, another more crucial weakness in terms of country differences that is complicating the ECB’s life: bond yields. In the current environment of rapidly rising longer-term rates, the ECB will closely watch how quickly yields are rising and whether this remains sustainable for the more vulnerable eurozone economies. This is starting to become more of an issue as last week saw peripheral yields soar to the highest levels since the announcement of the EU recovery fund. Continued rapid increases in interest rates would result in a choked off recovery and could cause further financial stress. Don’t forget that the ECB has always warned against so-called unwarranted tightening of financing conditions.

The recent increase in bond yields and the widening of spreads could worsen the ECB’s stagflation problem as higher yields and worsening financing conditions have a relatively stronger impact on growth than inflation. Therefore, we were not at all surprised by recent market rumours that the ECB is working on a new programme to tackle the unwarranted widening of bond yield spreads. With such a programme, the devil is definitely in the detail as it would require assumptions on ‘neutral’ or fundamentally justified bond yield spreads across countries and would also potentially create new legal headaches. Still, we have always expected the ECB to eventually come up with an anti-fragmentation asset purchase programme to accompany its path of policy normalisation. In any case, inflation divergence in the eurozone is currently one of the most negligible problems the ECB is facing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article